Putting Data in Action: Why Consumers Expect It — and Deserve It

June 25, 2025 | 2 min read

Blog

Blog

Aug 12, 2016|0 min read

Copied

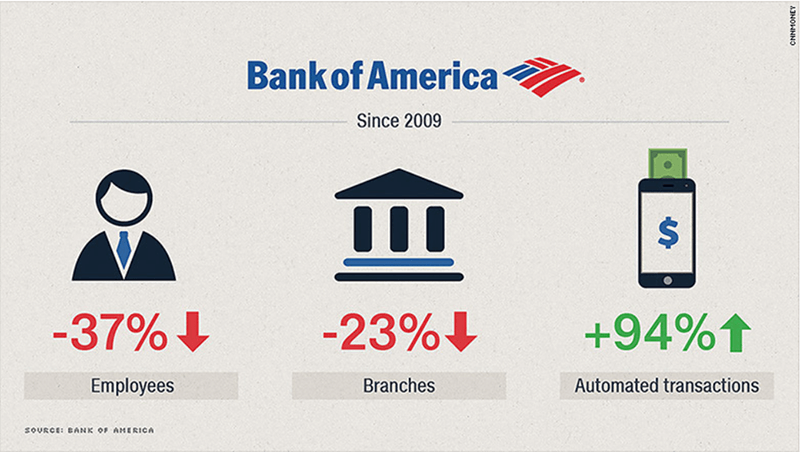

Banks are beating credit unions in mobile banking utilization and it’s not even close. As a group, banks with a mobile app boast 27% enrollment whereas credit unions stand at 12.6% enrollment. In an age where mobile banking has a huge impact on overall customer satisfaction and plays a vital role in capturing the millennial and emerging affluent segments, the quality of one’s mobile offering is crucial. Moreover, increased mobile banking usage drives improved financial performance for FIs. A successful mobile banking app drives customers to a lower cost channel; Chase cites a cost of 65 cents for each teller deposit vs only 3 cents using mobile. As big bank customers have flocked to the mobile channel and become less dependent on in-person interactions, that has allowed these institutions to eliminate branches and reduce cost structure.

Customer utilization can be measured by dividing financial institutions’ estimated lifetime mobile banking app installs by deposit accounts or measuring enrolled customers relative to deposit accounts, a lower figure reflecting attrition.

As a group, the 4,097 banks with a mobile banking app stand at 30.8% in lifetime installs and 27% in enrolled customers; the 2561 credit unions with a mobile banking app lag at 13.6% in installs and 12.6% for enrolled customers. These figures are drawn from the FI Navigator mobile banking module.

For the purposes of this analysis we're only focusing on the 68.2% of banks (4,097 out of 6,009) that have a live mobile banking app and the 42.1% of credit unions that do (2,561 out of 6,080). These figures skew downward because only 32.8% of banks under $100 million in assets have a mobile banking app (536 out of 1633) and only 24.9% of credit union under $100 million in assets offer one, 1124 out of 4508.

It’s easy to paint this as a story of big bank domination in mobile. The 20 banks holding over $100 billion in assets stand at 37.7% in lifetime installs and 32.8% in enrolled customers. These banks were the earliest adopters in mobile, with an average of 69 months in the space. They’ve had more time to market their offerings to customers and communicate the ease of use. On the flip side, smaller banks — the 536 with less than $100 million in assets — have only had a mobile banking app for an average of 25 months; they stand at only 9.6% in lifetime installs and 8.6% enrollment. As we progress in asset size and mobile banking longevity, utilization significantly improves.

But as we compare credit unions and banks, longevity doesn’t necessarily matter as much in driving utilization.

While credit unions were earlier adopters of mobile banking in every asset segment (<$100 million, $100-$500 million, $500 million-$1 billion, $1-$10 billion, $10-$100 billion), they lag banks in customer utilization.

Consider the 234 credit unions between $500 million and $1 billion in assets. With lifetime mobile banking app installs at 12.3% of deposit accounts and enrolled customers at 11.5%, they trail the 608 banks in the same asset class at 13.3% and 12.4% respectively. This has happened even though these credit unions, as a group, had apps deployed nearly 9 months before their bank peers (4.09 vs 3.36 years). Banks in this asset segment have seen their mobile banking enrollment grow 30.5% in the last year — 9.5% to 12.4% — while credit unions have only seen an 18.6% uptick in enrolled customers (9.7% to 11.5%).

What makes this all the more puzzling is that credit unions holding between $500 million and $1 billion in assets are not necessarily losing on account of features. Some of the features providing the greatest lift in enrollment across the industry — a measure of enrollment before the feature was made available and after — include bill pay, account alerts, mobile deposit, fingerprint authentication and P2P payments. While banks between $500 million and $1 billion hold an edge in account alerts (31.3% making the feature available vs 21.4% of credit unions), they lag credit unions in mobile deposit availability (66.4% vs 87.4%), fingerprint authentication (11.3% vs 28.6%) and P2P payments (27.6% to 29.5%). Bill pay has become almost universal for institutions of this size (93.8% of banks, 93.2% of credit unions).

The 256 credit unions with a mobile banking app that fall between $1-10 billion in assets are faring somewhat better. In the last year, their enrollment has grown from 11.2% to 13% while the 563 banks in that segment have grown from 11.4% to 13% enrollment. They're neck and neck. However, these credit unions have again been at the game longer (4.27 years vs 3.71 years for their bank peers) and banks in this asset segment still boast a 27.3% annual growth rate in enrollment since Q2 of 2013 while credit unions check in at 21.2% annual growth. Banks between $1-10 billion again lead in alerts availability (35% vs 26.2% of credit unions) but lag credit unions in mobile deposit (77.1% vs 94.9%), fingerprint authentication (14% vs 32%) and P2P payments availability (29.8% to 32.8%).

Feeling overwhelmed by this barrage of data? Here’s a simple summary. As a group, credit unions between $500 million and $10 billion in assets have offered mobile banking apps for a longer duration and have proven to be even more feature rich than banks at this asset size. Yet banks are still growing their mobile banking enrollment figures more quickly. Why is this happening? Is it a marketing failure on the part of credit unions? Are credit union customers slower to embrace new technologies even when they are made available? There is no definitive answer.

The only thing we know for sure is that the big banks are lapping everyone in both feature provision and usage. Javelin Strategy & Research published a report last fall showing that 38 percent of big bank customers utilize mobile deposit, while only 18 percent of community bank and 16 percent of credit union customers do. Similarly, 46 percent of big bank mobile users have utilized mobile P2P while only 21 percent of credit union and 13 percent of community bank users have done so. The big banks provide features before other institutions can and reap the benefits as their customers flock to the lowest cost channel.

In terms of feature set, banks holding over $100 billion in assets maintain a massive advantage. Consider some of the most added mobile banking features of the last year. At this time last year only 2.8% of FIs offered fingerprint authentication, whereas 12% do now. Yet it’s not a rarity among the biggest banks; 13 out of 20 offer it. Quick balance, the ability to check your balance without signing in, has grown in availability from 2.3 to 10.5% of FIs. Yet half of the big banks offer that feature already.

Mobile deposit is now extended by 64.8% of FIs, up from 51.6% last year; all but one of the 20 largest banks offer it. P2P payments have grown in availability from 17.3% to 21.7% of FIs; 70% of the big banks offer this functionality. The ability to view check images? 12 of the 20 largest banks offer this functionality in their mobile banking app while only 13.2% of FIs with an app do. Viewing eStatements? Again, 12 of the 20 largest banks offer it while only 5.4% of FIs with an app do. 90% of big banks offer account alerts through their app while only 22.8% of FIs do overall.

The bottom line is that your customers expect a feature rich mobile environment which will make managing finances easier. Moreover, they will choose those institutions that are pushing the boundaries of what is possible as their primary FI.

June 25, 2025 | 2 min read

June 23, 2025 | 2 min read

June 10, 2025 | 2 min read