Ready to Get Started?

Learn more about how MX can improve your customer’s journey, uncover growth opportunities, and help you innovate faster.

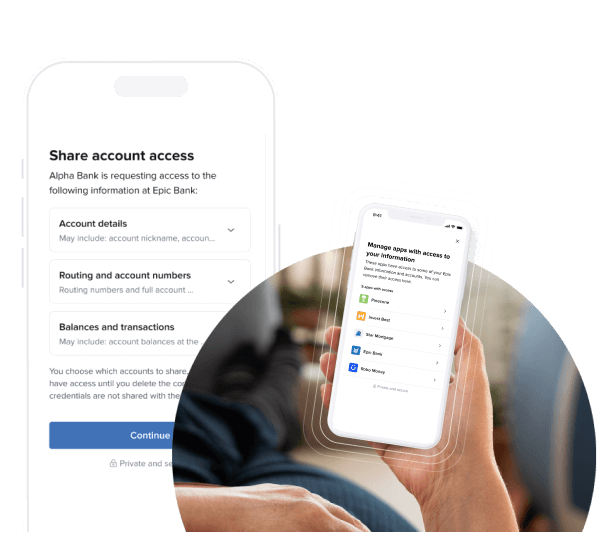

MX improves the consumer-permissioned data sharing experience and enables financial institutions to better monitor and manage where data is shared. Enable consumers to create a 360-degree view of their finances, gain greater insights and personalized experiences — without the need to share usernames and passwords.

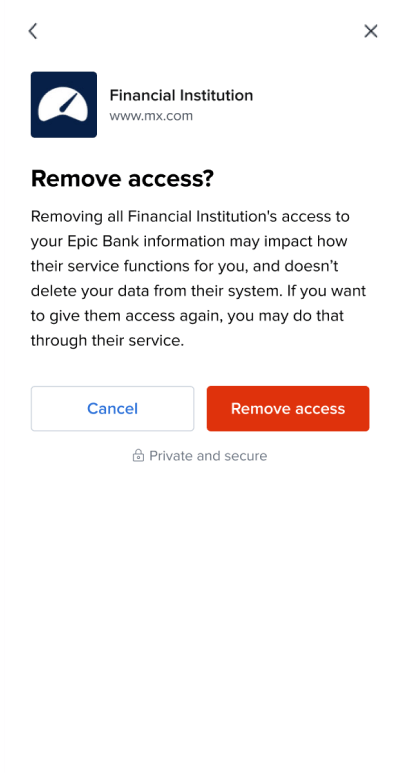

Empower consumers to connect to and share their financial data on their terms with permissioned data sharing and a consent dashboard to manage and revoke access at any time

Better monitor and manage what data is leaving your organization’s platform and where it’s going to meet compliance obligations under Section 1033 and uncover new product and partnership opportunities to grow your business

Quickly go to market with a connectivity solution built to be 80+% market ready — enabling integration and implementation in as little as 6 weeks or less — and accelerate third-party onboarding with a self-service portal and ready-to-use templates

Leverage API data requests to power Account Owner Identity, statements, transaction history, account aggregation, balance checks, and account verifications (IAV)

MX's Data Access solution can help you get ahead of 1033 compliance, consent and API management, intermediary onboarding, and more

Be confident in secure data sharing with 70% of connection traffic flowing through OAuth APIs and more than 500K connections flowing through Data Access

Ready to Get Started?

Built to FDX standards, MX’s Data Access solution improves the data sharing experience with a secure, open finance API. It also enables financial institutions to better monitor and manage where data is shared, unlock actionable insights to drive growth and retention, and meet 1033 compliance obligations.

MX’s account aggregation solutions enable consumers to easily connect and view all of their financial accounts in one place — and give financial providers full visibility into consumer financial data to better meet their needs.

Learn more about how MX can improve your customer’s journey, uncover growth opportunities, and help you innovate faster.