Setting the Standard for Financial Health Starts with Data Access

June 16, 2025 | 2 min read

Blog

Blog

Dec 4, 2019|0 min read

Copied

Millions of consumers fall victim to cybercrime daily. But with so many e-commerce sites and online stores, becoming a victim of a data breach is the last thing on most people’s minds. When a data breach does occur, it doesn’t just have a devastating impact to your customers, it also hurts your financial institution.

The truth is, data breaches are becoming an all too common occurrence. According to findings from Javelin Strategy & Research, “in 2017 there were 16.7 million victims of identity fraud, a record high that followed a previous record the year before.” And according to Arkose Labs, in the third quarter of 2019, “fraud increased 30% overall.”

What’s more, regardless of where or how the fraud occurs, consumers are inclined to put the blame on their financial institution. Terbium Labs, a digital risk protection company, “found that a strong majority of shoppers (68 percent) would hold their bank at least partly responsible for fraudulent activity.” And “another 17 percent say they’d only hold their financial institution responsible regardless of how the compromise occurred.” Furthermore, recent data shows that “this will directly impact the bottom line as financial institutions stand to lose 45% of their customer base if a data breach occurs.”

As well as negatively impacting your financial institution, data breaches can be quite serious and have long-lasting effects way past when the incident occurs for consumers. In 2016, financial losses cost consumers an average of $690 out of their own pockets. Unplanned financial strain can cause added stress to consumers’ lives.

Cyberattacks will continue to evolve and develop in sophistication as online and digital interactions become the new norm. Fighting off such attacks and keeping customers’ information safe is an ongoing process that requires safety procedures with rigorous preventative measures. However, before executing a thorough safety program, you need to know the key differences between perceived fraud and actual fraud.

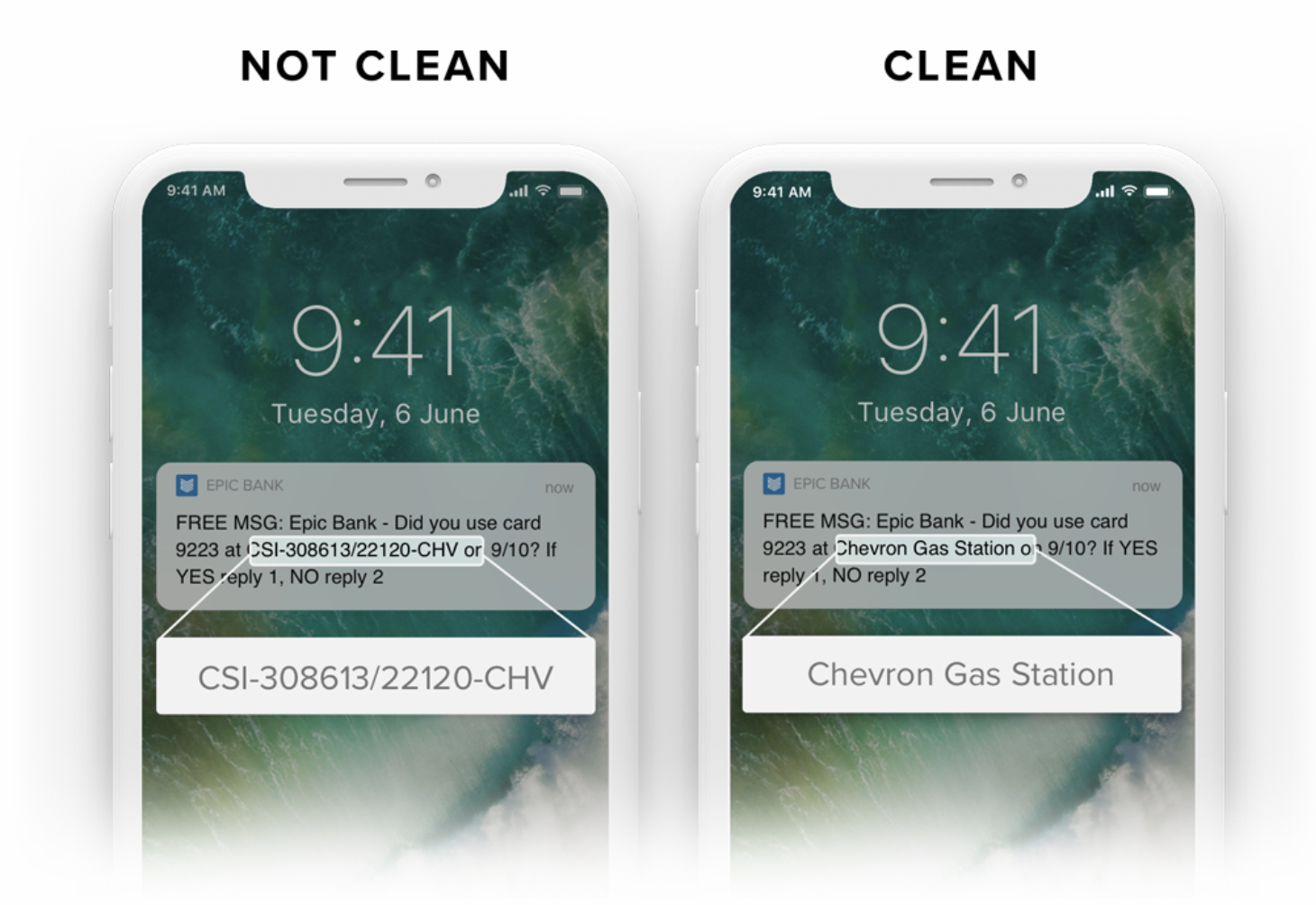

Perceived fraud is when a customer believes they’re the victim of fraudulent activity when in reality they’re just the victim of confusing financial information. One of the key elements to catching fraudulent activity is being able to understand your data. Imagine this simple scenario: one of your customers sees a transaction that looks something like this “CSI-308613/22120-CHV,” and they immediately panic. They think it’s a fraudulent activity, so they call into your institution to resolve the issue. But there are plenty of cases where transactions like this are not in fact fraudulent at all. They just happened to be labeled with a confusing string of letters and numbers that makes them impossible to decipher. This takes time away from solving real issues, hurts brand loyalty, and adds unneeded anxiety for your customers.

That’s why it’s so important to be able to quickly sift through transactional data quickly and accurately. The good news is you can turn CSI-30978/838751-CHV into Chevron Gas, so a simple fuel purchase doesn’t become a support call or a dispute charge claim.

If perceived fraud is left unmanaged, it can eat up your organization’s resources and makes you more susceptible to real fraud. After all, when your team is inundated with unnecessary requests, you’re unable to devote those resources toward spotting patterns and flagging truly suspicious activity.

In an increasingly connected and data-driven world, it’s becoming more and more difficult for financial institutions to better protect their customers most sensitive information from cyber security attacks. Making your data easily understandable by structuring, cleansing, and augmenting it, helps turn messy transactions into readily accessible insights. Once your data is enhanced, you’ll be able to track the patterns of your customer’s transactions and spot outliers and suspicious activity instantly. This frees up your time and resources to focus on preventing actual fraud, while also reducing frustration and worry for your customers.

Luckily, there are solutions that financial institutions can implement to decrease the chances of fraud. MX transforms obscure transaction data into clean usable information. With cleansed, categorized, classified, and contextualized data, you’re able to make better informed decisions when it comes to preventing fraud and tracking suspicious activity. Cleaner data also helps customers proactively identify fraudulent transactions on their end, allowing you to take action sooner in the event of a data breach.

June 16, 2025 | 2 min read

April 8, 2025 | 4 min read

April 2, 2025 | 2 min read