Putting Data in Action: Why Consumers Expect It — and Deserve It

June 25, 2025 | 2 min read

Blog

Blog

April 17, 2020|0 min read

Copied

Customer lifetime value in banking is notoriously difficult to pin down.

In most retail industries, you can calculate customer lifetime value by multiplying the average value of each sale with the average number of transactions each year over the course of the retention period. But in banking, average sales per year is an almost meaningless metric.

Some customers have a single checking account with their primary financial institution while others have several loans and lines of credit. And then there’s the matter of the profit margin between savings accounts and lending rates, which shifts depending on regulatory environments among dozens of other variables.

Nevertheless, some industry experts have estimated customer lifetime value. For instance, Novantas pins average customer lifetime value around $2,000 to $4,000, and Dan Rosenbaum at Oliver Wyman puts it at roughly $4,500. And since financial services companies frequently spend hundreds of dollars to acquire each new customer, potential customer lifetime value is almost certainly worth far more than they spend.

Customer lifetime value also differs widely depending on customer metrics, including the type of products and services each customer uses. For instance, StrategyCorps analyzed over 2 million accounts at 100 financial institutions and pinned an average dollar amount to three core segments:

They found that super-profitable customers consist of roughly 10% of all customers but provide 67% of total relationship dollars, while unprofitable customers consist of roughly 40% and provide 1.4% of total relationship dollars.

In a similar vein, Javelin Research writes that customers who are most likely to adopt digital banking technology —particularly personal financial management (PFM) apps —are 18 percent wealthier than average customers. These customers also have “relationships with more financial institutions and manage more accounts” and are more likely to own every major financial product, including savings accounts, retirement accounts, mortgages, and car loans. Finally, they’re also more likely to “charge purchases to a credit card (52% vs. 36%), swipe a debit card (46% vs. 24%, or pay with a prepaid or payroll card (10% vs. 4%).”

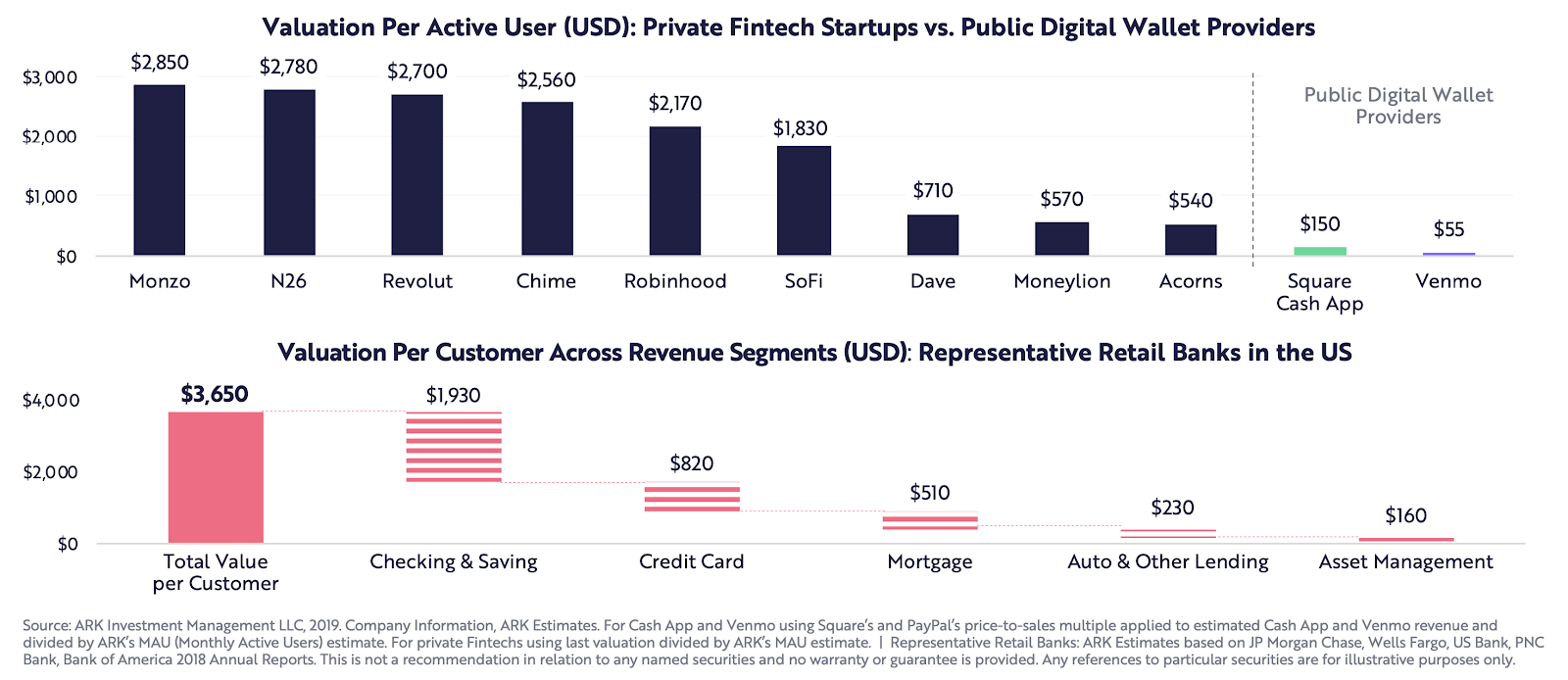

Another way to measure customer lifetime value is through the metric of valuation per active customer — a measurement investors use to decide where to put their funds. At fintech startups such as Monzo, N26, and Revolut valuation per active user measures in the high $2,000s. While it’s not an exact translation for banks and credit unions, it does give approximate insight into what investors believe about valuation.

How do you enjoy these profits? It’s all about thinking of long-term value. As Bradley Leimer, Co-founder of Unconventional Ventures, said in our interview with him, Empowering Lifelong Customer Relationships in a Digital World, “banks need to make customer lifetime value actually translate to a lifetime value from the financial provider – not the other way around.”

He adds, “With long-term advocacy programs like this, the incentives of financial institutions will be aligned with the incentives of account holders, and long-term relationships can develop.”

Finally, he says, “I want to see banks not just rebuilding the core, but rebuilding the core value proposition for the customers so it benefits all customers in the long term.

“Banks need to make customer lifetime value actually translate to a lifetime value from the financial provider — not the other way around.” — Bradley Leimer, Co-founder at Unconventional Ventures

A range of experts in the industry back this call to advocacy. Forrester Research says, “Customer advocacy is the key driver of loyalty at retail financial services firms. Loyalty, in turn, yields the most sustainable revenue growth for these firms. ... Focusing on customer loyalty is no longer just a smart strategy. In an age of empowered customers, it is an imperative.”

KPMG says, “Banks that embrace change and systematically transform themselves to meet new customer demands will achieve a competitive advantage in the marketplace. Those that continue to ponder—or worse yet, resist—change will suffer.”

Infosys joins in these calls as well, saying, “With the increasing commoditization of banking services, banks today need to look beyond their traditional goals – like driving customer satisfaction, customer revenue, and customer retention. Instead, they must focus their energy on winning customer advocacy.”

And Deloitte writes, “Becoming more customer‐centric should be a priority for all financial services providers. In the current challenging economic environment, it can be a driver for growth and profitability, help defend against competitors and ensure financial services institutions meet their regulatory obligations.”

“Focusing on customer loyalty is no longer just a smart strategy. In an age of empowered customers, it is an imperative.” —Forrester Research

Generally speaking, loyal retail customers are five times more likely to purchase again and four times more likely to refer a friend to the company, according to Temkin Group. The same study also found that 87% of customers who say they had a great experience will make another purchase from the company, compared to 18% of customers who had a very poor experience. In addition, Deloitte suggests that retail customers who have a positive experience are likely to spend 140% more than customers who report negative experiences.

Put simply, as you become a true advocate for your customers, you’ll win long-term brand loyalty and enjoy the full lifetime value of your customers.

June 25, 2025 | 2 min read

June 23, 2025 | 2 min read

June 10, 2025 | 2 min read