Putting Data in Action: Why Consumers Expect It — and Deserve It

June 25, 2025 | 2 min read

Blog

Blog

Dec 18, 2018|0 min read

Copied

Read or watch our recap of the latest news in the fintech industry:

Welcome to the December edition of Essential Fintech News -- your source for the latest trends in fintech. As we close out on another exiting year, we look forward to three key areas in which we see the fintech industry making major strides in 2019:

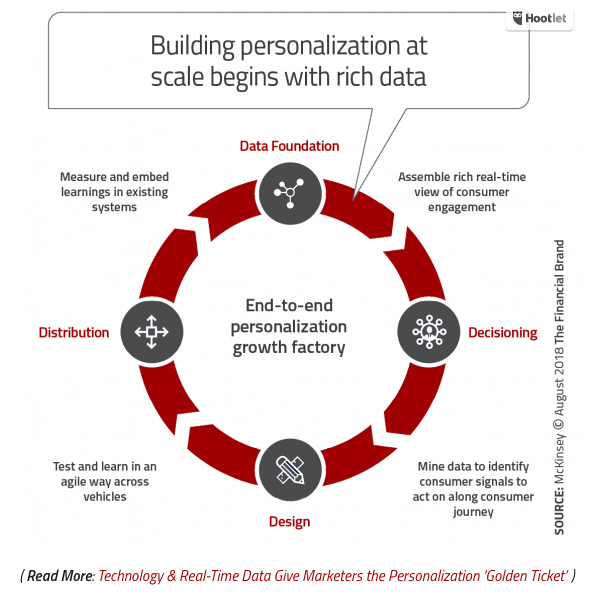

With louder voices and ever-increasing clutter from the latest vendor apps and developments in financial technology, keeping customers loyal with personalized experiences and tools – like the ones we’ve become accustomed to in our consumer retail lives – will be key in 2019.

As Jim Marous fromThe Financial Brand put it: “Many financial services organizations are taking a ‘GAFA’ (Google/Amazon/Facebook/Apple) approach, leveraging insights and data derived from services and individual organizations to boost their core business.”

Read the Financial Times article here.

In the past decade we have seen the rise of ‘open’ initiatives. We now have open source software, open government and open innovation. Up next is open banking – the idea that banking data is accessible and shareable with third parties upon customers’ explicit consent via secure applicable program interfaces (APIs).

Open banking is gaining momentum around the world. There are no global standards as of yet and there is still much work to be done before widespread acceptance and implementation. As our mission is to empower the world to be financially strong, MX firmly believes people own their data and should be able to choose to share it securely, privately and with clear intent for its use. We will be helping to shape the future of open banking in 2019.

(For more about the rising voice of the customer, watch the recording of the December MX-sponsored American Banker webinar “The ROI of Advocacy” and read the MX white paper, “Open Banking in the U.S.: Where Are We?”)

Banks, credit unions and fintech developers have long understood the value of their customer data. In 2019 they will take major steps toward using that data not only for their own advantage, but also for the advantage of their customers. It will start with more financial institutions building a data-driven culture, knowing their desired business outcomes, defining the process before the system, and then starting initiatives that deliver what some companies (such as USAA and Amazon) call a “data-driven customer obsession.”

The 2019 data-driven and artificial intelligence (AI) predictions of a few dozen industry leaders are summarized in a recent article inForbes.

June 25, 2025 | 2 min read

June 23, 2025 | 2 min read

June 10, 2025 | 2 min read