Putting Data in Action: Why Consumers Expect It — and Deserve It

June 25, 2025 | 2 min read

Blog

Blog

April 22, 2016|0 min read

Copied

In this interview with Michal Panowicz, Managing Director for Products, Marketing & Digital at mBank, we learn the process to become a digital bank and why it matters now more than ever before.

To me, the most critical thing is making the transition to becoming a digital bank. Most banks misunderstand why this is so important or even what it means. Many people think that “digital” means putting out a new app, or beautifying the user experience on the front end. But what really defines a digital institution in finance is having end-to-end digital product-and-services processes. A digital bank can receive customer requests from any channel and interact with their customers directly via digital or remote channels — all on the same core banking platform.

Because most banks don’t have end-to-end digital capabilities, they offer mobile apps where you can’t do much of anything. Sure, you can see your balances and maybe make a deposit or manage your money in a limited way, but you can’t sign up for a loan or buy insurance or interact directly with a representative. With a digital bank, every feature is easily available on every channel because it’s just a matter of creating an interface that can access the single digital core.

Going forward, not having end-to-end digital capabilities is only going to increasingly hurt traditional banks, and so it’s time to focus on making the full transition to digital. Importantly, bankers should realize that going digital does not mean giving up branches, which are still useful for many interactions and for many customers. Digital banks are greatly enhanced by branches, yet these branches operate on the same digital process infrastructure as all other devices/form factors.

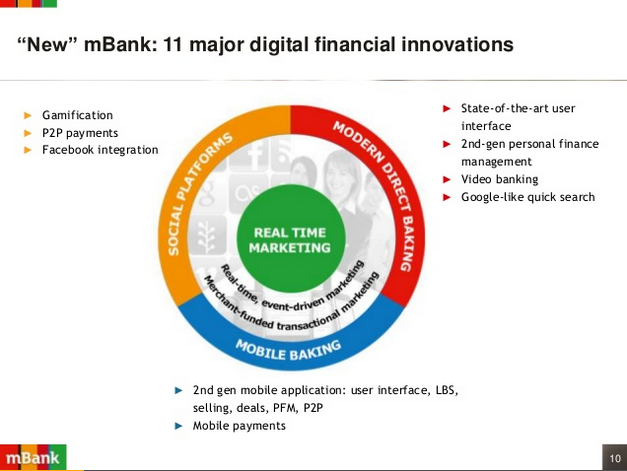

By making the full transition to digital at mBank we are able to focus on the following areas:

It is a big undertaking. It’s a dramatic decision. For instance, Banco Bradesco in Brazil spent around $2 billion replacing their old legacy IT, so it’s certainly no small task. Basically, you have to unwind the whole bowl of spaghetti that legacy technology has become.

One other option that isn’t necessarily simple but may be more feasible for some institutions is to set up a side bank, a new digital entity, and migrate customers gradually to the new institution. Obviously that strategy will take some time and does create some transitional overlaps, but it’s better to get to work on making the transition than to wait until it’s too late.

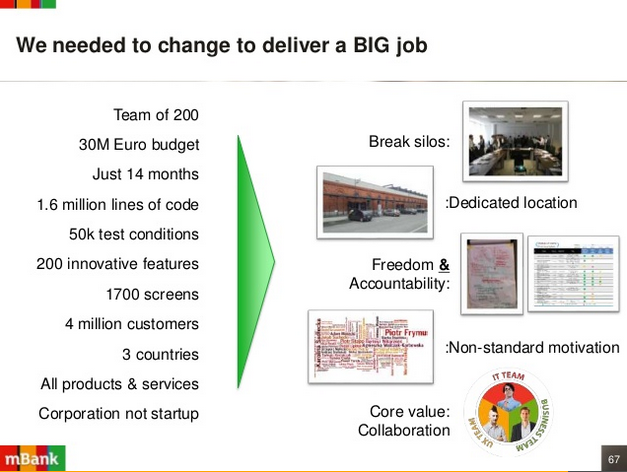

Here is the process we went through for digital change:

We’ve harmonized all our products — mortgage, car loans, mutual funds, brokerage, insurance, etc. — on digital. More importantly, we’ve also learned how to sell each of these products through digital and remote channels, which dramatically cuts our costs compared to the competition because we’re not worried about all the overhead that comes with having a lot of branches.

In addition, customers appreciate that no matter how they choose to interact with us the experience is consistent. The employees at the call center see the same interface as branch staff, and have the same complete information on customers as customers themselves have customers. In too many banks customers need to be handed off to different call center staff as each can see only a portion of who the customers is – think servicing your mortgage, checking and credit card with the same person. So at mBank anything that changes in one place is automatically updated across the board. That’s all because we have end-to-end digital capabilities.

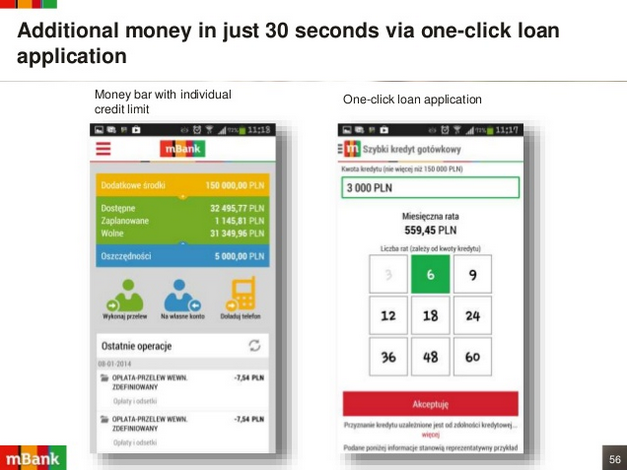

This allows us, for example, to offer loans in 30 seconds across any device:

We do. In fact, 100% of our customers are exposed to personal financial management functionality because it’s fully integrated into our core and available on any interface. While regulation in Poland prohibits us from allowing users to aggregate external accounts, all of our users can see their transactions categorized and budget accordingly. Our users can also see predictions of their future liquidity as well as their overall household budget and can change their habits ahead of time based on those predictions.

Yes, since our founding in 2000 we’ve grown to have 4.4 million customers, which makes us the third largest bank in Poland. We’ve been able to move quickly and appeal to potential customers because we started out as a digital bank, and we hope to continue this growth into the future.

June 25, 2025 | 2 min read

June 23, 2025 | 2 min read

June 10, 2025 | 2 min read