The Evolution of Primacy: A Deep Dive with Fintech Takes

July 14, 2025 | 3 min read

Blog

Blog

June 9, 2016|0 min read

Copied

The first thing to note about Brett King’s book Augmented is that it’s a joy to read. You can flip to any page and find a fascinating trend, data point, or anecdote about the future of technology. What’s more, King’s tone is consistently one of exuberance and wonder. You can’t help but feel his optimism shine through on each page.

Augmented covers four major disruptions: artificial intelligence, embedded experiences, smart infrastructure, and healthtech (including gene editing). You can see from this list that the book’s content is much broader than King’s previous work about banking, and King uses this to his advantage. By citing advances in a range of fields, King illustrates how changes in one industry spillover into other industries. He also shows why it’s so devastating to focus exclusively on your own field at the expense of understanding broader market trends.

Change begets change, which doesn’t bode well for people stuck in traditional modes of thinking, especially when it comes to banking. King says that “along with fossil fuel generation facilities and energy retailers, banks, accountants and financial advisers will be amongst the hardest hit industries over the next 20 to 30 years.” He adds that “some banks will survive, but it’s very unlikely that they’ll look anything like the banks your parents grew up with.” In the Augmented Age, finances and financial education will be seamlessly woven into the fabric of daily life, making the physical location of branches irrelevant.

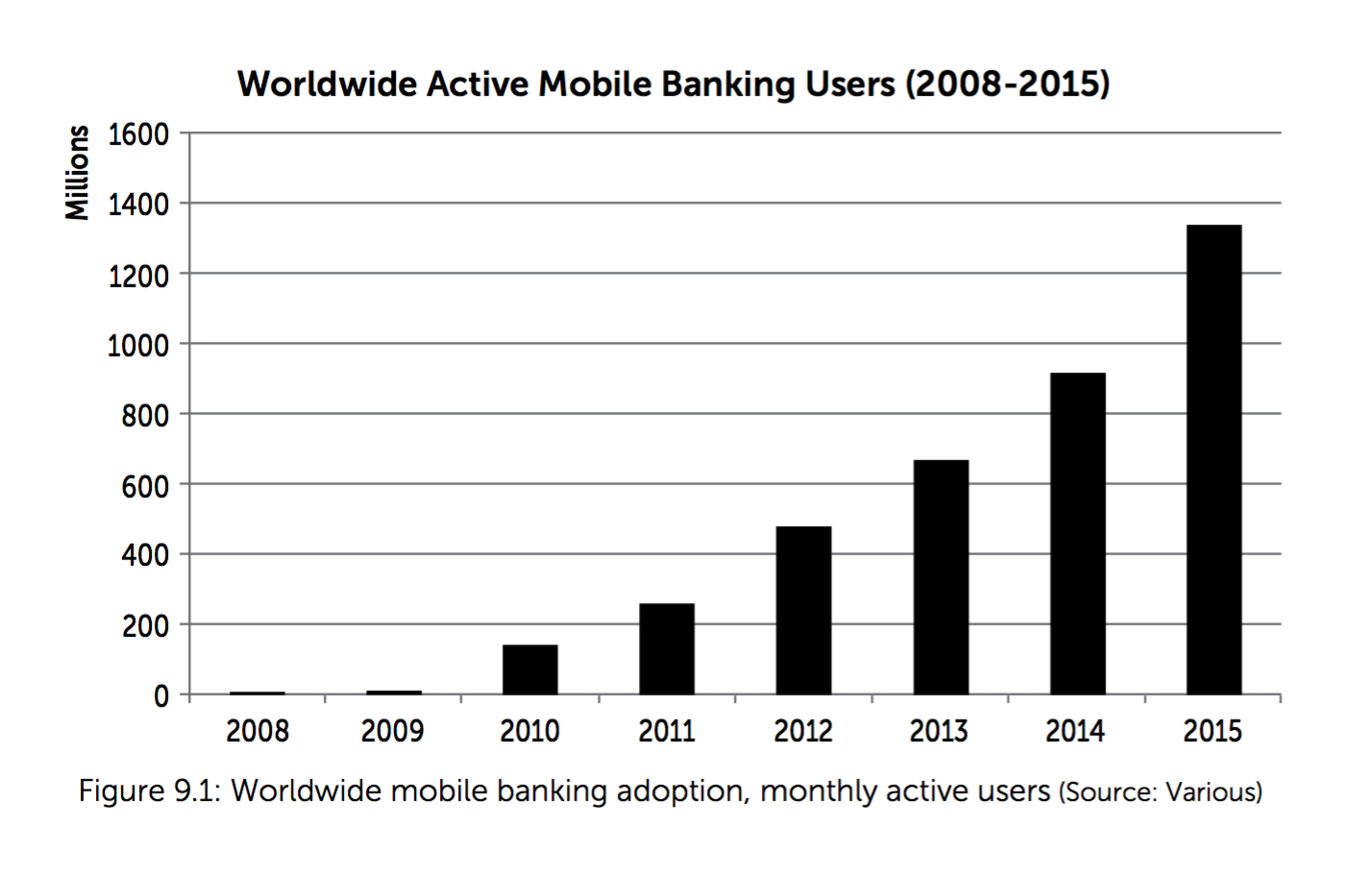

You can already see how quickly the industry is changing by looking at the rapid rise of mobile banking.

King also walks the reader through how the foundation of financial advice will continue to change as artificial intelligence improves. He puts the situation rather bluntly: “What is better? A financial adviser you meet once a year who gives you guidance on your portfolio and investment strategy, and basically tries to pitch you the hot investment fund of the month OR a bank account that is smart enough to monitor your daily spending as you tap your phone to pay and then coach you on how to change your behavior so you save money, as well as looking out for the best deals on the things you really want to splurge on, and a robo-advisor that is constantly optimizing your investment portfolio to maximize your returns, with lower tolerances and better information than the best financial adviser in the world has access to?”

It’s hard to argue with the implications of that question. Automated advice is here to stay and will only get better and better.

Altogether, Augmented is the guidebook business people need (especially bankers) to get ahead of the rapid changes coming during the next decade. King helps you anticipate what’s coming next so you can outsmart the competition.

July 14, 2025 | 3 min read

June 25, 2025 | 2 min read

June 23, 2025 | 2 min read