Setting the Standard for Financial Health Starts with Data Access

June 16, 2025 | 2 min read

Blog

Blog

April 4, 2018|0 min read

Copied

What's the value of partnering with fintech companies? In every institution, there are individuals who aren't willing to change — who worry about what change may mean and are skeptical of the benefits promised by the digital transformation.

And yet fintech is a leading force in banking. Whether you manage a large, corporate bank or a small credit union, fintech will likely continue to grow in dominance.

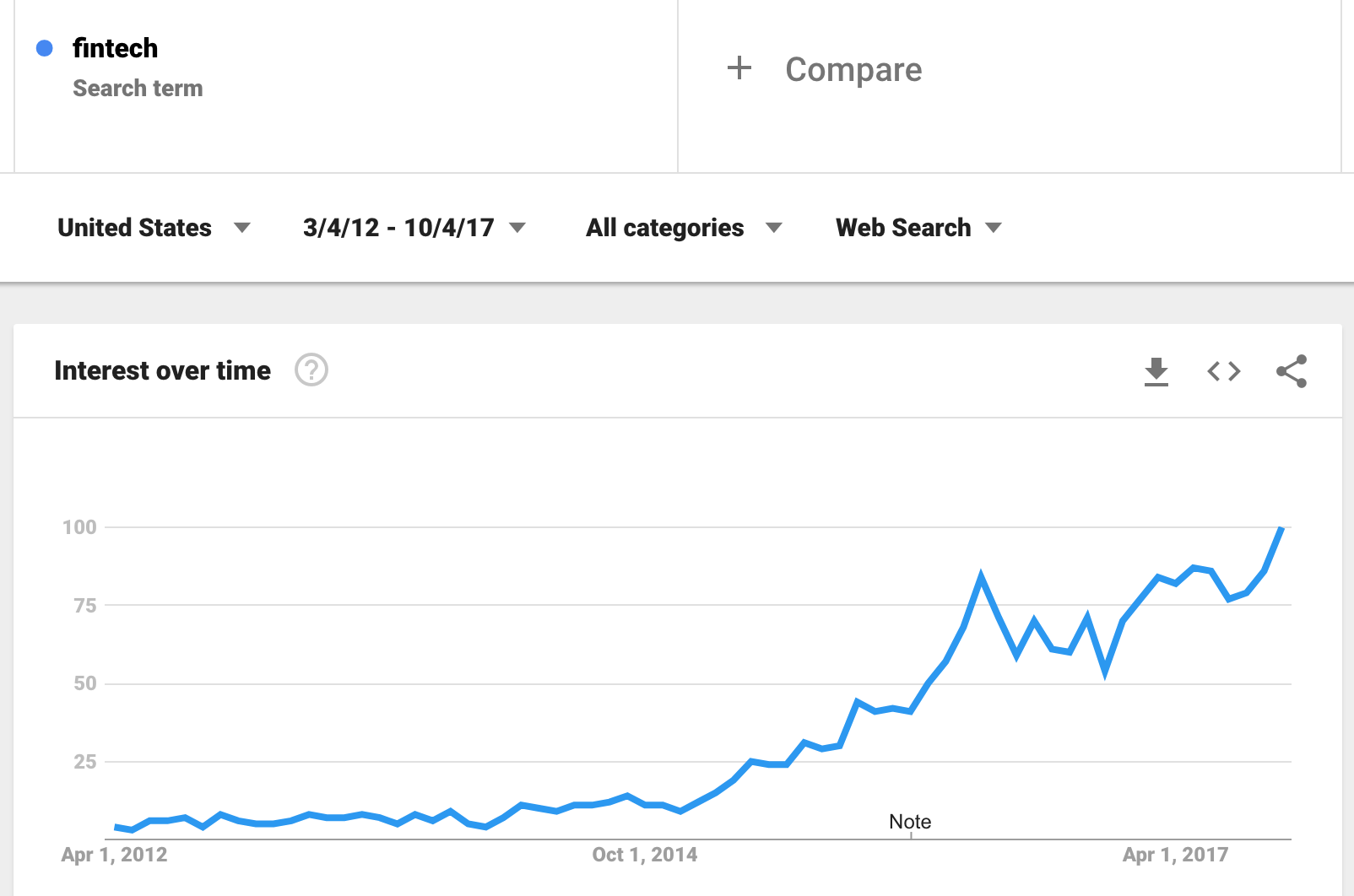

Just look at the Google Trends related to the fintech:

The question is, How can you get employees, managers, and upper tier management on board with investing in the right financial technology before the competition leaves you behind?

Admittedly, every financial institution must find a balance between investing in new fintech solutions and meeting their other financial obligations. And there is some level of concern about doing too much too fast and overwhelming employees.

Yet fintech data offers an ROI that is simply too important to overlook.

To show staff and others in the industry what this value is, consider a few key points.

A good place to start is with data, since data is at the heart of the true ROI in every fintech situation. That is, the more data you collect and analyze, the more information your financial institution has to provide better recommendations and services to your users, which in turn delivers better resources for your employees.

For instance, a 2015 report fromPWC found that 2.5 quintillion bytes of data were created every day that year. The big data market itself was $32.1 billion, and it has likely grown substantially more since then.

Data — enriched through the proper methods — is so valuable because it provides answers to questions such as what services a user needs and how bankers can reach their targets faster.

In short, data is powerful information that can streamline the overall function of any business.

Let’s consider some ways it is doing this right now.

Microsoft recently released key information about what users expect from their financial institutions. According to their findings, users want easy banking solutions, a wide range of options, and responsive service.

Without these types of innovative solutions (think tech here, not just a teller), users can easily and effortlessly turn to a third party provider instead. That could be an online-only financial institution or one of the up-and-coming fintech companies sidestepping the traditional banking institution today.

In short, financial institutions must focus on and improve user experience to maintain loyalty. This isn’t even about growth as much as it is about maintaining users.

Another way to look at the value of analytics is to consider ways it saves financial institutions money.

Say a financial institution has a special high-cost promotion to run. It does so with the promise that only a very limited market would achieve the best promotional offer, reducing its risk. Other users would receive less. However, by analyzing data, it was found that there were unnecessary discounts applied. Those discounts could have cost the financial institutions millions.

What machine learning can do is to provide the bank with information about this type of scenario – patterns of unnecessary spending or discounts. Then, the financial institution can make changes, reducing costs, still meeting customer expectations, and enjoying less loss along the bottom line.

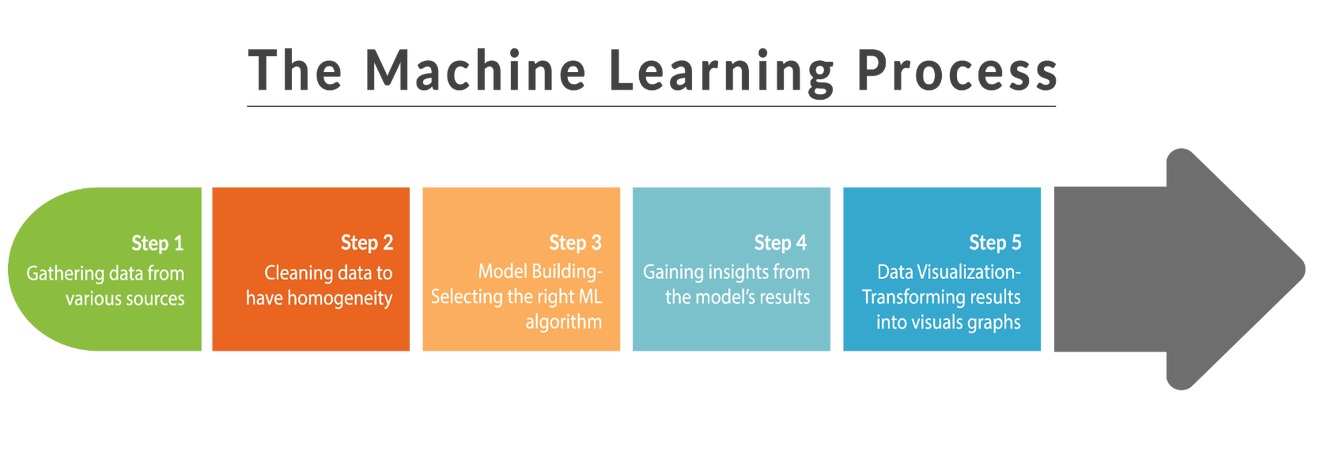

Of course, the success of machine learning depends 100% on the quality of data it pulls from, as a well-read computer scientist illustrates in the graphic below:

McKinsey reports about a situation in Asia in which a well-known bank with a large share in the market failed to provide customers with the products they needed, creating turnover. Instead of simply choosing any product, it used advanced analytics to determine what users really wanted based on demographics and other key characteristics. It used various points of data to determine what specifically meet their current customers’ needs. This makes it possible for the organization to invest wisely where it matters most.

These examples show one thing — that data is incredibly valuable and will continue to be so in the future. It helps save money, ensures every investment is made well, drives customer growth, and helps reduce customer loss. These are monetary-based benefits fintech offers to every financial institution today.

When financial institutions focus primarily on in-branch service at the expense of digital convenience, they risk losing their user base. Having a friendly staff and being involved in the community isn't enough. Users demand convenience, and companies that don’t meet user demands don’t survive.

All of this illustrates the necessity of investing in fintech, especially since the volume of transactions handled at a physical branch has declined by more than 45 percent across the industry since 1992, while the cost per teller transaction has skyrocketed.

In other words, focusing primarily on a traditional growth model (e.g., building branches and hiring new tellers) is merely an expensive way to fail. In addition, the revolution in the financial industry is not slowing down, as evidenced by the sharp decline in transaction volumes shown above. If anything, the change is speeding up. Users are visiting physical branches less and less, and they’re demanding digital channels more and more.

And this is why it's so crucial to invest in fintech now.

June 16, 2025 | 2 min read

April 8, 2025 | 4 min read

April 2, 2025 | 2 min read