Opportunity over Obligation: Considerations for Standing Up an Open Banking API

April 16, 2025 | 2 min read

Blog

Blog

March 11, 2020|0 min read

Copied

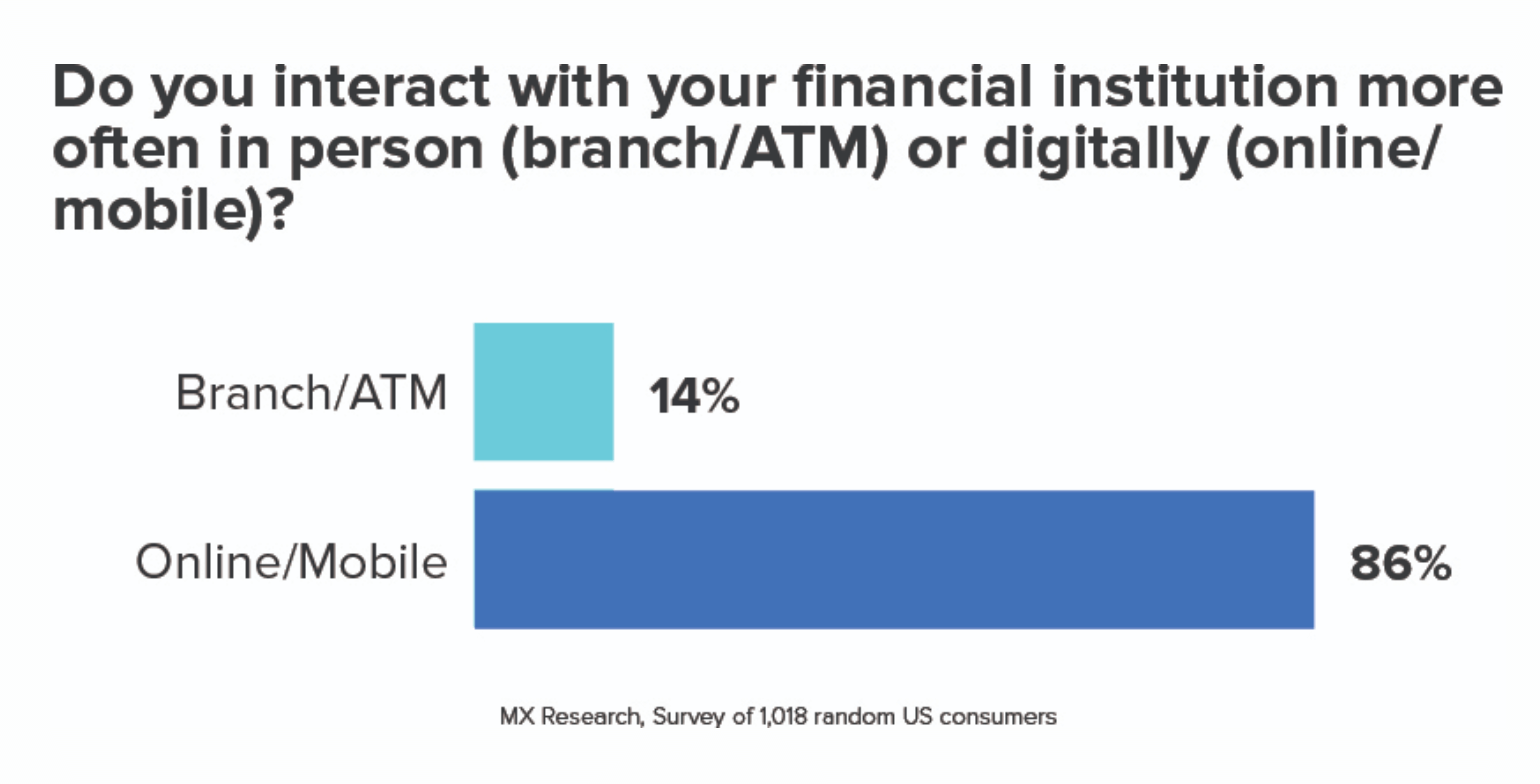

If you want to be an advocate for open banking and data sharing within your organization, you should know that there’s already a lot of activity going on in the marketplace. Many of the largest financial institutions are jumping in early and granting access via APIs, so if you haven’t moved already, you’ll likely be a fast follower rather than a leader in the industry. And yet it’s better to start now instead of later, especially because people are already overwhelmingly choosing digital channels over traditional channels (indicating consumer demand to optimize digital channels).

To get a competitive edge, it’s best to play offense. This means that successfully implementing open banking is not just about focusing only data leaving your organization. It’s also about using your customers’ incoming data to actively provide better insights. After all, you can’t give the right advice if you only have access to your customers’ held accounts. You also need to see held-away accounts. Data aggregation and open banking enables you to have a better view of your customers.

For instance, BBVA Open Platform offers APIs that help financial services companies verify identification, move money, originate accounts, issue cards, receive notifications, and more. If a fintech company is looking for a simple way to identify the customers they add to their platform, they can connect with the BBVA Open Platform API, which searches public and private databases, social media posts, watch lists, and sanctions — all in one API call. In this way, fintech companies don’t have to build this process from scratch. Companies such as Digit, Xero, and Wise are already making use of BBVA Open Platform. While BBVA hasn’t yet fully embraced data sharing in the sense we’ve been talking about in this guide, they are setting the stage for big moves in open banking.

To start, note that financial strength is not financial literacy. It’s not about checking boxes to offer the “right” financial products to your customers. Financial strength is about giving customers the option to withstand financial hardships and take more risks. For many people this means moving from living paycheck to paycheck to saving, investing, and eventually even reaching the Holy Grail of living off of interest and returns.

Financial strength plays out differently depending on the individual, but at the end of the day, the tools that people need to get there are really not that significantly different. They want to know information such as, “Am I on track?” or “Am I meeting my goals?” or “What does my cashflow look like?”

For example, Citi’s Developer Hub enables developers from various digital companies to connect to Citi via API. Notably, Intuit uses this connection to authorize data sharing with Quickbooks and Mint, Quantas uses it for their credit card offerings, and SingSaver uses it for instant account verification with Citi cards. The offerings in the develop hub vary by country, but Citi allows account aggregation, access to transaction data, authorization, and reward information in many places. By creating this developer hub, Citi is positioning itself for flexibility and stronger connections for their customers who use third-party apps.

With open banking, you might create a hyper-personalized offer for a savings account or a credit card or home loan with a better rate than the one they have because you can see you offer a better product than the one they have. This represents a huge opportunity to provide contextual advice and present tools that can help people change their behavior.

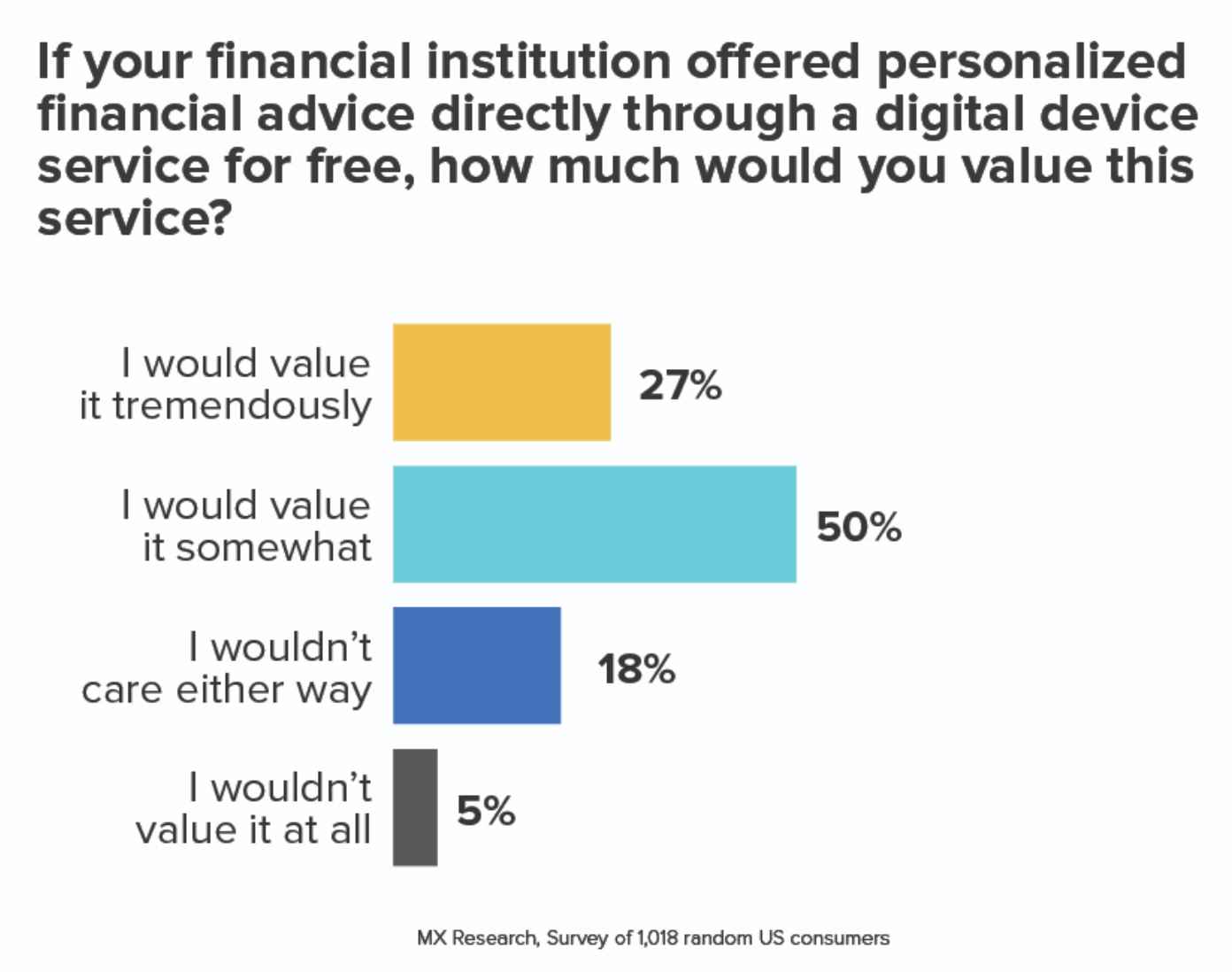

It’s something that customers are hungry for. In fact, we found that 77% of customers said they would value such a feature.

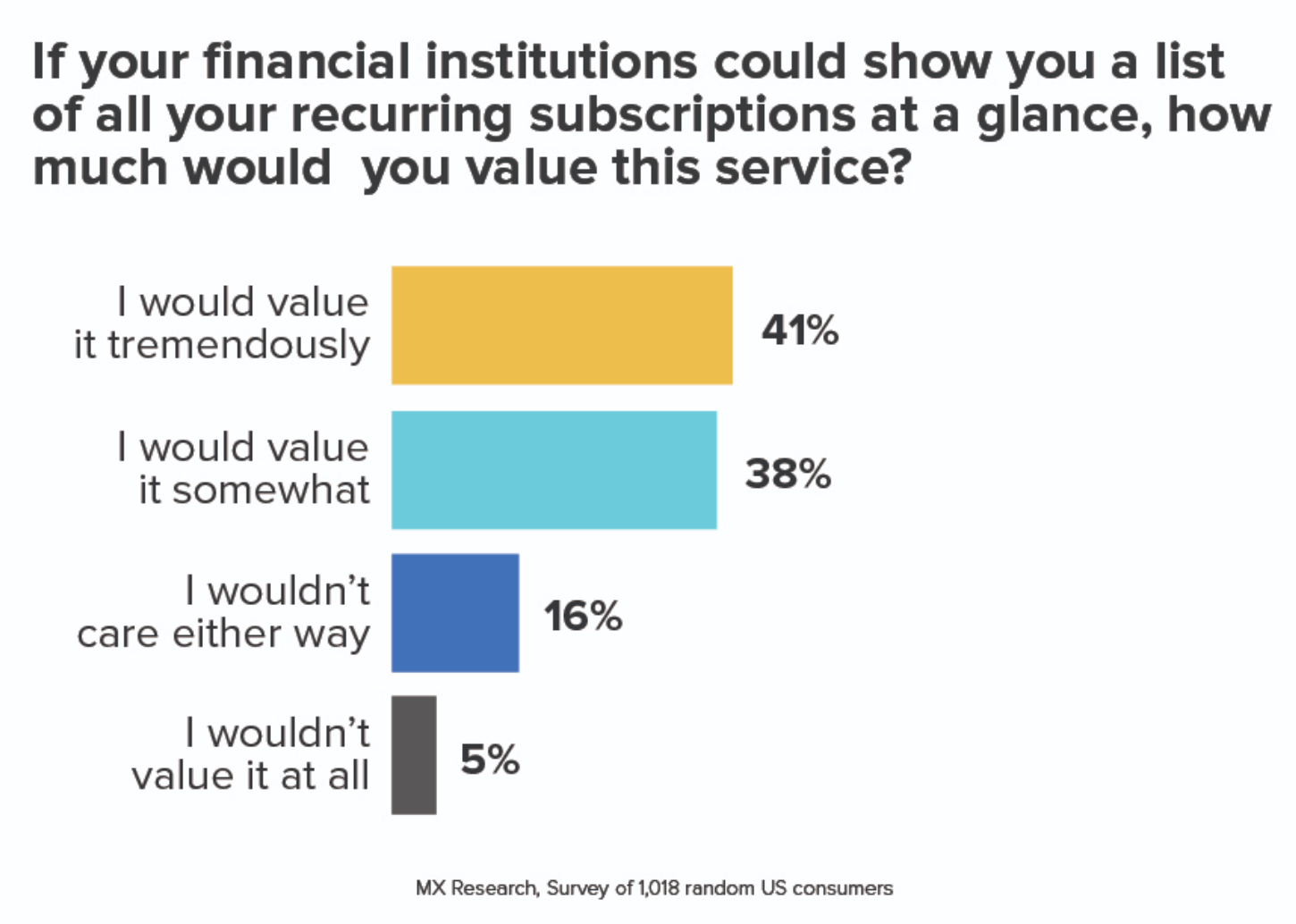

In addition, consumers expressed interest in having the ability to see all their recurring subscriptions at a glance, with 79% saying they would value such a feature.

You might also minimize risky behavior such as predatory lending. With open banking and clean data, you can use algorithms to scan transaction-level data, searching for patterns and outflows that indicate whether someone is paying down a high interest loan. Once you’ve flagged these instances, you can educate the customer, present them a lower interest debt consolidation loan, and then follow up with guidance on how to avoid any sort of future debt pitfalls.

In other words, you’re not just blasting your entire customer base with a message that you offer an 8% debt consolidation loan. Anybody can do that. Instead, you’re reaching out with empathy and a timely message around the true cost of high interest lenders. This way you deepen the relationship and show that you value each customer’s business.

In this same vein, you can help customers redirect spending into investing accounts to change long-term outcomes. For example, you might track a customer’s progress toward a savings goals, showing them ways to save money by the end of the month for their upcoming trip by adjusting their habits.

Capital One launched DevExchange with the motto, “Use our stuff to build your stuff.” Like BBVA, they offer the ability to verify identity and move money via API calls. They also let third parties connect customers with a view of their Capital One accounts and transactions via tokens rather than credentials. In addition, they give third parties the ability to create accounts with Capital One directly within these third-party products. Use cases include integrating wedding registries with a Capital One account and opening a savings account directly within a money management app.

When you start to roll out these projects, you might get confronted about ROI. Someone might ask, “What is the business case for this?” or “What are the business objectives?”

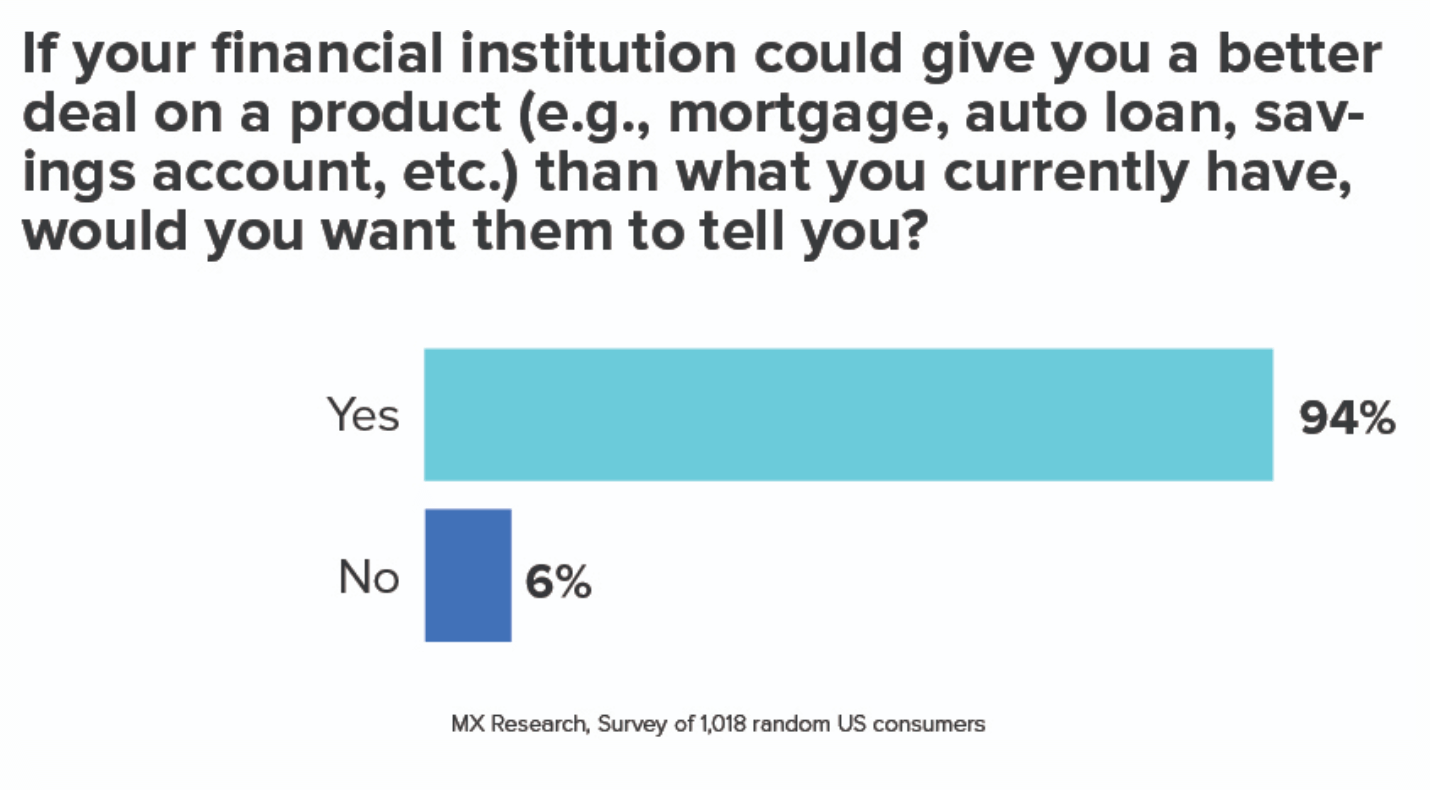

The truth is that your customers are demanding these solutions. When we asked customers if they wanted their financial institution to tell them if they could give them a better deal on a financial product than what they currently have, 94% of them said yes. They’re looking for you to put their data to use in ways that benefit them.

The ROI from these initiatives comes in three ways.

First, and most importantly, you build trust and long-term loyalty with your customers, setting you up for success through the coming decade and beyond.

Second, you best position yourself to sell your products to the right person at the right time. No more mass blasting shiny mailers to your entire customer base.

Third, you put more money in the accounts of your customers and thereby increase deposits. Take the ROI on things like a predatory loan reduction program, for instance.

When you successfully implement a plan like this, you’re immediately decreasing outflows so people are holding onto more of their income and increasing your loan portfolio in the process. On this note, if you could pick just one metric, you might ensure that every one of your customers has $400 in an emergency savings account by the end of the year.

Looking for a deep dive into open banking?

Check out the Ultimate Guide to Open Banking.

April 16, 2025 | 2 min read

March 28, 2025 | 6 min read

March 17, 2025 | 7 min read