Are You Evolving with Generations of Consumers?

April 25, 2025 | 3 min read

Blog

Blog

Aug 5, 2016|0 min read

Copied

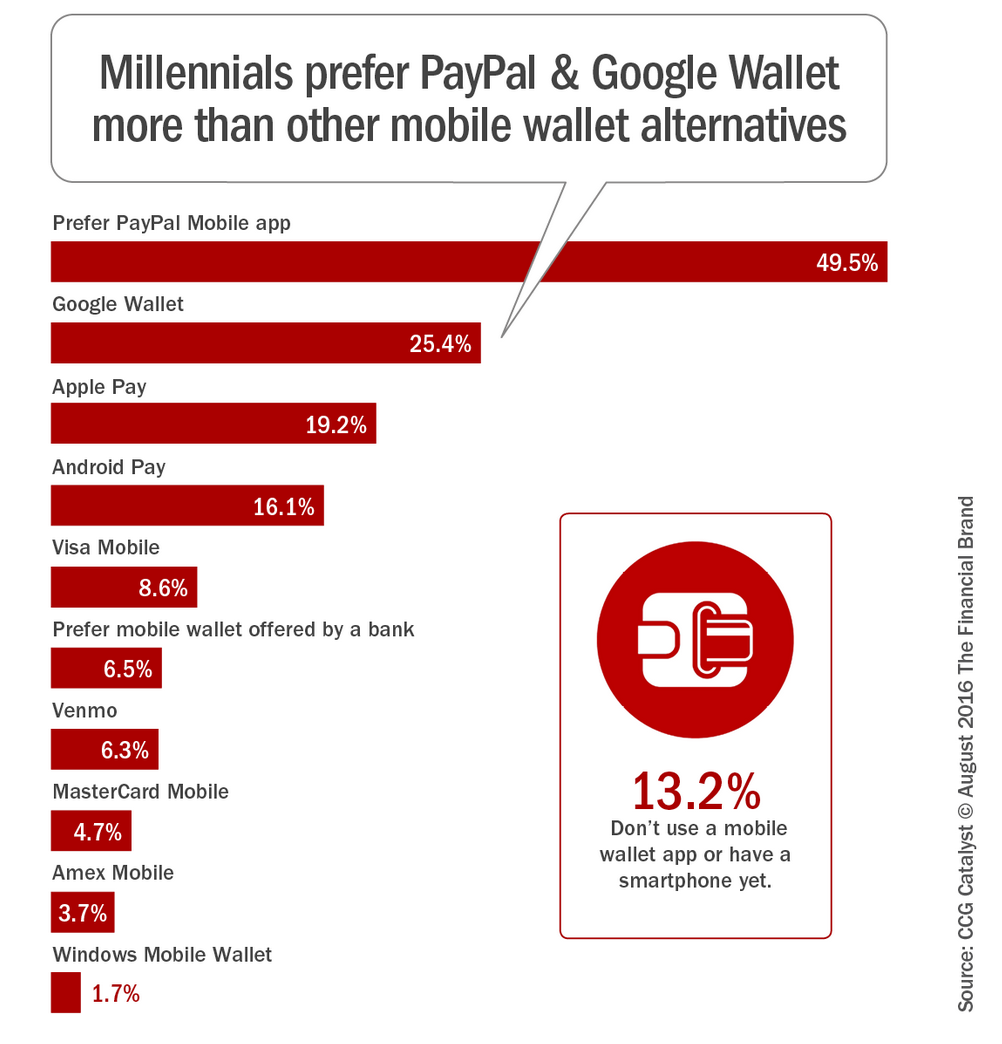

Jim Marous summarizes a report from CCG Catalyst Consulting Group about Millennials and mobile wallets. The report shows that Millennials overwhelmingly prefer options such as PayPal, Google Wallet, and Apple Pay to mobile mobiles from their financial institution. The Financial Brand repurposed this chart to show the breakdown:

Note that the survey must have asked for multiple answers because the total results far exceed 100%. The total of those who prefer brands created in the past two decades exceeds 115%, while the total of those who prefer more tradition brands (including banks, Visa, MasterCard, and Amex) is about 24%. This disparity is enormous, and doesn't bode well for traditional brands. Once Millennials and those younger than Millennials become the majority of consumers, traditional payments such as cash and checks (and possibly even debit and credit cards) will go away. Payments will be synonymous with a portable digital device such as a mobile phone. What's to stop PayPal or other players from combining with a major bank on the back-end, expanding their deposit services, and cutting out traditional players altogether?

Note that the survey must have asked for multiple answers because the total results far exceed 100%. The total of those who prefer brands created in the past two decades exceeds 115%, while the total of those who prefer more tradition brands (including banks, Visa, MasterCard, and Amex) is about 24%. This disparity is enormous, and doesn't bode well for traditional brands. Once Millennials and those younger than Millennials become the majority of consumers, traditional payments such as cash and checks (and possibly even debit and credit cards) will go away. Payments will be synonymous with a portable digital device such as a mobile phone. What's to stop PayPal or other players from combining with a major bank on the back-end, expanding their deposit services, and cutting out traditional players altogether?

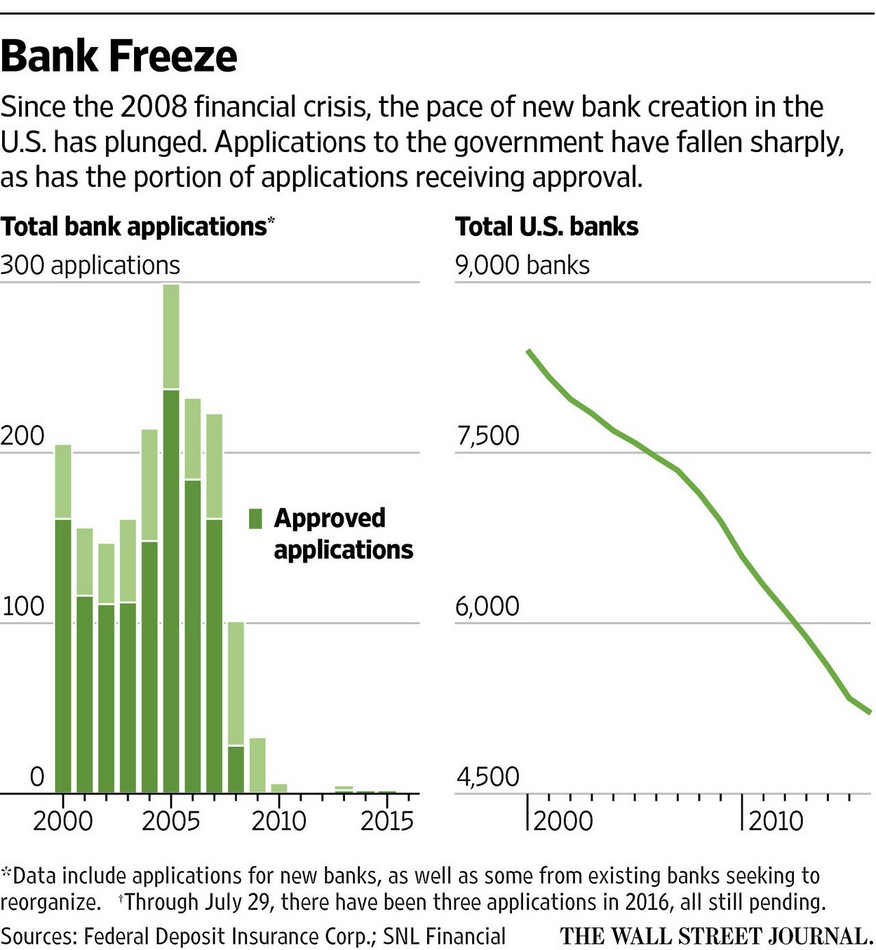

The Wall Street Journal shows that since the 2008 financial crisis, there have been almost zero new banks in the United States. Increased regulation is likely one cause, as well as the fact that the economic environment (including interest rates remaining near zero) is still fraught with difficulties.

April 25, 2025 | 3 min read

April 23, 2025 | 6 min read

March 25, 2025 | 3 min read