Solving Your Biggest Challenge: Putting Data into Action

April 30, 2025 | 3 min read

Blog

Blog

Dec 6, 2017|0 min read

Copied

Despite the fact that most people associate the term “fintech” with their favorite mobile banking app, technology has been an important factor in financial services for decades. Starting as early as the 1950s with credit cards forever changing the way consumers spend money, technology has forever changed this space.

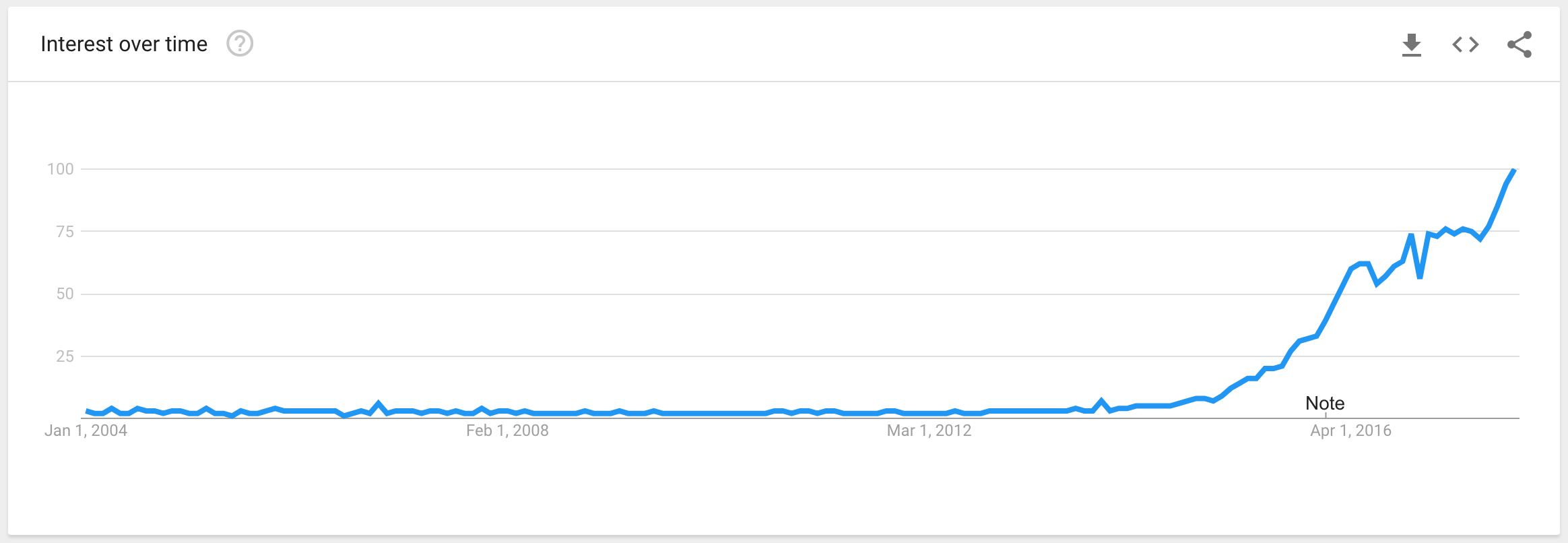

That said, the past 5 to 10 years has seen a huge surge in the popularity of fintech. As you can see in this chart pulled from Google Trends, starting in 2012 the industry has grown rapidly in the past 5 years especially. This growth has resulted in 13 fintech unicorns making their appearance, all scoring valuations of greater than $1B, led by Stripe ($9.2B), SoFi ($4.3B), and GreenSky ($3.6B). What do many of these unicorns have in common? They found their start in a fintech accelerator or incubator.

The biggest difference between an accelerator and an incubator is the stage at which they accept applicants, but both are focused on providing seed money and mentorship to startups through their highly competitive programs. Most programs run roughly 3 months and are followed by an opportunity to pitch their business to a combination of investors and industry experts.

Here are 7 of the fintech accelerators who have been helping to drive innovation in the financial services industry:

With over $390M invested capital, 500 Startups has helped more than 1,800 tech startups in only 7 years. Not only do they provide seed money through their venture capital fund, they are also passionate about providing everything a new start up needs to succeed, including running education programs and conferences across the globe.

In June 2016, 500 Startups announced their new fund, the 500 FinTech. Over 6 years leading up to this fund, 500 Startups had already invested in nearly 80 fintech companies including CreditKarma and Simple. This new fund will allow them to invest in nearly 100 additional early stage companies.

Companies accepted into ERA’s program receive $100,000 initial seed money, along with a 4-month program providing these startups with direct access to expert investors, technologists, product specialists, marketers, customer acquisition strategists, and sales execs spanning many industries.

Following their participation in ERA’s program, companies have raised more than $250M in investor capital.

SixThirty is an accelerator specializing in the fintech space. Based in the heart of one of the largest financial services hubs in the nation, SixThirty provides 8 - 14 fintech startups with up to $250K seed money each year.

In addition to funding, SixThirty’s program provides startups with expert mentors and the opportunity to network with a wide range of wealth managers, banks, and other institutions headquartered in the St. Louis market.

In exchange for 7% of the company, Y Combinator will invest $120K in accepted companies. More than 1,400 startups have been funded by Y Combinator and at this point the total valuation of these companies is more than $80B.

The program consists of 3 months of mentorship in the bay area where subject matter experts work tirelessly with founders to get their companies up to standard and ready for “Demo Day.” The Demo Day audience is carefully hand picked to be the best fit for each participating company.

Y Combinator has an impressive fintech portfolio including Stripe, Coinbase, and Future Advisor.

Founded in 2014, this accelerator provides a 6-month mentorship program to startups, culminating in upwards of a $500,000 investment. As a subsidiary of Wells Fargo, this program offers the benefit of being directly embedded into the Wells Fargo structure.

While Wells Fargo does not lead funding rounds as part of the program, they do have a number of unique benefits compared to other accelerators. Unlike many programs, this program is non-exclusive. It is also a purely digital program, allowing a much higher degree of flexibility for participants.

The Barclays Accelerator has locations in New York, London, Cape Town, and Tel Aviv. The program lasts 13 weeks and provides startups the opportunity to pitch directly to a broad network of influential members of the tech community.

In addition to receiving upwards of a $120,000 investment, participants always receive a lifetime membership to the Techstars alumni community providing ongoing networking and investment opportunities.

This accelerator now has locations in Hong Kong, Dublin, London, and New York. The 12-week program gives startups direct access to senior staff in the financial sector, as well as user groups to test product ideas and proofs of concept.

The program concludes with demo day, providing selected companies the opportunity to pitch to financial service executives, investors, and journalists.

Working with an accelerator or incubator is a great way to gain the funding and mentorship a startup needs to get started. To truly be successful in financial services, however, you will need data. This is where MX comes in. We provide fintech startups with the cleanest, most reliable data on the market.

April 30, 2025 | 3 min read

March 6, 2025 | 2 min read

Feb 11, 2025 | 2 min read