How Financial Institutions Can Leverage AI While Maintaining the Human Touch

June 5, 2025 | 2 min read

Blog

Blog

Nov 20, 2019|0 min read

Copied

As the banking industry goes through a digital transformation, two deep currents are driving changes within the global financial services ecosystem:

People can search for a phrase such as “home loan” or “high-interest savings account” and immediately scroll through hundreds or even thousands of options — many of which are directly available via their digital device. Decisions aren’t restricted by locality or by traditional banking hours.

People no longer have to walk into a banking branch to change how they bank. They can tap their phone and transfer money or even log in and get a loan on their phone. In so many ways, banking is faster and more immediate than ever.

As Chris Skinner, author of Digital Bank, puts it, “We built an industry on the physical distribution of paper in a localized world, and we’re now having to get to grips with the digital distribution of data in a networked world.” For bankers, it’s not business as usual.

How should financial institutions best make the leap to being digital-first institutions, prepared for whatever the future may bring?

To answer this question, we created the Ultimate Guide to Digital Transformation, which pulls data from a range of sources, including an original survey of more than 1,000 random U.S. consumers, to get a clear sense of what leaders in financial services must do to make the most of the digital age.

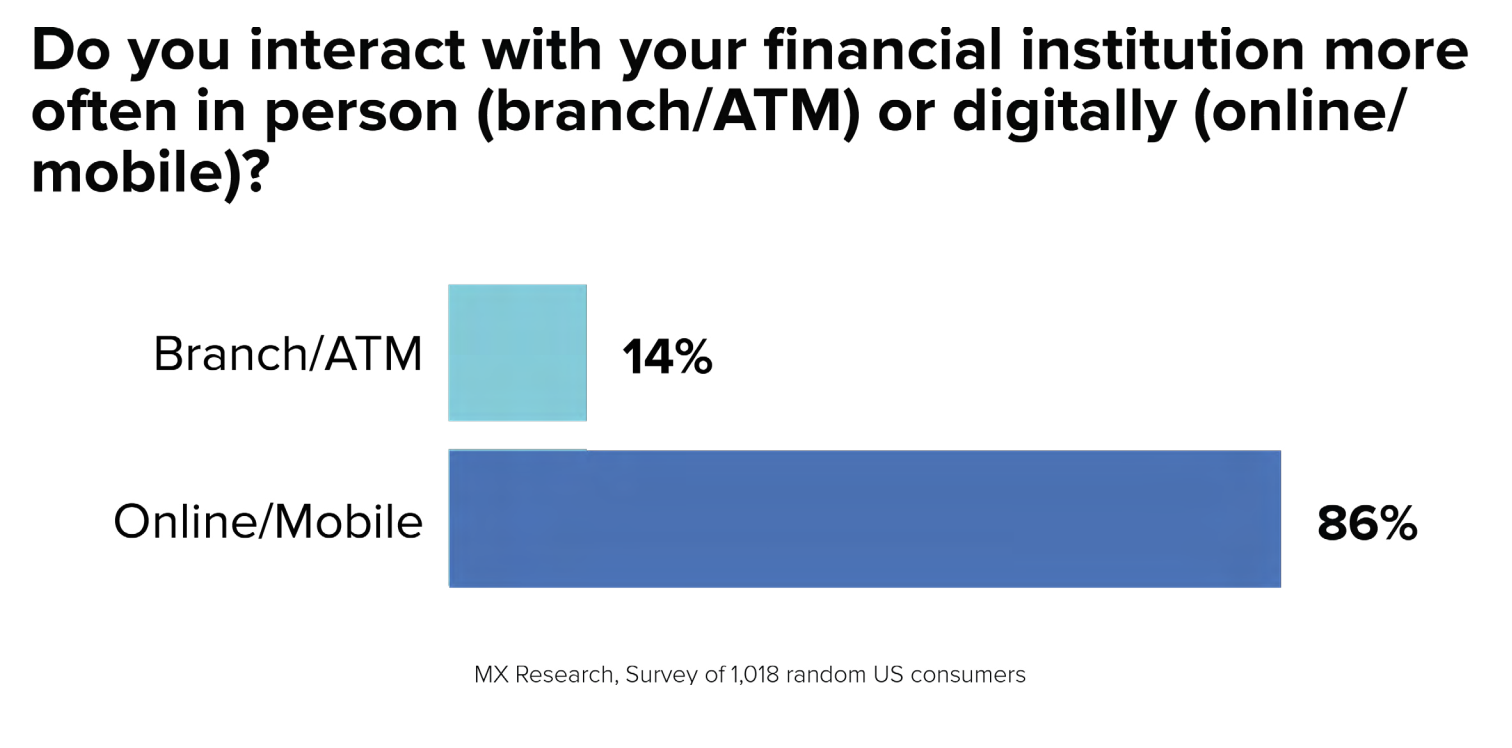

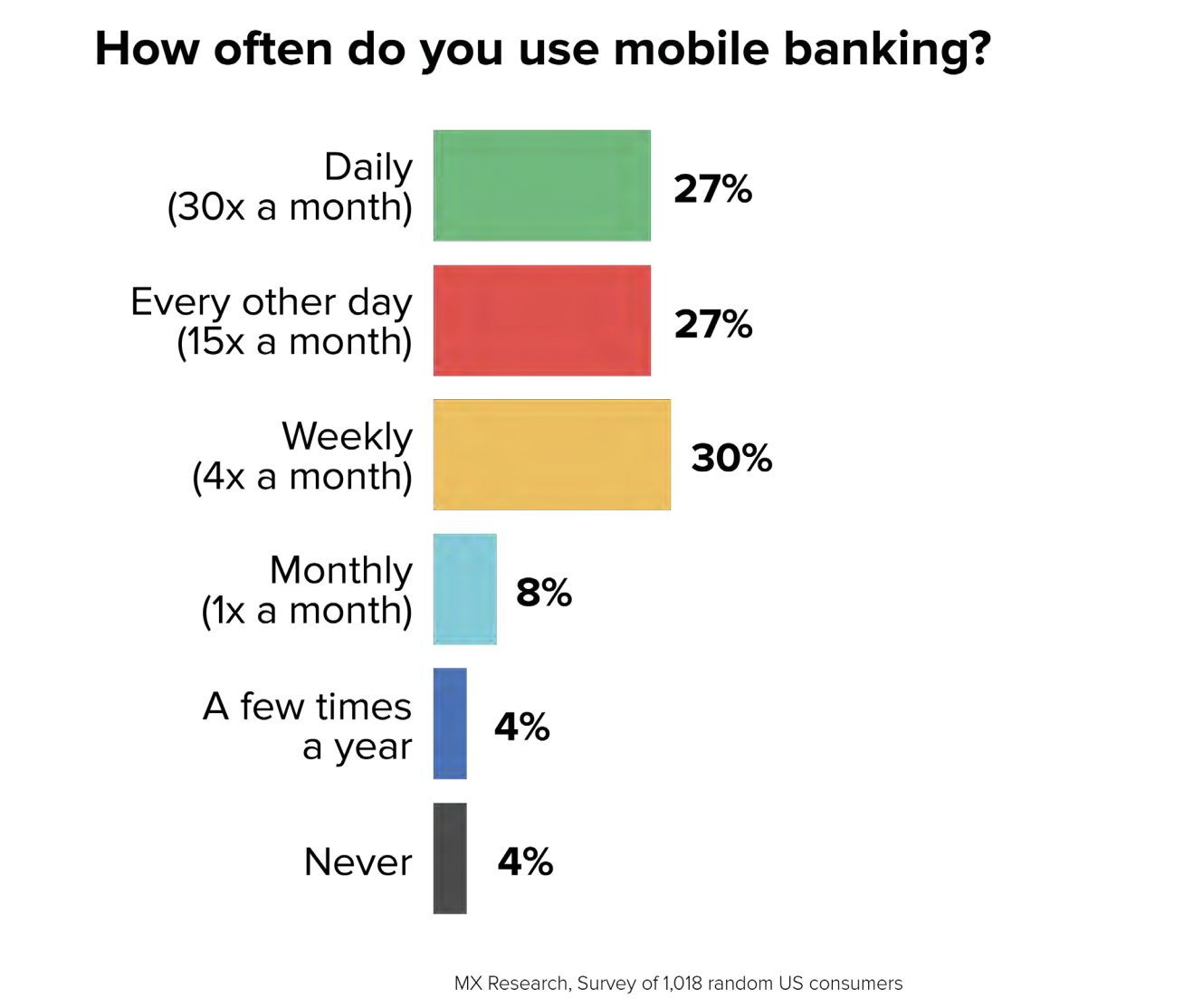

According to our research, 86% of U.S. consumers are interacting more frequently with their financial institution digitally than in person and more than 80% of consumers use mobile banking at least once a week. The new guide to digital transformation provides a roadmap for financial institutions to drive breakthrough customer experiences at every meaningful touchpoint.

Other findings included within the Ultimate Banker’s Guide to Digital Transformation:

Given the increased choice and decreased friction in the digital age, the goal of all financial services companies must be to do what’s in the best interest of the end user by empowering them to be financially strong. Put simply, that’s the best way to win their long-term loyalty. (Otherwise, they’ll bank elsewhere.)

If you're looking for a guide in the transition to digital coupled with dozens of real-world data points, download the Ultimate Guide to Digital Transformation.

June 5, 2025 | 2 min read

Feb 18, 2025 | 1 min read

Jan 30, 2025 | 2 min read