Ready to Get Started?

Learn more about how MX can improve your customer’s journey, uncover growth opportunities, and help you innovate faster.

MX enables financial providers to deliver digital and mobile banking experiences that increase engagement, drive business growth, and help consumers better understand and manage their finances. Give consumers the data-driven, personalized money experiences they need to reach their financial goals.

Create simple, yet comprehensive, digital and mobile banking experiences — from frictionless account opening to intuitive personal financial management tools to automated insights

Confirm account and routing information instantly with token-based connections that avoid human error and ensure credentials are never shared

Protect, guide, and inform consumers with AI-driven, predictive insights that make it easy for them to take action to reach their financial goals

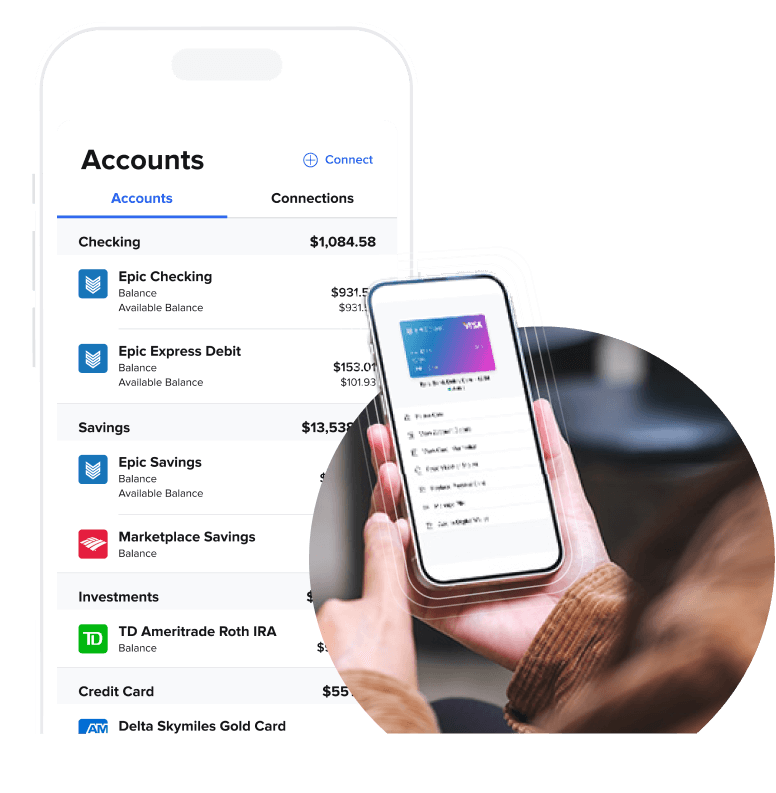

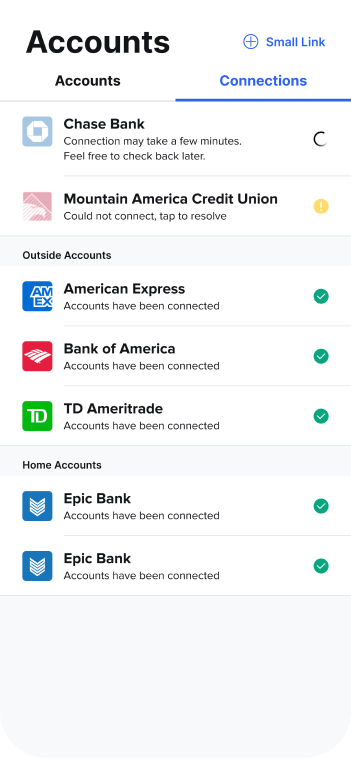

Make it easy for consumers to connect external accounts in a few simple steps and gain a more complete picture of their finances

Create an easy onboarding experience for connecting and funding new accounts with tokenized OAuth connections

Quickly build, or build upon, existing mobile banking solutions with SDKs and proven, pre-built features to configure personalized products, shorten the development cycle, and go to market faster

Ready to Get Started?

MX’s account aggregation solutions enable consumers to easily connect and view all of their financial accounts in one place — and give financial providers full visibility into consumer financial data to better meet their needs.

MX simplifies personal financial management (PFM) for consumers from connecting all their accounts in one place to best-in-class digital money management capabilities to proactive, personalized financial insights.

MX delivers embedded insights supported by artificial intelligence and machine learning to protect, inform, and guide consumers with personalized guidance, offers, and recommendations based on behaviors and financial data.

MX offers a fully-featured digital banking platform that empowers financial institutions and fintechs to deliver data-driven, contextual, and personalized experiences.

MX provides fast, reliable verification technologies to help organizations better manage risk, protect against cyberattacks, and maintain compliance. MX reduces your reliance on manual verification processes with instant account verifications (IAV) and account owner identification.

Learn more about how MX can improve your customer’s journey, uncover growth opportunities, and help you innovate faster.