Build

Personalized Money Experiences

The top financial institutions and fintechs use MX to connect financial accounts, surface insights from transaction data, and build better money experiences that grow their business and improve consumer outcomes.

Schedule a demo to get started today.

Intelligence You Can Act On. Trusted Connectivity. Enhanced Data. Embedded Experiences.

MX helps companies do more with financial data that empowers consumers to reach their financial goals. We power actionable financial data intelligence to increase engagement and loyalty, acquire more customers, and identify growth opportunities. From securely verifying data to enhancing it with the most robust data engine, no one does data like MX.

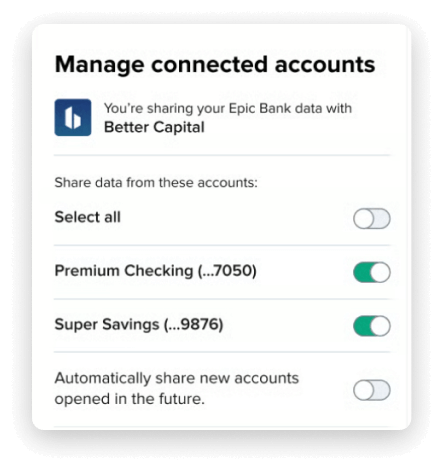

Connect Accounts

Securely link and verify financial data with the industry’s leading connectivity solutions.

Enhance Data and Surface Insights

Make financial data actionable and deliver insights with context, cleansing, and categorization.

Build Experiences

Use MX APIs and tools to build personalized experiences that drive engagement and growth.

What Our Clients Say

"Thanks to our digital solutions, all consumers need to do is provide authorization to their accounts. The difference in those experiences is substantial — one is chaotic and overwhelming, while the other is peaceful and serene."

Brent Chandler, Founder and CEO

FormFree

Why MX

MX is here to empower the world to be financially strong. It’s a noble mission and we’re honored to be a part of it.

13,000+

connections with financial institutions and fintechs

>170B

transactions processed, averaging more than 150M per day

95%

category coverage across platform for transactions with user-editable categories

How We Safeguard Data

At MX, we believe in the power of financial data and are committed to safeguarding it in our approach to security and compliance.

Ready to Get Started?

Explore how MX can help you get the most from financial data and build better money experiences for consumers.

Sign up to receive the latest news, announcements, and event info from MX.