The Evolution of Primacy: A Deep Dive with Fintech Takes

July 14, 2025 | 3 min read

Blog

Blog

May 11, 2016|0 min read

Copied

New research reveals that consumers are hungry for advice to help manage and improve their financial health but a hesitance to aggregate accounts could reduce the usefulness of the insights generated by financial institutions. Javelin finds that while 46% of bank PFM users are willing to provide passwords to their primary FI for aggregation of external accounts, only 17% of non-users would be willing to do so. “The ability to deliver personalized insight and advice hinges on compiling a complete picture of a customer’s finances: deposit accounts, credit cards and loans, and investments, including those held at secondary FIs,” writes Javelin in its April report Digital Money Management in 2016: Moving Beyond Fits And Starts. “But gathering this data requires customers to share their login and passwords, a model that FIs oppose innately.”

Bank of America, Chase, Wells Fargo and PNC are some of the FIs that have led a backlash against aggregation services. PNC Financial CEO Bill Demchak recently told American Banker that he refers to data aggregators as “aggravators” and that “they slow service for the rest of our accounts.” In the fall of 2015 customers of Mint and other personal finance apps were temporarily cut off by a number of large banks. But it’s not just large FI outages that cloud the future. Javelin states that consumer anxiety around aggregation will be a significant hurdle to overcome. “Security certainly is one worry but so is the fear that FIs cannot be trusted with such intimate financial information without abusing it,” writes Javelin.

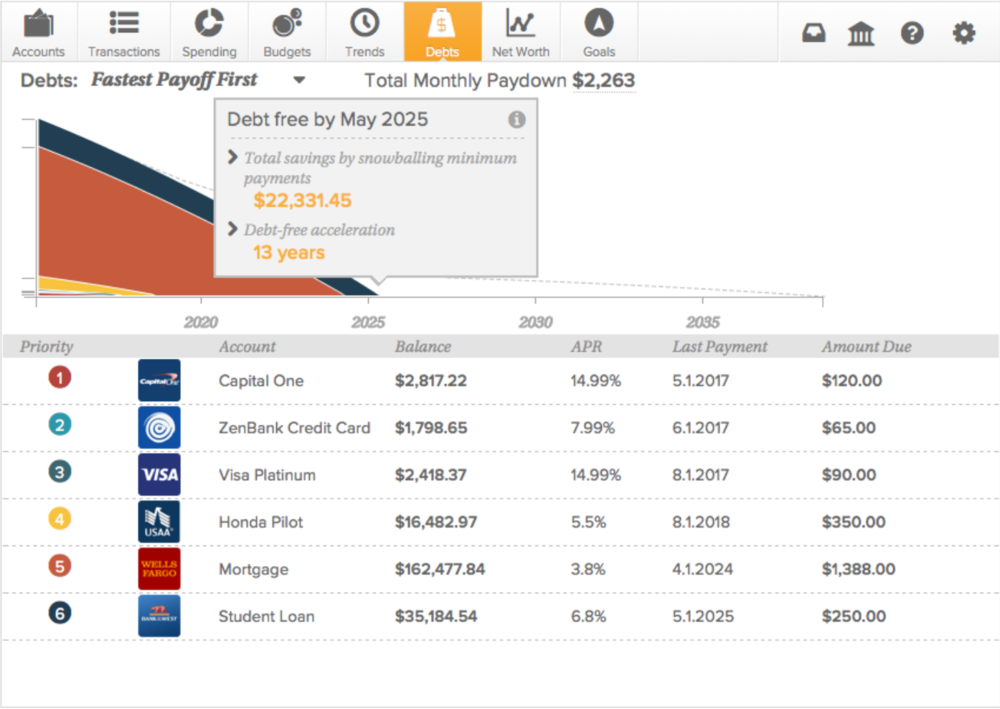

Those consumers who do become comfortable aggregating and provide a complete view of their financial picture will be arming their FI with the data to provide personalized financial guidance. Forrester states that the future of digital money management is financial coaching and then enabling consumers to take action. “Customers don’t look at their finances for fun; they want to make decisions and then act on them. Digital money management needs to help customers answer questions, give them advice on what to do next, and enable them to take action by themselves,” writes Forrester in its April report Use Digital Money Management To Deliver Personalized Financial Coaching. Forrester offers the example of MX’s Debts tool, enabling customers to “manage their aggregated debts from a single place and prioritize paying off certain debts.”

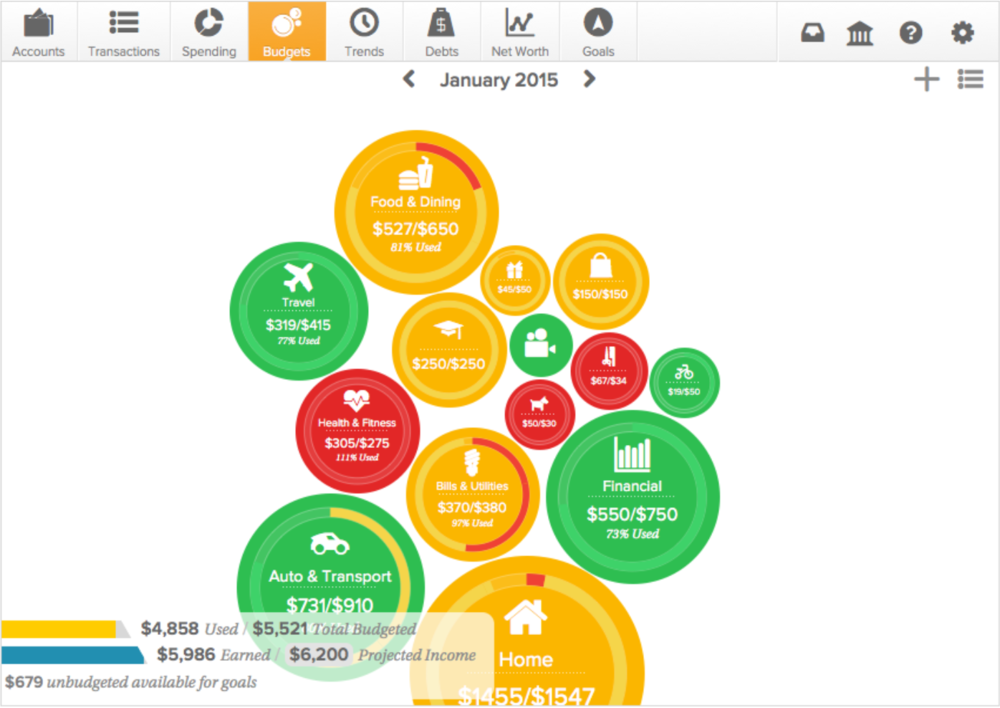

Forrester finds that the delivery of personalized, contextually relevant advice will rest on the rollout of new capabilities, including real-time data and data visualization. “Banking platforms that are capable of real-time transaction processing are a prerequisite if you want a mobile customer to be able to see an ATM withdrawal from moments ago, let alone provide immediate spending and savings recommendations,” writes Forrester. Beyond being immediate, the data must also be easily interpretable. Forrester identifies MX's bubble budgets as a standout in data visualization. “Instead of relying on pie charts, firms that use MX Technologies’ platform can show customers bubble budgets that use color, size, and icons to present data in a way that helps them see at a glance whether they are on track or not, is visually pleasing, and is easy to interact with on a smartphone or tablet.”

Other pieces of the technology puzzle will include game mechanics, appealing to one’s sense of competition or achievement to drive savings and improved financial health, and tying in back-end systems through APIs “to call on dynamic product and customer data. This enables personalization for individual customers, instead of directing customers to static landing pages to seek generic advice or guidance.”

Spending-related offers, capitalizing on customers’ spending patterns and geolocation to offer them deals from nearby merchants, have been rolled out by some vendors as a cost savings benefit. However, Ally Financial is using geolocation for an entirely different purpose — to prevent purchases from even happening. Ally recently rolled out a “Splurge Alert” app which asks users to identify stores where they tend to overspend. The app uses geolocation to ping users when they approach that budget busting merchant— a “splurge zone” — and also alerts designated friends in the hopes that they’ll lure the user away from temptation. Ally touts the app as the first of its kind to combine geotracking and social interactions to help consumers change their spending patterns.

Delivering better personal finance insight and advice will be crucial for banks and credit unions looking to cement primary FI status and keep consumers from leaving. Javelin finds that 35% of consumers are likely to turn to FIs, personal finance apps and technology leaders like Google and Apple for “digital financial management services that offer advice regarding how to better manage money or improve their financial health.” However, the consumer preference strongly tilts toward FIs providing this assistance, as 3 in 4 would first choose their bank or credit union.

The desire for financial advice is particularly strong among Moneyhawks®, an FI’s most profitable account holders, and Gen Y.2, consumers aged 24-35. “About 3 in 4 Moneyhawks who use personal finance features desire financial advice from their FIs and would consider it a compelling reason to remain a customer,” writes Javelin. More than half of Gen Y.2. desires financial advice from their primary FI and considers it a reason to stay. Financial institutions would be wise to take heed.

Moneyhawks® is a registered trademark of GA Javelin LLC, dba Javelin Strategy & Research.

July 14, 2025 | 3 min read

June 25, 2025 | 2 min read

June 23, 2025 | 2 min read