Convenience Drives Consumer Choice for “Top of Wallet”

July 18, 2025 | 1 min read

Blog

Blog

April 22, 2016|0 min read

Copied

By 2017, Millennials will have more buying power than any other demographic in the United States. That means that banks and credit unions can’t risk ignoring this demographic.

Here are nine stats worth paying attention to if you're interested in knowing how Millennials bank.

1. Millennials are far more likely than any other demographic to leave their primary bank if that bank doesn’t meet their needs. This chart from FICO shows the specifics:

2. 58% of Millennials are interested in their bank “proactively recommending products or services.” This is compared to 46% of those over 55. (Accenture)

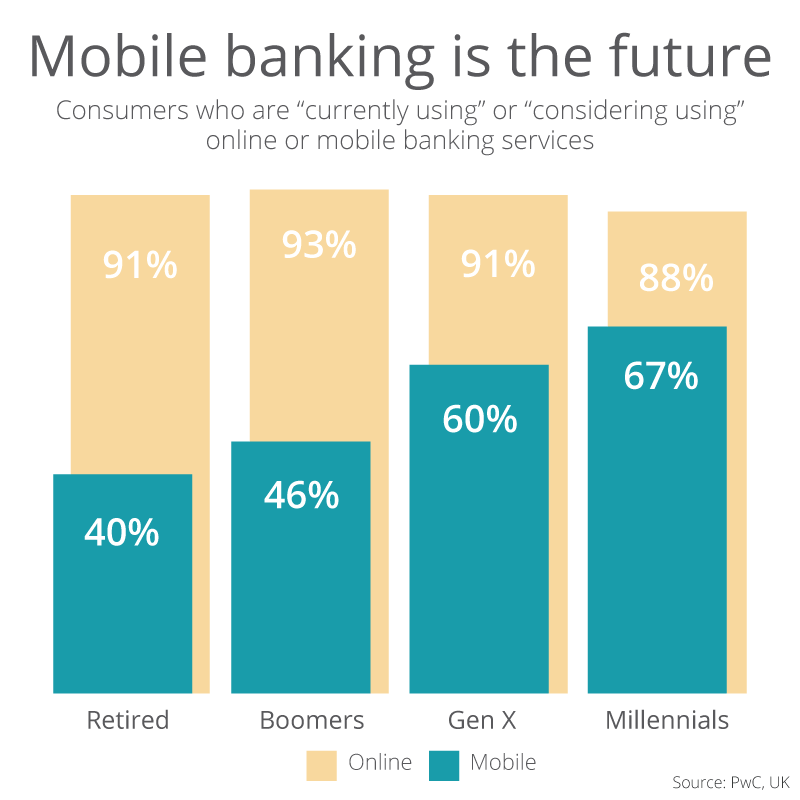

3. Millennials are more likely to use mobile banking than older demographics. In addition, they’re less likely to use online banking. Here’s UK data from PwC:

4. 67% of Millennials are interested in financial management tools from their bank or credit union. That’s compared to 33% for those over 55. (Accenture)

5. 74% of Millennials say that mobile banking is very important to them. That’s 76% greater than the Baby Boomer response. (ICBA)

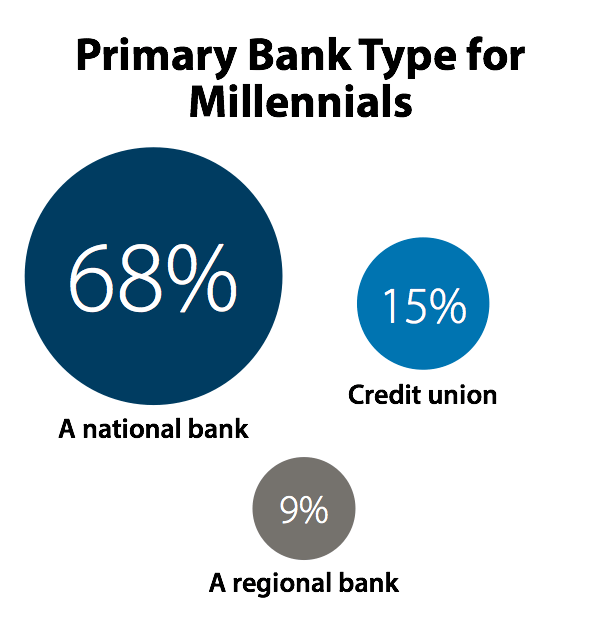

6. 68% of Millennials say that their primary bank is a national bank. Again, FICO shows the breakdown:

7. 85% of Millennials say they wish they could do banking and shopping on their smartphones. (Mitek)

8. On average, Millennials spend 35 hours a week with digital channels. That’s 50% more than the average of the other combined demographics.

9. 52% of Millennials have used mobile payments, according to data released today at Money20/20.

It’s clear that the trend here is toward digital—specifically, mobile. Young people are increasingly mobile natives. They expect to be able to do business where they want, when they want. This is likely the main reason they've chosen to bank with national institutions: These institutions generally pay more attention to mobile development. Banks and credit unions that want to stay competitive in the future should take note.

July 18, 2025 | 1 min read

April 25, 2025 | 3 min read

April 23, 2025 | 6 min read