FormFree is a market-leading provider of the consumer-permissioned asset, employment and income data needed to verify and certify a consumer’s Financial DNA®. Expediting the loan application and origination process, FormFree provides automated verification solutions to consumers, banks, financial institutions, credit card companies, payroll service companies, and crowdfunding service providers. The fintech leverages data, years of experience, and patented analytics and algorithms to create valuable products and data-driven intelligence to usher in the new era of transparent, fair, and liquid credit markets while making credit more available to the underserved.

The Challenge

FormFree works with nearly 3,000 lenders and has integrations with over 100 different platforms as it seeks to transform the industry of direct source data and lending. Many of its products, however, are dependent on consumers granting FormFree access to their credentials. While many consumers have become more accustomed to providing their login credentials, that level of trust doesn’t come easily — and it’s something FormFree doesn’t take for granted.

In 2020, some of FormFree’s users were experiencing long connection times because of multi-factor authentication(MFA) pop-ups. This resulted in a high number of users who canceled the connection, making it difficult to collect data elements critical to the loan origination process.

The Solution

By utilizing MX’s modern connections — tokenized, credential-free API connections built with the highest security standards — on several of its highest-volume financial institution connections, FormFree improved lenders' ability to make more informed decisions about borrowers, minimizing lenders' risk while creating a seamless loan application experience for borrowers.

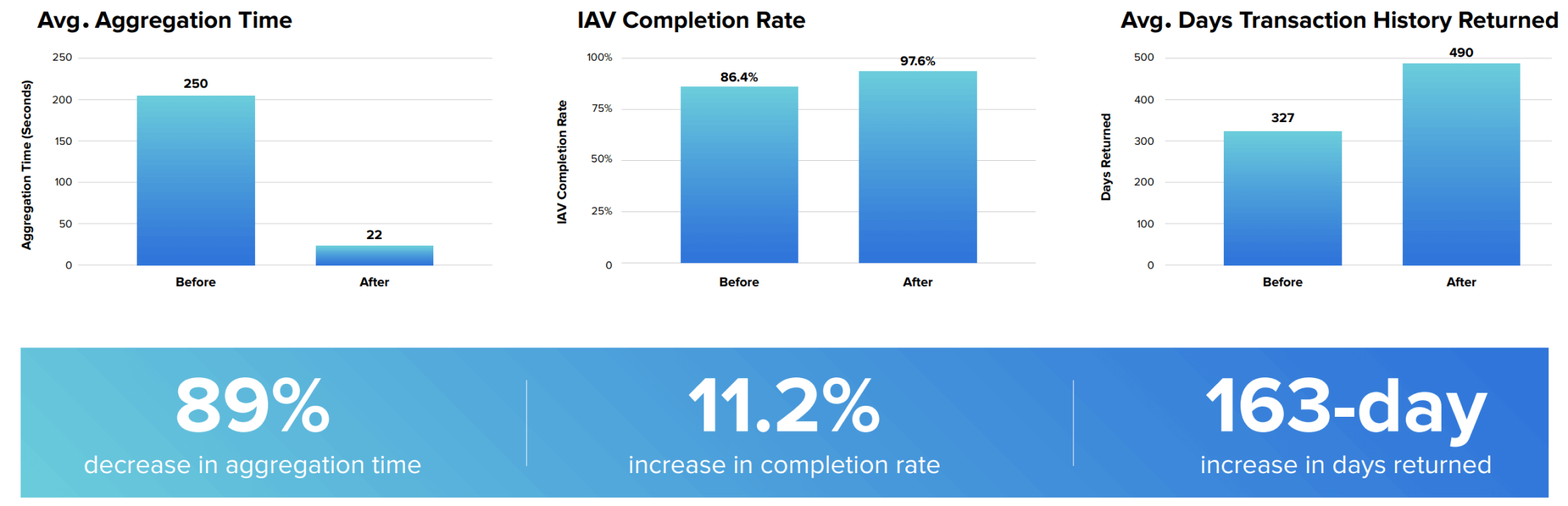

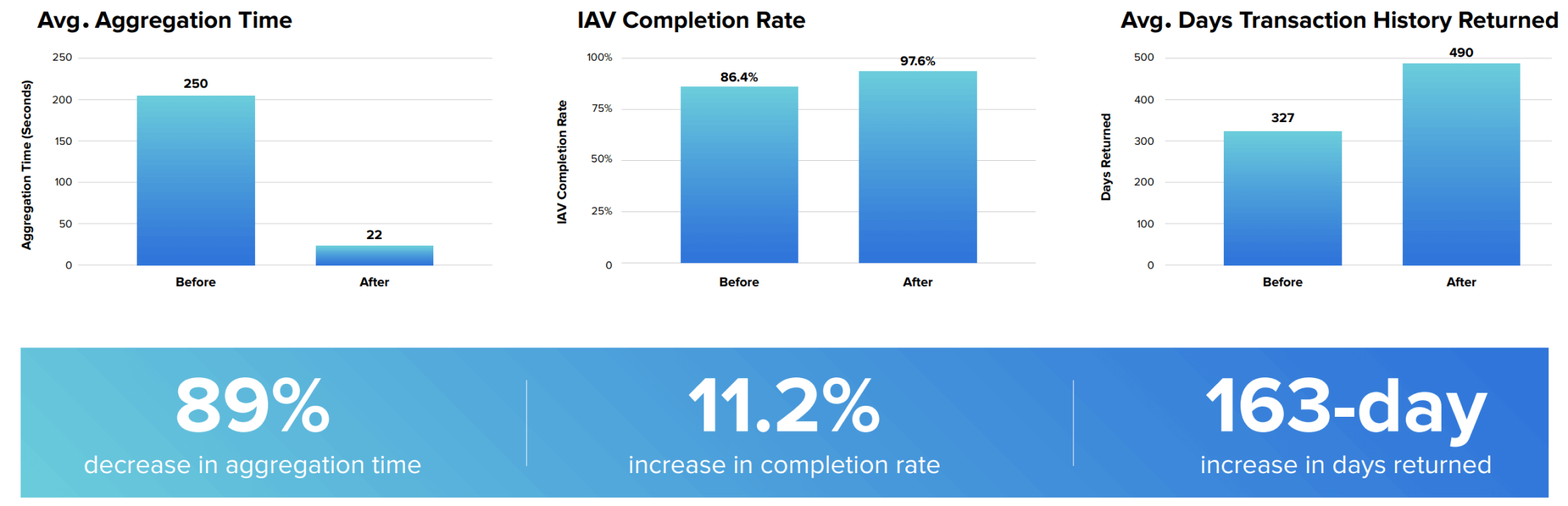

The average aggregation time for FormFree connections decreased by 89% to 22 seconds from an average of 3 minutes and 30 seconds. This change also significantly decreased the number of disruptive MFA pop-ups. By using MX's modern connections to quickly get lenders the necessary data, FormFree has greatly enhanced its customer experience, improving satisfaction and retention.

Additionally, FormFree saw the completion rate for Instant Account Verification jobs increase from 86.4% to 97.6% and improved average days of transaction history returned from 327 days to 490 days.

“Our experience with MX's modern connectivity has been world-class,”Francis said. “There haven’t been any MFA triggers when users go to refresh, and we have the security token, so the bank knows we’re allowed access when we ask for a refresh of the data. We've experienced so many positive outcomes from this rollout, including a huge decrease in the time it takes to complete an aggregation event. We attribute that to MX making the move to API and OAuth-based connections."

Empowering Consumers

FormFree’s mission is to create a better homebuying process by enabling creditors to understand a person’s ability and willingness to pay. FormFree leverages MX’s Account Aggregation and Data Enhancement products to automate lenders'verification of applicants’ identity, assets, income and employment. It has helped lenders calculate, verify and quantify what consumers can afford for over $2 trillion in mortgage loans, and since 2018, when its partnership with MX began, FormFree has used MX’s tools to help close more than 1 million loans.

“Buying a house is the single largest purchase most of us will do during our lifetimes — it’s a big deal,” Chandler said. “It’s also invasive. We’re required to collect a lot of documentation, fax it, print it, jump through all those hoops. It can be pandemonium.”

The aim is to replace that pandemonium with the peace of mind supplied by FormFree’s secure, time-saving solutions. FormFree provides lenders with internal, permissioned digital alternatives to traditional credit scoring and the outdated process of providing paper documentation.

By using MX's modern connections to help improve its UI and boost its connection rate, and by getting lenders the necessary data quickly, FormFree is further strengthening the level of trust from its customers and improving satisfaction and retention. FormFree anticipates that this improved experience will result in roughly a 15% lift in annual revenue going forward.