The Evolution of Primacy: A Deep Dive with Fintech Takes

July 14, 2025 | 3 min read

Blog

Blog

Sept 24, 2019|0 min read

Copied

With insights from 24 of the brightest minds in banking and 50 downloadable content pieces, Digital Banking Week 2019 exceeded all expectations. It's a one-stop opportunity to get informed about the latest industry trends on a range of fronts.

We’ve compiled highlights from each presentation here so you can get a taste of what was covered. There’s nothing else quite like it in fintech and banking.

The Behavioral Economics and Psychology of Money, Fairness, Effort and Trust

Dan Ariely’s goal in life is to “get people to act in ways that are in their own best interests.” When it comes to money, he encourages people to think about the opportunity costs of each spending decision in light of what they actually want in the long term. The problem, he says, is that “every store wants you to buy their latest product and every app wants your attention. We're dealing with our long-term interests against the short-term interests of all the entities around us,” he says, “and those entities have power.”

According to Ariely, financial institutions can help people avoid being driven by short-term desires by guiding them to focus on positive directional shifts over a long time period. He explains, “I want a banking app that says, 'You're headed in the right direction, but be careful: You're spending a little bit too much.'” [To offer such an app to your users, check out MoneyMap with Pulse.]

“I want a banking app that says, 'You're headed in the right direction, but be careful: You're spending a little bit too much.'” — Dan Ariely

He adds that spending too little can also be a problem, saying, “We get people to feel as if it's always good to spend less than the budget. No. Life is also about happiness. If somebody says, ‘I want to spend $200 a month on coffee,’ then if they spend less, that's not good.”

For Ariely, success in banking comes down to trust, and the quickest way to establish trust is to make sure users know what you’re doing for them — particularly when it’s primarily in their best interest.

“I think lots of banks do lots of wonderful things,” he says, “but many of the good things they do are invisible, so people don't see it.' To establish trust, financial institutions should loudly publicize every instance of when they act in the best interest of their users. If they show users that they’re truly looking out for the well-being of account holders, they’ll establish trust in the industry and drive up long-term loyalty in the process.

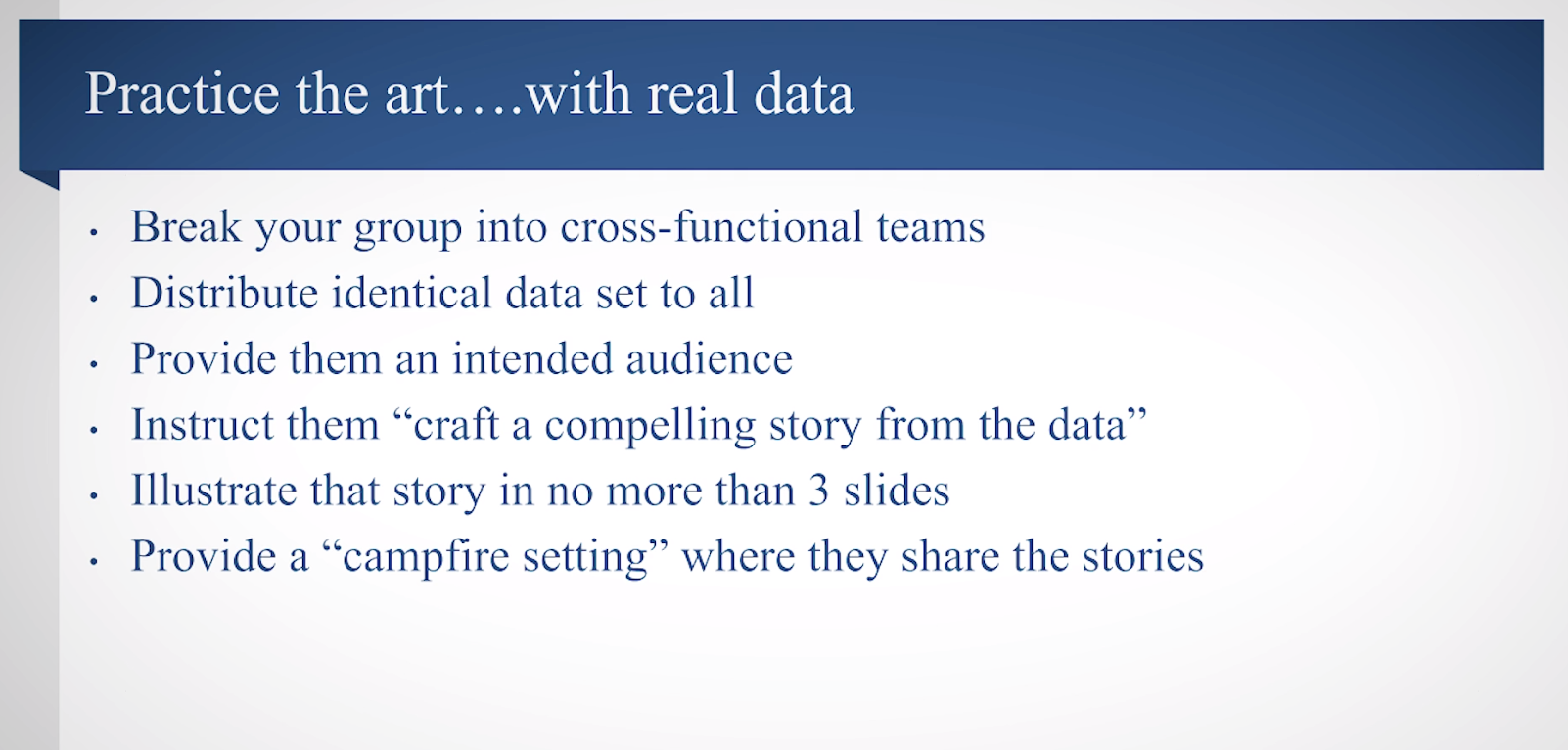

Schramm's Seven Secrets of Storytelling Success With Superlative Statistics

Schramm’s presentation was loaded with insights on how to tell effective stories with statistics. We’ve listed the essential points here, but be sure to watch the whole thing for details:

In this slide from his presentation, JD Schramm outlines how to perfect storytelling with data in your organization.

In this slide from his presentation, JD Schramm outlines how to perfect storytelling with data in your organization.

Data, AI, and the C-Suite: Powering the Future of Banking

In this interview, Ryan Caldwell talks about the major transition industries across the world are facing as they aim to collect, enhance, analyze, present, and act on data. For instance, Amazon, Apple, Google, and Netflix all use data to better serve their end users, and the more they serve their end users the more data they get, creating a flywheel effect. When Caldwell illustrates this fact to banking executives they ask him, 'Well, what is our flywheel? How do we do that?'

“If you're not consumer obsessed, I don't know that you can really survive in this new world.” — Ryan Caldwell

In response Caldwell says, “Focus your first steps on your capacity to understand your data. Then find a sherpa to guide you through the process. This is not a mountain where you want to run out of oxygen halfway up. You want to know what you're in for. You want to know the right steps and the right speed that you want to go at to properly ascend the Mount Everest of becoming a data-centric organization.'

Above all, he says it’s imperative to focus on the end user. “If you're not consumer obsessed,” he says, “I don't know that you can really survive in this new world.”

Fintech for the Aged

Lau highlights a strangely overlooked segment of fintech startups: People 50 and older. We say “strangely overlooked” because, as Lau says, “Those that are older than 50 in the United States, control 70% of bank deposits.” And yet not many fintech companies are focused on meeting the needs of this demographic.

And it’s a demographic that needs guidance. “35% percent of full-time gig workers are baby boomers or those that are older than 75,” Lau says. “We need more innovators that have the imagination and the mind to do what is right for consumers.”

She adds, “Our industry can help consumers make better financial decisions. We can anticipate their needs and act as their personal CFO, and we can challenge what can be done. What limit us is not the technology. It's not the ones and the zeros. What limits us is our minds and our hearts to do the right thing, so be part of the change and make banking better.” [Join the MX mission to empower the world to be financially strong.]

Theodora Lau says that fintech companies should focus on the entire age range as we develop tools for the future.

Theodora Lau says that fintech companies should focus on the entire age range as we develop tools for the future.

How a 100-year-old mission has helped USAA lead the industry

Neff Hudson outlines how having a strong mission has guided USAA for more than a century. “We use the mission,” he says, “Unlike other companies that might just look at a mission statement as a bit of boilerplate to kick off a presentation, we actually use it as a method of resolving differences.”

He says, 'The question that you have to answer at USAA is, ‘What are you doing for the member?’ If you can't answer that question, your project is probably not going to get across the finish line.' For Neff, the focus is around building “autonomous finance” — financial guidance powered by clean data and artificial intelligence. “We're going to be able to invent autonomous finance as an industry,” he says, “but it had better be invented with the customer in mind. If it's invented to make the balance sheet look good, I don't think we're going to like the results in the market.” As in so much else, USAA’s drives what they do.

USAA’s Mission: “USAA’s mission is to facilitate the financial security of its members, associates and their families by providing a full range of highly competitive financial products and services. In so doing, we seek to be the provider of choice for the military community. We do this by upholding the highest standards and ensuring that our corporate business activities and individual employee conduct reflect good judgment and common sense, and are consistent with our core values of: Service, Loyalty, Honesty and Integrity”

Banks, Bikes, and Bell Curves

Among many other things, Brandon Dewitt describes how bankers can help the majority of people who don’t necessarily want to budget. To this end he tells the story of launching Pulse, an MX product that brings intelligent automation to the lives of users — including the ability to highlight recurring subscriptions that a user may be overlooking.

“We had somebody internally here at MX say, ‘Well, this tool just isn't working because it says that I have three Netflix subscriptions, and that's ridiculous.’ Yet when they clicked into it, it showed their transactions that every single month, for months, three Netflix subscriptions have been drawn out. As they dug into that, they found that their 16 year old daughter had a Netflix subscription, and their wife had a Netflix subscription, and they had a Netflix subscription.” This is the kind of guidance that banks and credit unions can offer their account holders to build long-term user loyalty.

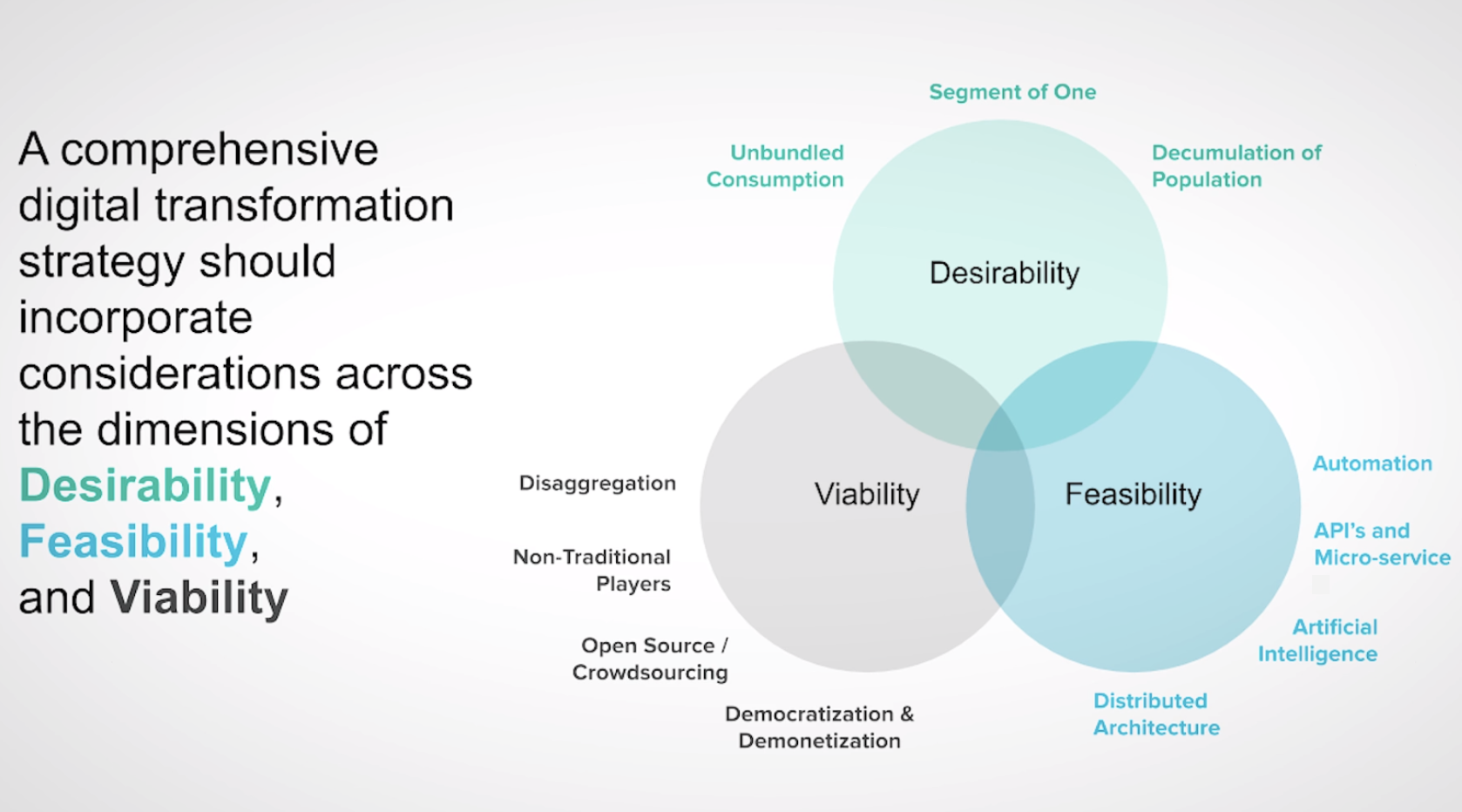

Strategic Growth in Digital Banking

When it comes to finding the right approach to banking Liz Wolverton says that “it's critical to move away from tactical into strategic.” Then she adds, “a comprehensive digital strategy embraces broad considerations across three core elements: desirability, feasibility, and viability.”

“Desirability is not just about automation,” she says. “Flat automation results in a very shallow experience.” Instead, financial institutions must guide users in a variety of contexts using a personalized approach. “Feasibility is about how I enable the organization to deliver digital,” Wolverton says. This includes the architecture that makes digital possible. “Viability is making sure that the bank has its eyes wide open to the business model changes that are needed.” This approach includes changing how banks hire talent. “If you're going to bring in innovators,” she says, “you have to create a place where innovators are going to thrive.” Liz Wolverton shows three essential components of a comprehensive digital transformation strategy.

Liz Wolverton shows three essential components of a comprehensive digital transformation strategy.

Investing in Innovation at Scale

Peggy Mangot is driven to create solutions that help customers improve their financial health. She says that “the true unique differentiators and successful financial institutions of the future will be consistently delivering experiences that help their customers in financial health — help them understand their money, and make better decisions.”

“The true unique differentiators and successful financial institutions of the future will be consistently delivering experiences that help their customers in financial health.' — Peggy Mangot

For Mangot, this doesn’t mean creating a bunch of static, informative guides to spell out financial management best practices. “Our research has shown that financial content doesn't work,” she says. “We're done with telling our customers what they should be doing. They don't want to hear it. What our research has shown and what’s resonating is giving them tools that they can then help them control their own spend.” Such tools give personalized advice and suggestions that meet the needs of users right when they most need them. “Consumer expectations today are driven by the apps that they use every day — news apps, gaming apps, sports apps,” says Mangot. Financial apps are no different and must keep ahead of expectations.

The Illusion of Digital Transformation

Marous gives financial institutions the playbook for how to make the leap to digital. He focuses on the importance of data and pulls from surveys he’s run, showing that consumers want value in return for their data. “The consumers said in most of our reports, they want to share information with their financial institution but they want something in return,” he says. “They want value in return that will basically make their day easier, make it more seamless, make it less friction, and pretty much work on their behalf without their having to be there.”

He continues: “I have a relationship with a very major financial institution. And that major financial institution probably knows more about me than I know about myself. The problem is I don't know that they know that. They never show the ways that they know me, look out for me, and reward me. Without that type of tight integration, without that application of data, data is nothing more than a tool for internal use. That's not digital transformation. That's not digital engagement.” For Marous, all of that is the illusion of digital transformation. True transformation requires collecting data, cleaning it, and then putting it to use in intelligent and beneficial ways so the end user unquestionably knows the benefit you’re giving them.

Open Banking: How Data Driven Innovation Can Positively Impact Customer's Lives

Jane Barratt outlines three key benefits of open banking: 1. Increased privacy and security, 2. Interoperability (which results in the ability to see your money in a single consolidated view), and 3. Engagement opportunities.

One specific benefit here would be to empower users who are stuck in a predatory debt cycle. Barratt says financial institutions that leverage open banking will have the ability to “look for signs of people who have engaged with predatory lenders or who are more likely to engage with predatory lenders.” She adds that “instead of just giving a loan consolidation offer, what you can do is create a program designed for these people that is part education and part offer.” From there you’ll help them out of the cycle and toward true financial health.

In same vein, open banking will help users get better deals on products. “Why couldn't financial institutions be always on the lookout for better deals for your customers?” Barratt asks. “If you can see transaction histories, why not enable bot to bot negotiations so you can see that I paid X amount for a product, but the bank is able to find a better product for me.” These are just a few of the ideas Barratt gives on how open banking will change the industry.

[For more, see “Open Banking in the U.S.” by Jane Barratt]

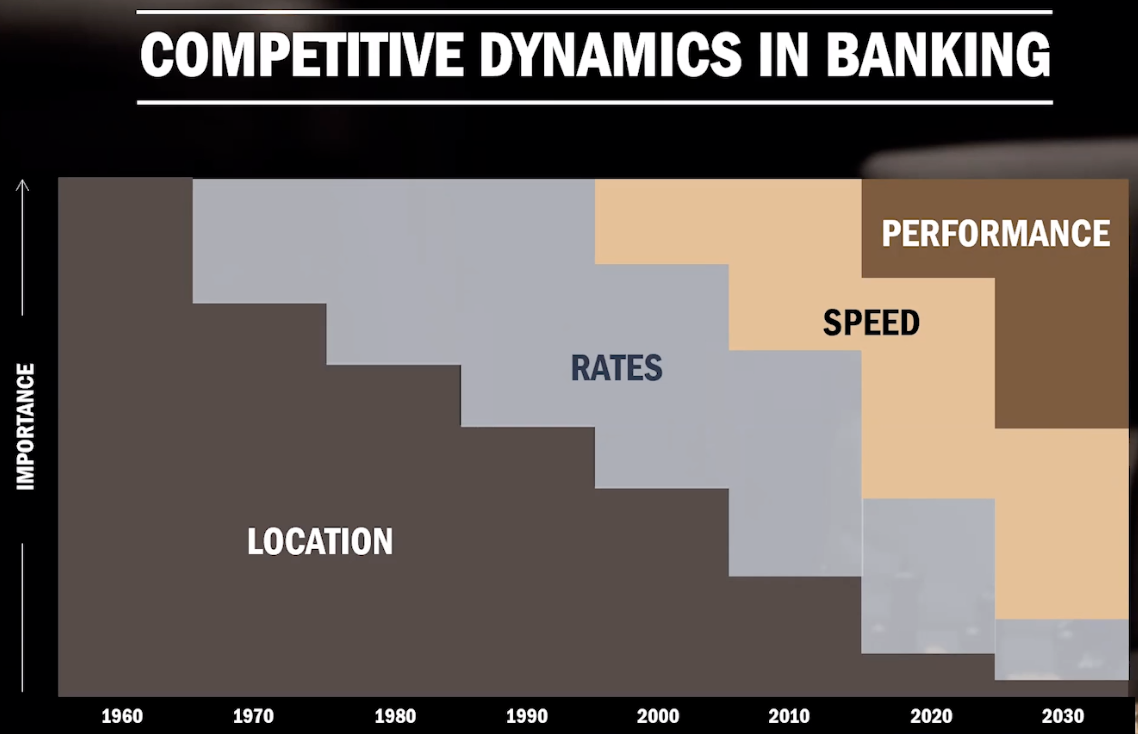

Financial Industry Trends: The Impact of Data in the Digital Age

Ron Shevlin highlights three trends that will stem from using data more intelligently in banking. First, there’s “the assimilation of AI.” He says, “AI is going to become indistinguishable components of systems and tools. The ability to collect and manage data will determine an institution's success and failure in utilizing AI.” Second, there’s the “platformification of analytics,” which means that “analytics capabilities will be provided as a service like open platforms that aggregate analytics tools, data sources and data management services.” And third there’s what Shevlin calls “the new financial health, which is going to become the new competitive dynamic in the industry.”

Everything here hinges on data. As Shevlin says, “investing in AI technologies without having the data to fuel and drive those technologies isn't really going to produce a lot. … Without a sufficient quantity and quality of data, AI is pretty much useless”

The same can be said about financial health. Shevlin says, “We can walk into a hospital, and they can take a drop of blood and calculate hundreds of different health related scores based on that single drop of blood, but yet in the financial services world, we have what? One financial health metric, FICO, and it really isn't a financial health metric.” With the data available today, financial institutions no longer have to rely on a single metric. “The end game is health or performance,” Shevlin says. The institutions who win users will be those “who best help their customers to manage their financial health.”

In this chart, Ron Shevlin shows that the competitive dynamic in banking has shifted from primarily being about location until the 1990s (when it primarily became about rates) until the 2020s (when it’s primarily becoming about speed) until the 2030s (when it will become about performance).

How to Justify Investing in Data Innovation: A Strategic Advantage

Wells outlines three categories of pitches that bankers might make to their board when it comes to data. First, there’s a pitch about analytics and insights — a pitch that shows how you’ll get the resources and tools to gather data. Second, there’s a pitch about enriching and presenting the data. “Once you've got that data structured, cleansed, presentable, and ready to be powerful,” she asks, “how are you going to present that to the customer in such a way that it really delivers on the full promise?” Third, there’s the opportunity for data as a new line of business, which consists of making data “so valuable and so unique that they'll pay you a profitable exchange rate for access to that data.”

She says that when she was at Mint, their “ultimate objective was to become a data business,” but they were acquired before it became a reality. “I'm excited that MX is pushing in that direction,” she says.

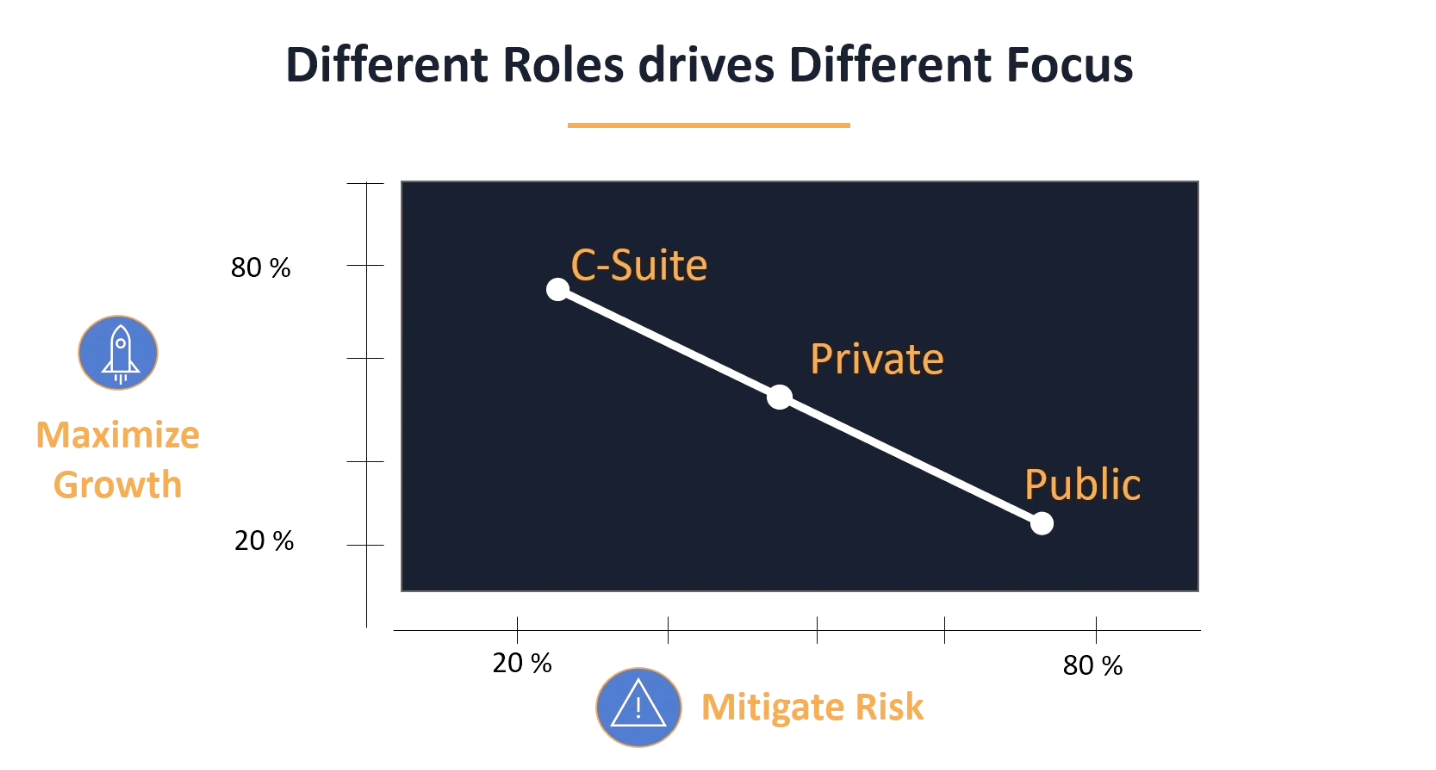

The way to approach your presentation depends entirely on the audience, according to Wells. The C-Suite is mostly concerned with understanding your growth strategy, a public board is most concerned with understanding your risk-management strategy, and a private board is interested in both growth and risk management. If you develop your messaging to match the concerns of the audience, you’ll have a far better chance of getting approval for your pitch.

Donna Wells shows how to cater to three audience types when pitching your idea. The C-Suite wants to see how you'll maximize growth. Public boards want to see how you'll mitigate risk.

From Digital Transformation to Data Transformation

Sieber talks about how when she first started in banking at BBVA she heard bankers say that they were becoming technology companies. Now she increasingly hear them say that they’re becoming data companies. “The most valuable asset that banks have is their data,” she says. And she adds that success hinges on “banks leveraging and taking advantage of the data that they have, but then also using and taking advantage of data outside of their ecosystem and partnering with the likes of fintechs and others.”

“The most valuable asset that banks have is their data.” — Scarlett Sieber

She shares that BBVA has heavily leaned into an advanced data strategy, with their chairman Carlos Torres Vila going so far as to say, “We believe the knowledge derived from financial data can transform the banking industry, its relation with customers and its role in the world.” BBVA partners with MX to optimize their data-driven mission.

10 Steps of Digital Transformation

Howie Wu speaks to the fact that regardless of the industry, consumers are hungry for convenience. “Their objective,” he says, “is to make sure they can conduct interactions as seamlessly and as easily as possible … so that they can go on with their lives.” To exceed their expectations, Wu encourages financial institutions to craft a solid, compelling strategy — one that doesn’t just center around doing whatever everyone else is doing. For Wu, this requires getting the entire organization on board (not just a few people who are focused on digital banking).

The process looks like this: First, start with envisioning the experience you want to deliver. Second, outline the initiatives and resources it will take to deliver that experience. Third, get feedback and input from across your organization, “rejiggering and modifying if you need to.” By keeping conversations like this open, you’ll be on your way to actually delivering the experience your users demand. From there “you have to come back and revisit,” Wu says. You have to ask, “Are we on the right path? Are we still targeted to accomplish what we've set out to accomplish?”

3 Customer Experience Myths Busted by Data

Luke Williams shows that despite our best intentions, we human beings too often believe in myths. Why? According to Williams, it’s because there’s something about the myth that’s partially true and because even the falsehood embedded in the myth is close to what is true.

In this talk, Williams tears apart three myths that affect business. We’ll look at two here.

First, there’s the belief “that catastrophic service failures hurt your business more than ordinary service failures.” In reality, the data shows that most singular, catastrophic failures don’t actually hinder a business all that much in the long run. The stock price might plunge, but it usually recovers soon enough — as long as there aren’t a string of ordinary, recurring failures.

Second, Williams talks about “a blind belief that if we just make customers happier, we're going to somehow make more money.” To prove this idea wrong, Williams shares a story about how Wal-Mart found that their customers hate their stores — that the stores are “a graveyard of people unhappily walking around,” as Williams puts it. In light of this finding, WalMart improved the layout in some test stores so it felt better inside and so people could get in and out faster. Afterward, Walmart found that sales fell in these stores, indicating that what makes users miserable sometimes makes companies more money (and illustrating the need for more ethical, humane economic models than the one we currently have).

The Peculiar Business of Banking

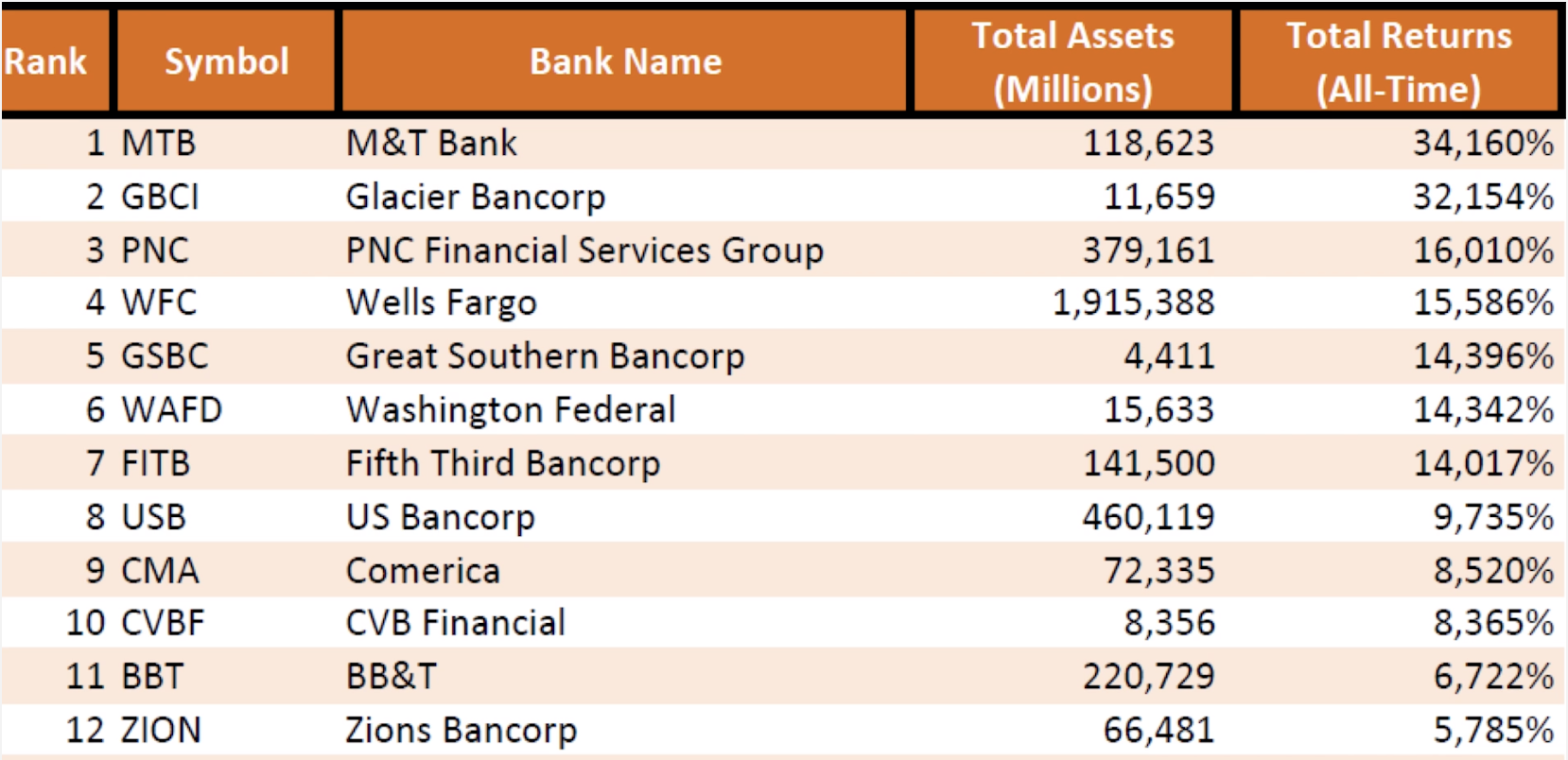

“Two years ago I decided to take all the publicly traded banks in the United States and to rank them by total shareholder return since going public,” says John Maxfield. “I then identified the banks that had created the most value as publicly traded companies, and have gone out over the last two years and spent time with the executives of these companies, trying to tease out what it is that enables their banks to perform so much better than all of their competitors.”

Maxfield walks through the basics of banking and what makes it so different from other industries. “Banking is like any other business,” Maxfield says, except for three things: 1) extreme leverage, 2) Infinite demand for the product, 3) tight regulation. “If it is so difficult to run a bank,” Maxfield asks, “why would you ever want to run one? Well, the answer is that, while there is very high risk, there's also very high potential reward.” He then tells the story of Robert Wilmers, CEO and chairman of M&T Bank, which is the bank that has returned the most value in recent years. John Maxfield has analyzed which banks have had the highest total returns since going public and analyzes how they’ve done it.

John Maxfield has analyzed which banks have had the highest total returns since going public and analyzes how they’ve done it.

Banking 4.0: Banking Everywhere

King talks through key points of his latest book, Bank 4.0: Banking Everywhere, Never at a Bank — specifically around the topic of open banking. King says, “At the heart of it, open banking really is about one question: Whose data is it anyway? Ultimately, it's the customer's data, and open banking forces us to free up that data so the customer can get benefit from it.”

'Ultimately, it's the customer's data, and open banking forces us to free up that data so the customer can get benefit from it.” — Brett King

“We have to understand that what open banking will power, in the ecosystem, is in fact artificial intelligence,” King says. “In the future if you can't predict the customer's desire to buy a home, if you don't know when they're starting that search, you'll be still waiting there for them to come in and ask for a mortgage, and sign a piece of paper, when others, with the data available from open banking systems, will have already made them an offer.”

Brett King outlines various ages of banking, culminating in the upcoming era of ubiquitous banking, where all banking activities will be embedded through our daily activities.

How You Can Compete Against a $9 BILLION Dollar IT Budget

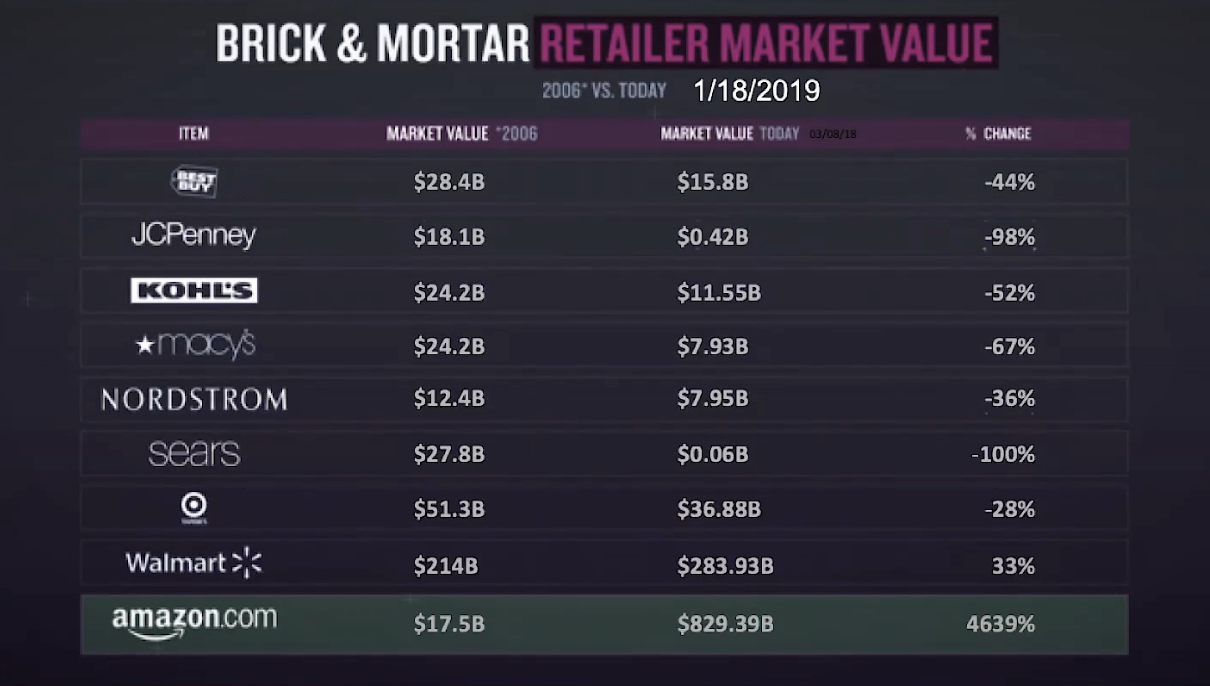

“We're entering the data age of banking,” says Don MacDonald, “where the data can tell you more about your consumers in a period where they rarely come in to a branch. The technology has changed the rules.” As proof, MacDonald shows the market value of some of the biggest names in retail from 2006 to 2019.

As you can see, most of these retailers have collapsed in the wake of the digital age, except for Amazon, which has grown 4639% over this time period. How did Amazon do it? Primarily by owning the digital channel, which has enabled them to gather and refine their data at a level far superior to their brick and mortar competitors.

Financial institutions can do the same. “How do you turn data into action?” MacDonald asks. “It may well start at a very simple clip. We don't believe that there's a single silver bullet that you can just simply turn on, but can you actually aggregate all of your internal systems? Whether it's the loan origination system, your credit card system, your debit card, you can do that with aggregated data. Then you can begin to look at external data. You can begin to start using some of this information using our tools or someone else's tools to be able to provide things like AI-assisted nudges to help your customers retain and become financially well.”

A Moral Imperative: Data-Driven View of Financial Health in the US

Adrienne Harris tells the story of two women who struggle to make ends meet. The first is a heterosexual, married, white, American woman with a median household income of $59,000. The second is a black, gay, single immigrant caring for elderly parents at home in another country with the same income. Harris talks about how financial institutions can best serve these women and why it’s the right thing to do on so many levels.

“Make no mistake. We can offer people better financial products. We have the means and we have the data to do it in an impactful way.” — Adrienne Harris

Speaking of the second woman, Harris says, “We know how to improve her financial health no matter where she sits on the income and wealth spectrums. We just don't know how to leverage the data for those ends. In fact, more often than not, we use that data to do the opposite of improving financial health. We use it to market to people. Or we leverage it to discriminate against them.”

“Make no mistake,” she says. “We can offer people better financial products. We have the means and we have the data to do it in an impactful way.”

Don’t Forget About the Infrastructure

Latimore explores three main areas of banking infrastructure: the mainframe, cloud, and 5G. According to Latimore, the mainframe is secure and sometimes comes with lower total cost of ownership, depending on the context. What’s more, with IBM’s Z15, mainframes can also be cutting edge. The cloud, by contrast, carries more agility and flexibility, but it has led to a few security hiccups, such as a Capital One breach earlier this year. (That said, Capital One is still committed to the cloud).

Finally, 5G will revolutionize the space in ways we can only begin to understand — all because computing power of this capacity will turn every device into a thin client. “Rather than having to update native apps all the time, which is a colossal pain in the neck,” Latimore says, “you just change it on the server and the app becomes a truly thin device that is just making calls to the central server. Updates, as they happen centrally, mean that you don't have to backward compatible or make backward compatible all of your apps.” In addition, with computing power at this level, “You'll be able to think about offering really pointed and customized advice.”

Financial Inclusion: A Global Perspective and Lessons for the U.S.

Bradley Leimer talks about the 1.7 billion people — 22% of the world — who are unbanked, a number which includes millions of people in the United States. While we’ve made tremendous progress on this front, we still have a way to go. “We're talking about the ability, within our lifetimes,” Leimer says, “to get this 1.7 billion number to zero.”

Leimer outlines how far we’ve come, highlighting the amazing turning point we saw in 2007 with the rise of M-Pesa, the iPhone, Finovate, and other things. He also calls attention to what we need to do now. “We need to make sure that everybody has this opportunity to move money, store money, saved money, invest money,” he says. “We need to optimize their spending, optimize their use of credit, regardless of who they are. And now technology is helping us do that. The biggest opportunity in financial services then is to serve everyone around us. People should be treated equally regardless of their background, regardless of their race, origin, religion, their gender, their location, their education, their wealth, and most importantly their profitability. So the true revolution of financial services is in serving the needs of a diverse financial population in every community that we serve.”

Overcoming Barriers for Better Member Experience

Stephanie Maxwell talks through several ways to create a better member experience including via giving an omnichannel approach, helping employees with financial literacy, and building on a foundation of data. Maxwell says they’ve focused on “making every channel equally important.” This means they aim to “keep the member in the channel of their choosing throughout the entire life cycle of the interaction” instead of forcing them to switch from their app to the phone or from the phone to coming into a branch.

She also says that they train new hires in financial literacy and education. “It was very surprising to me that there was not basic financial literacy for new hires,” she says. “What we are really starting to focus on is how to have money as a conversation within their own lives. How to help them budget, help them understand what it means when you're going to have a non-sufficient funds, and how to move money between ACH versus card, even basic transactions like that.” By training employees on financial health, their team is in a far better position to guide members to get what they actually need.

Finally, Alaska USA is working to optimize their data. “We started with a lot of disparate data, and we're actually very fortunate right now,” says Maxwell. “It's all in one location which is great, and going through the process of partnering with MX to make sure that data is first cleansed, but then I'm really excited for it to be enhanced.”

Harnessing the Power of Open Banking

Emma Steeley busts two myths about open banking by showing that people are using it and that people want to submit credentials via open banking. “Clients across multiple sectors are using the open banking APIs,” she says. “HSBC are using this in their unsecured loan. M&S Bank also, in their mortgages. We have clients using our service for tenant referencing, and even cell phone providers who all understand the power that the transaction data can deliver, and the uplift that it can actually bring to their businesses.” She adds that “the APIs in the UK have been incredibly robust, certainly for the last 12 months, with consumers increasingly giving their explicit consent in order to share their data when the value exchange is present.”

“Open banking is not perfect yet,” Steeley says, “but it definitely does work. Customers are willing to share their data. It's really rapidly starting to gain momentum. It's being used across multiple sectors for multiple use-cases. Whether that is income verification, affordability, tenant referencing or source of funds, really, the use-cases are endless, and they are definitely starting to be utilized. We feel like the opportunity with open banking is limitless, so our advice to everybody is to start soon.”

The History of Thrift in the U.S. and What We Can Learn From It

Andrew Yarrow tells the history of thrift in the United States, illustrating how the country has gone from a long period of encouraging savings to instead encouraging spending and credit. It went so far as to have many people, including author William White, call thrift “un-American” and label it as 'an economy of scarcity.'

This anti-thrift sentiment has gone too far, creating a terrible situation for many Americans. Yarrow reveals the ugly truth in a string of stats: ”The top 0.1 percent of households hold about the same amount of wealth as the bottom 90 percent; Median, not average, net worth in the United States is behind about 20 other countries according to Credit Suisse's annual wealth report. Our median net worth or savings is one third that of Australia or Switzerland, and just two-thirds that of France or Canada. Almost half of Americans approaching retirement have nothing saved in the 401k or other retirement savings vehicles. And barely half of U.S. workers have an employer-based pension or retirement savings plan.”

The answer? “Americans need to save. They really need to have resources to be able to live decent lives in the present, during their retirement, and ideally to pass some money on to their kids.” [MX helps financial institutions do this for their users.]

The summaries and highlights here only scratch the surface of what's available from Digital Banking Week. Click the link below to see each video in full and download 50 content pieces that will help you be a leader in digital transformation.

July 14, 2025 | 3 min read

June 25, 2025 | 2 min read

June 23, 2025 | 2 min read