Putting Data in Action: Why Consumers Expect It — and Deserve It

June 25, 2025 | 2 min read

Blog

Blog

Feb 26, 2018|0 min read

Copied

MX recently hosted another FinTech Festival in the beautiful mountains of Sundance, Utah. These exclusive events, which are for key players in digital banking, give financial institutions the chance to learn and collaborate with some of the best minds in the industry.

As part of event, we asked a series of questions to participants and wanted to share the anonymous answers here. Note that the respondents tended to be involved with digital banking initiatives, so the data skews that way.

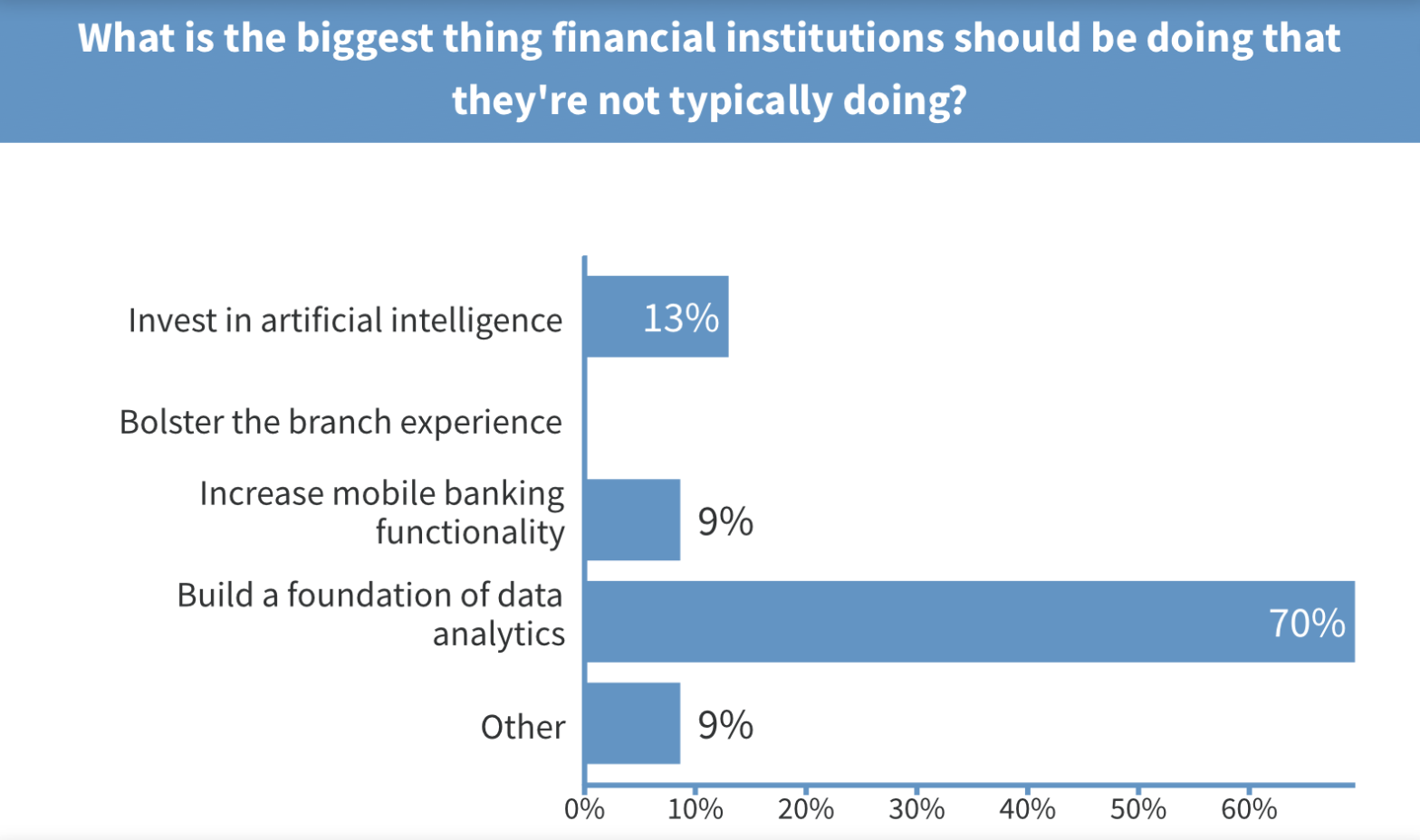

First we asked what's the biggest thing financial institutions should be doing that they're not typically doing.

70% claimed that banks primarily need to build a foundation of data analytics while 13% said they primarily need to invest in artificial intelligence and 9% said they primarily need to increase mobile banking functionality.

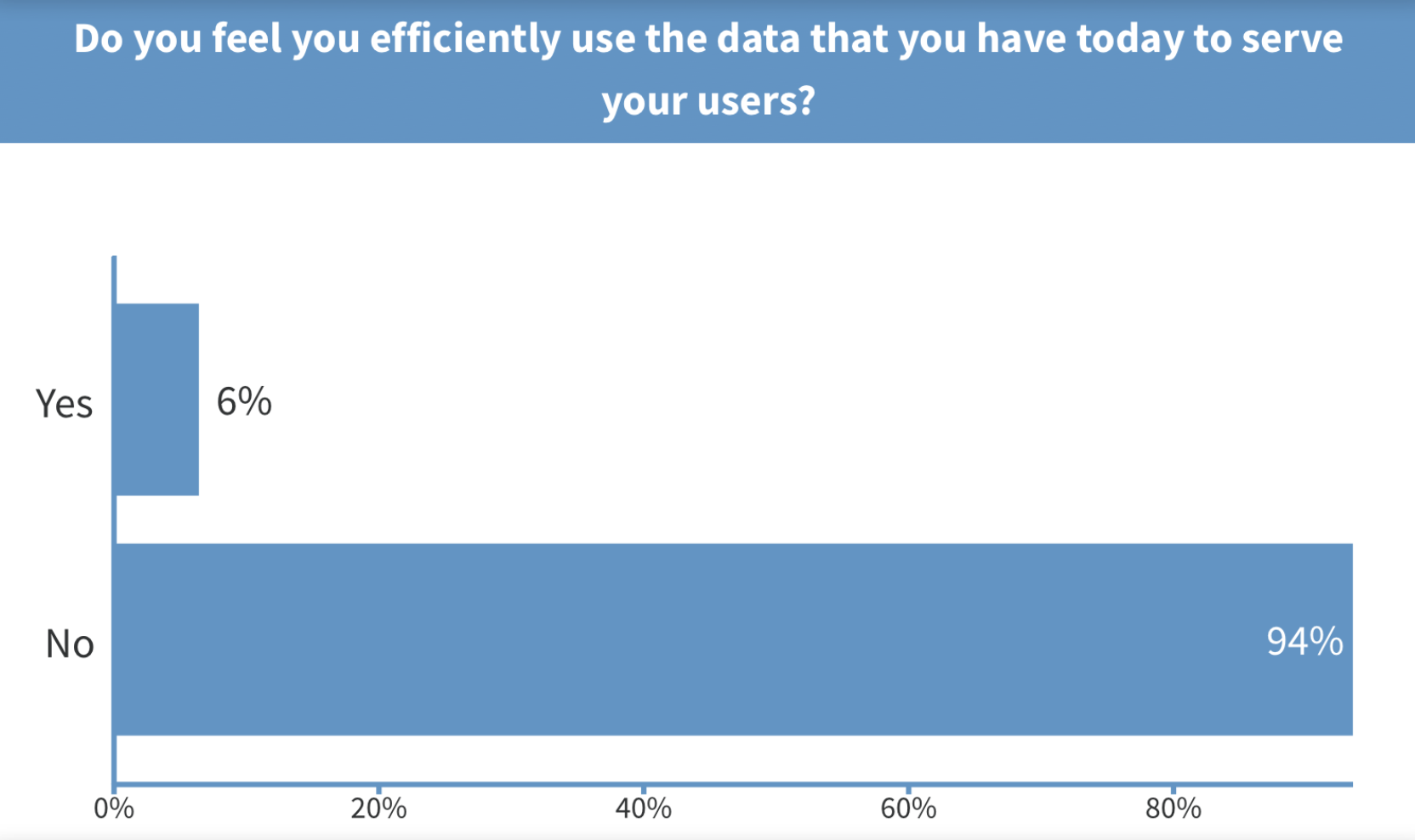

Interestingly, even though 70% of respondents said that financial institutions should primarily be building a foundation of data analytics, only 6% felt that their institution was efficiently using the data they have today to serve their users.

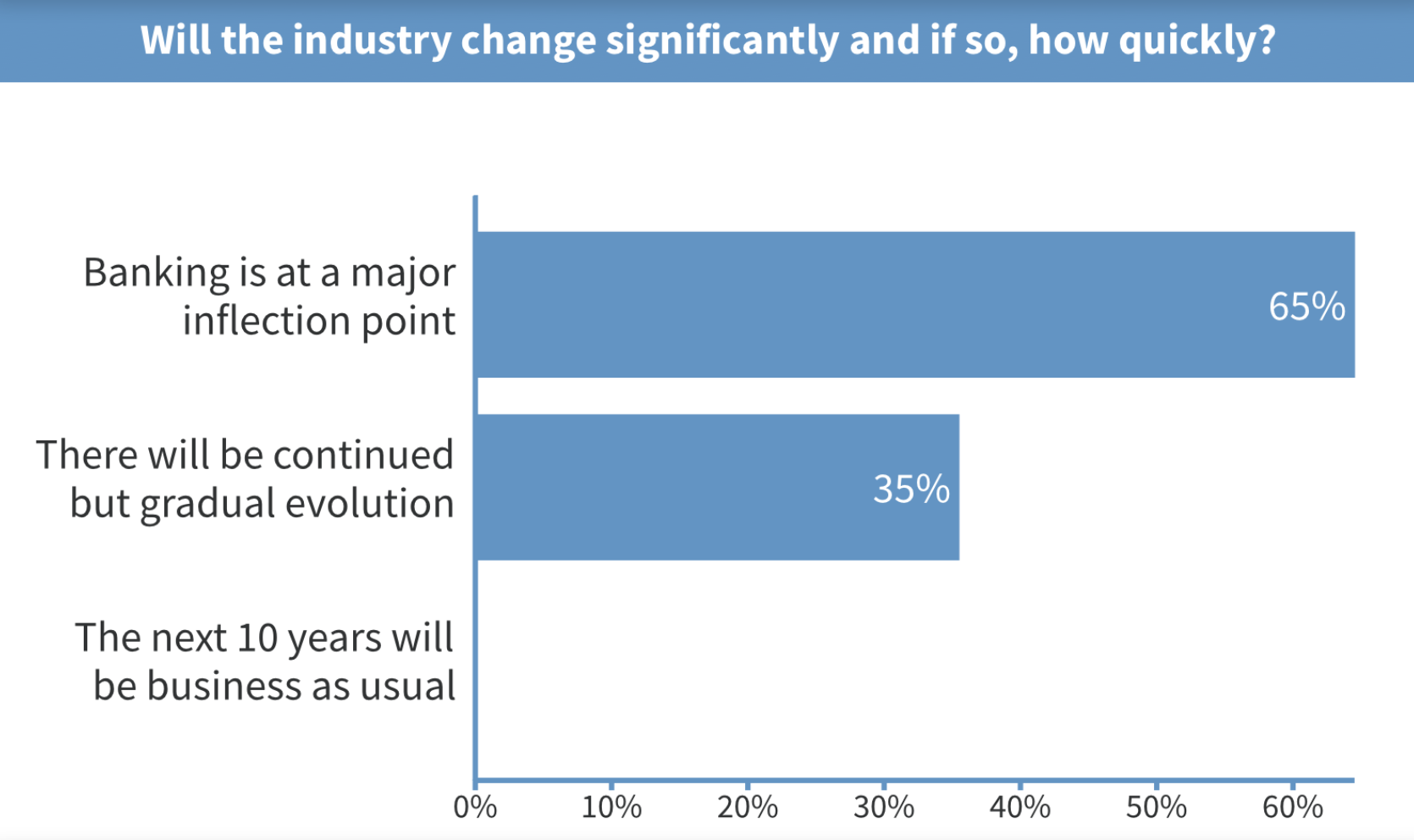

What's also telling is that 65% of respondents said that banking is at a major inflection point, 35% said that there will be continued but gradual evolution, and 0% said that the next 10 years will be business as usual. We've been doing surveys like this for years, and this is the first time no one has selected 'business as usual.'

Altogether, this snapshot (combined with a multiplicity of other snapshots from analysts across financial services) tells a story of an industry that's hungry to use data to more effectively help end users.

June 25, 2025 | 2 min read

June 23, 2025 | 2 min read

June 10, 2025 | 2 min read