How Financial Institutions Can Leverage AI While Maintaining the Human Touch

June 5, 2025 | 2 min read

Blog

Blog

April 22, 2016|0 min read

Copied

Whether financial institutions know it or not, the fight to remain top of mind and be the primary financial institution for account holders is THE (or one of the) biggest challenges they face. Consumer trends, banking revenue models, the competitive landscape, and the rise of digital have fundamentally changed the game.

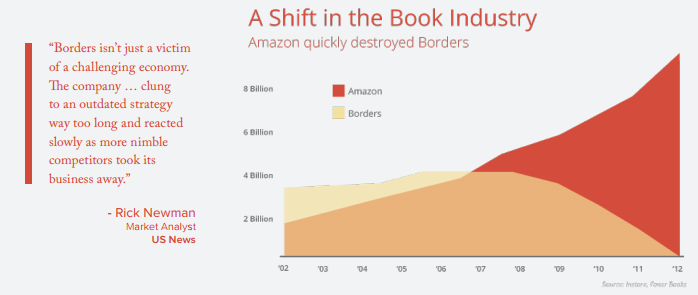

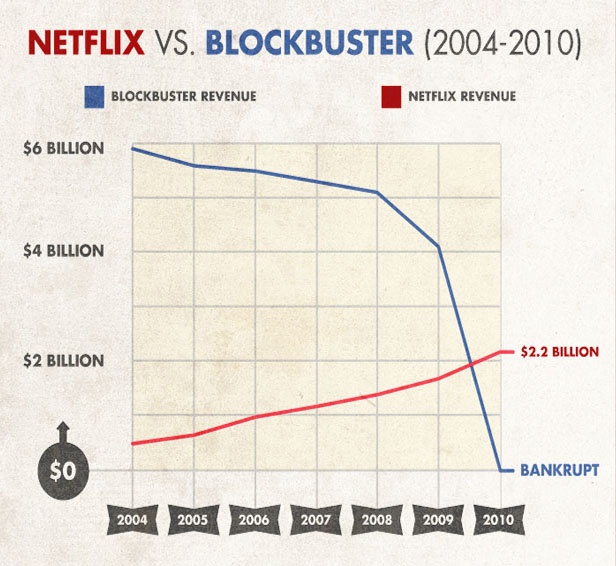

As with all disruption, things build up slowly without you really noticing and then BAM, a catastrophic change happens. As you can see with the Borders example below, Amazon slowly crept up on them since 2002 and finally overtook their revenue by 2007. After that it was all downhill and once 2009 hit, it was past the point of no return. As for Blockbuster, they were declining in revenue slowly for 4 years before a big hit in 2008 and then they were past the point of no return in 2009.

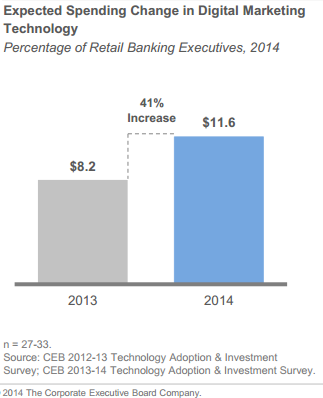

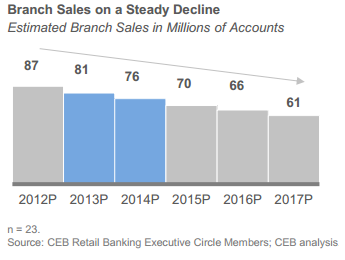

In terms of how this relates to you, Western World banking growth is flat or in decline as margins are shrinking. Before the financial crisis, the banking industry relied heavily on leveraging and fee based models to generate revenue. AT Kearney says, “Today’s increased regulations and competitive challenges are forcing banks to deleverage and identify alternative sources of value. Enter digital banking. New digital models steer banks in the direction of customer relationships that present new sources of value. The focus is on engaging customers and building trust in the key activities of digital banking: marketing and sales; customer onboarding; and account opening and servicing.”

Now the only way for financial institutions to grow is to increase share of wallet through providing extraordinary value to customers and beating your competition.

There are a number of forces impacting banking right now. These are the ‘gradual changes’ happening, before MASSIVE disruption. They can be significant challenges or opportunities, depending on how you want to look at them.

Forces include:

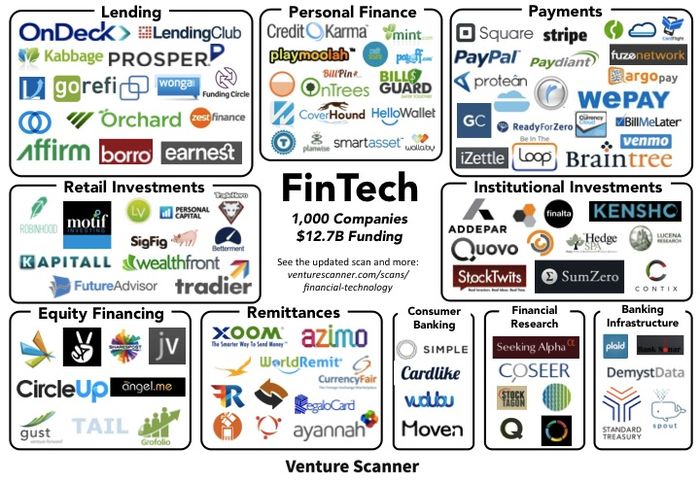

Source: Venture Scanner, October 2014

With margins shrinking and external forces eating away at the fringes of the industry, the only way for banks to grow is to create immense value for their account holders.

The financial experience account holders come to expect should be personal to them, seamless across any device and take advantage of the unique features of each channel they choose to interact with you through.

Community banks and credit unions place a lot of their value on the personal service they offer. However, given the vast majority of interactions that now occur through digital, what are they doing to make that experience personal? If they fail to use data to personalize the digital experience, it won’t take long for them to become obsolete. As BBVA chairman and CEO, Francisco Gonzales said, Up to half of the world's banks will disappear due to the cracks opened up by the digital disruption of the industry.'

What are you doing to prepare for this massive disruption?

For More On This, Check Out Our 2015 Banking Trends Slideshare:

Some interesting facts about the current state of digital:

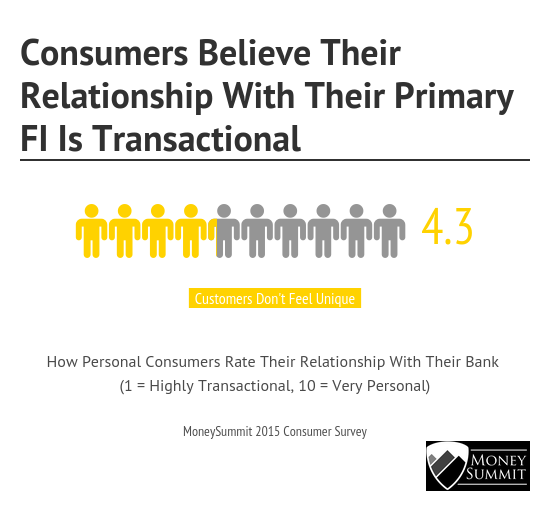

Checking balances and looking at transactions is in its nature, highly transactional. Because this is what consumers are spending the large majority of their time doing, no wonder they don’t feel a personal connection towards their financial institution.

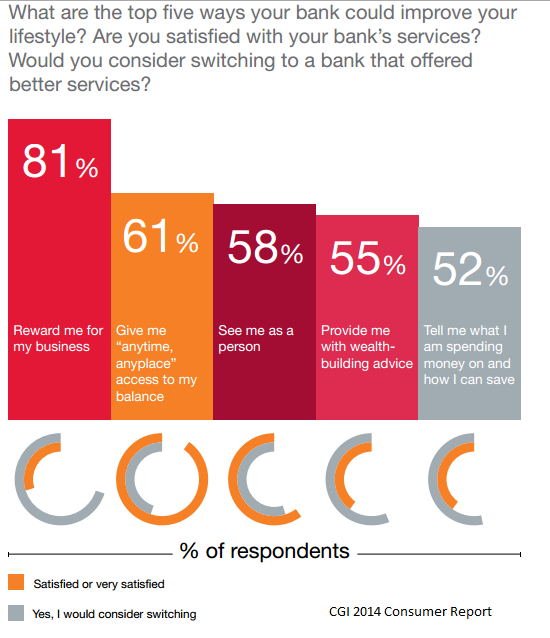

However, there is massive opportunity to give consumers a greater experience which expands into financial empowerment. CGI says, 'Digital transformation begins from the outside in. It starts with understanding your customers and leads to fundamental changes within your organization that revolutionize the customer experience. Consumers want their banks to be a relevant part of their lives—more than just a repository for their money. Based on our survey findings, the five top consumer wants are the following:

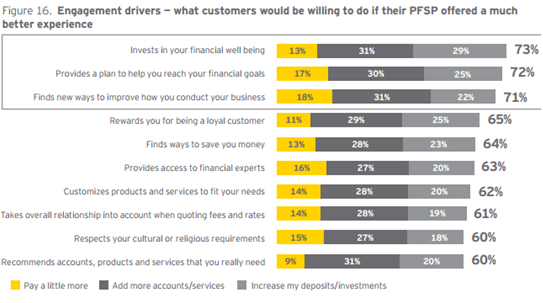

Ernst & Young shares similar findings:

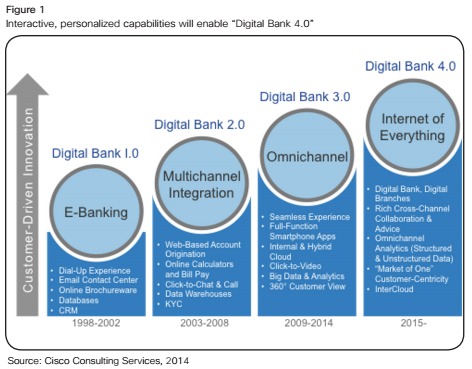

While Cisco believes we are now in a ‘digital bank 4.0’ era where customer centricity, omni-channel analytics & rich cross-channel collaboration & advice is paramount:

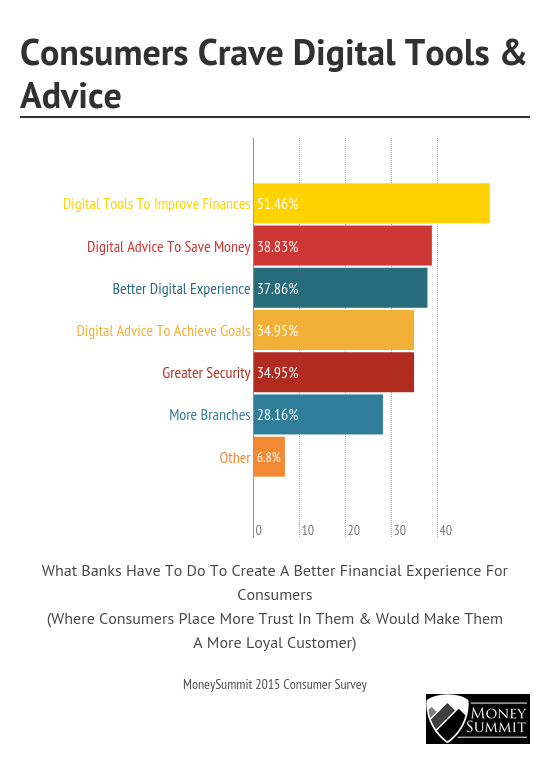

And finally, our consumer survey shows that digital tools to improve consumers financial lives are almost twice as important to consumers as ‘more branches:’

It is pretty clear across all of these reports that for banks or credit unions to win they have to:

At a leading industry conference NetFinance, 15 executives from the top 100 banks were asked a similar question about how banks can compete in the digital era. They said:

“Customers don’t think in siloes, they are just interacting with their financial institution. If we can help customers through the progression of life financially, I think we are going to win big time. This is not a focus on providing products or services, but the overall experience. If you can guide me with my finances and particularly through a major event, you will gain my trust most likely for life.

Another participant likened it to an example with USAA. At USAA, customers can search for cars or houses within an app, and then follow up with a dealer or expert. “This is where the loyalty comes from. Digital created the initial discovery and it is useful for the consumer without a hard push. This, in the long run is the business model.”

June 5, 2025 | 2 min read

Feb 18, 2025 | 1 min read

Jan 30, 2025 | 2 min read