Raising the Bar on Customer Satisfaction in 2026

Jan 2, 2026 | 3 min read

Blog

Blog

April 22, 2022|0 min read

Copied

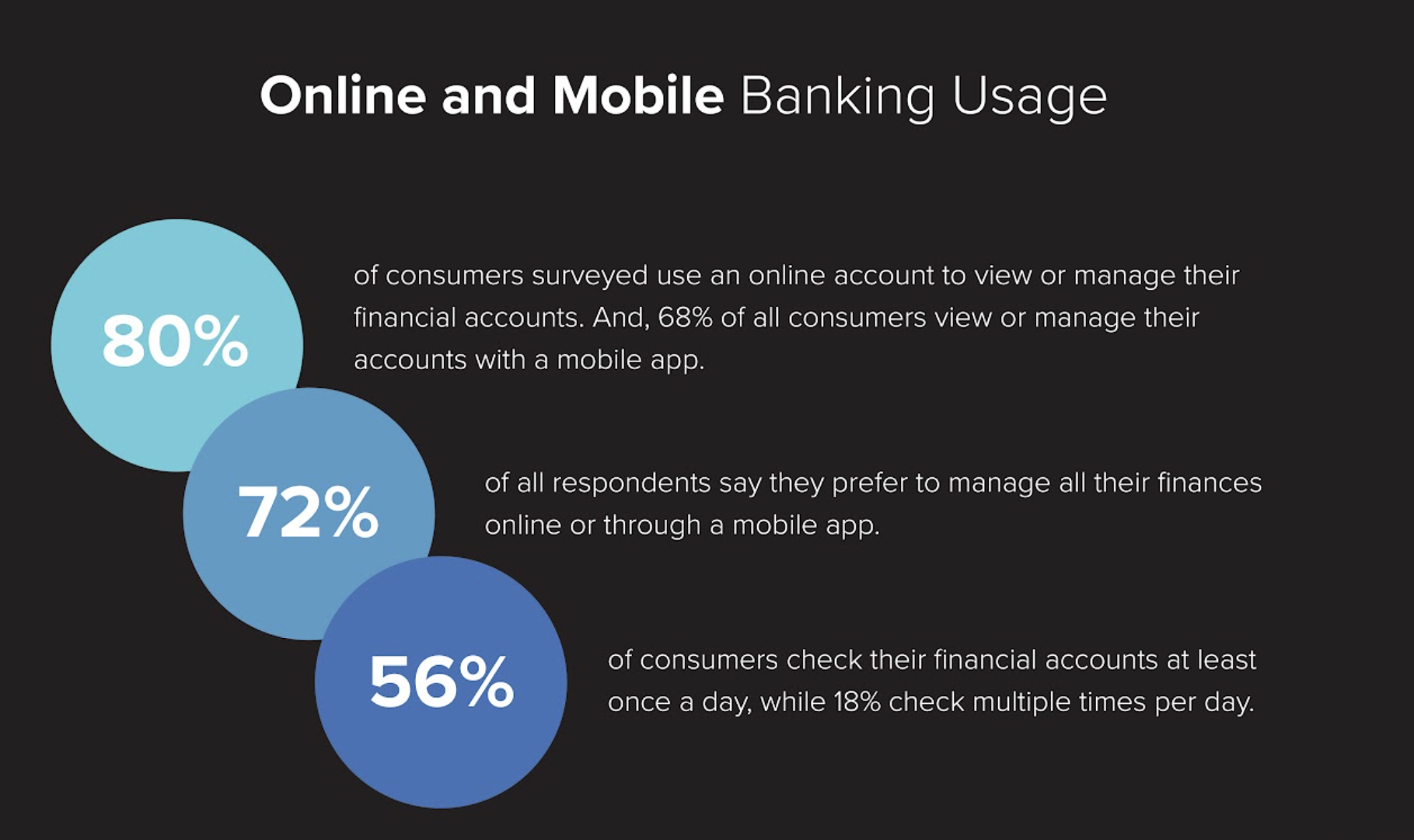

Digital experience matters, especially when it comes to finances. How easily a user can access, move, and manage their financial accounts is now a big differentiating factor when it comes to a consumer choosing a financial service. New research from MX shows that online and mobile banking are by far the most used methods for viewing and managing financial accounts, even across generational gaps. Seventy-two percent of all respondents say they prefer to manage all their finances online or through a mobile app.

Consumers are also checking their finances more often. Fifty-six percent of consumers check their financial accounts at least once a day and 18% check multiple times per day.

With that many eyes constantly looking at their financial accounts, there is an opportunity for banks, credit unions, and fintechs to deliver more seamless and frictionless money experiences. In fact, something as simple as being unable to connect a fintech app to your bank or credit union may lead consumers to go elsewhere. When asked what they would do if their preferred bank or credit union did not support connecting to their favorite fintech apps, 72% said they would seek out a different bank or credit union that could connect. This was even higher for Millennials and Gen X respondents at 75%.

The demand for digital is high, but so is the level of opportunity. When a financial institution takes the time to provide seamless, stress-free digital experiences, it also creates loyalty that leads its consumers to never feel the need to look elsewhere. And when the time comes to apply for a loan, open another savings account, or seek out financial advice, they already have a clear path to solutions.

Jan 2, 2026 | 3 min read

Dec 3, 2025 | 3 min read

Nov 10, 2025 | 2 min read