Putting Data in Action: Why Consumers Expect It — and Deserve It

June 25, 2025 | 2 min read

Blog

Blog

Sept 19, 2018|0 min read

Copied

Read or watch our recap of the latest news in the fintech industry:

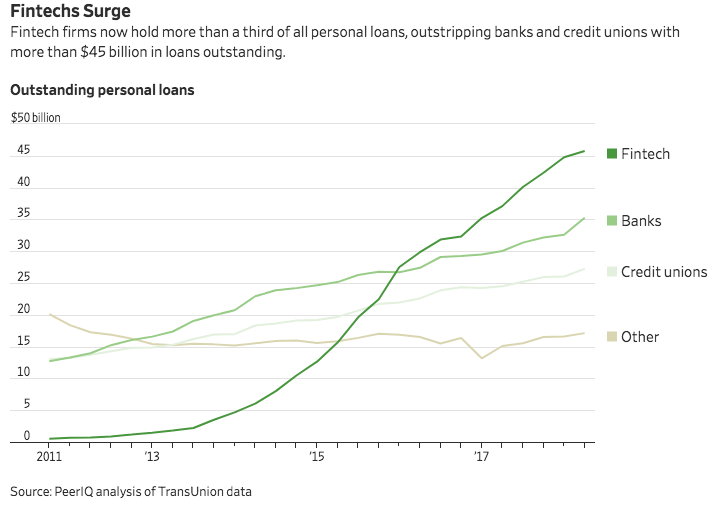

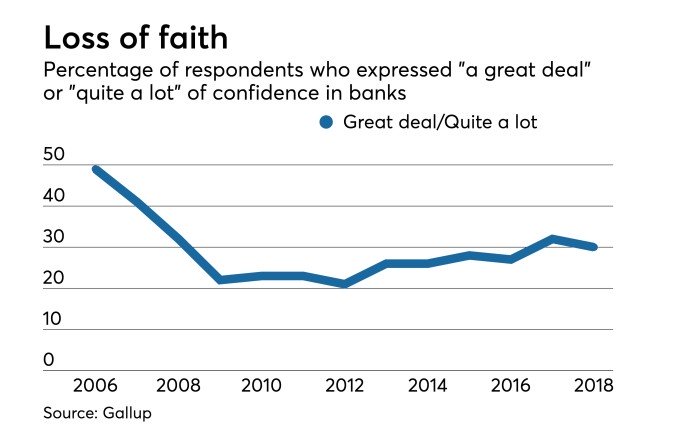

Banks have revamped many of their operations over the last decade, and they’ve spent billions of dollars complying with a host of new rules. But if they can’t figure out a way to win back more of the public’s trust, all that work could be for nothing.

Read the story by Victoria Finkle in American Banker(Sept. 14)

Research reveals what drives brand loyalty at USAA, and why they consistently rank atop one satisfaction study after another.

Read the story by Bill Streeter in The Financial Brand(Sept. 10)

.png?t=1539024312851&width=565&name=Financial-Banking-USAA-Repurchase-Intention-565x402%20(1).png)

The trend for mobile and online banking continues to take its toll on physical bank branches and staff numbers, with new figures from the European Banking Federation showing an ongoing decline

Read the story in Finextra(Sept. 11)

In the past year, it’s a deal about one-third of us made: We handed over our bank data to a fintech app in exchange for it to help us quickly manage our money or provide some other benefit. However, it turns out we have some concerns about the very thing we’ve been doing to save us time and money, new research shows.

Read the story by Mary Wisniewski in Bankrate(Sept. 3)

June 25, 2025 | 2 min read

June 23, 2025 | 2 min read

June 10, 2025 | 2 min read