When Fraud Looks Like Trust

Feb 13, 2026 | 2 min read

Blog

Blog

April 22, 2016|0 min read

Copied

Banks may not die off and go the way of Blockbuster but they face the dual threats of disintermediation and commoditization and will have to innovate digitally in order to remain relevant. In a January 14 webinar Forrester Research analyst Peter Wannemacher shared a series of predictions for 2016 and beyond, keying on the strategies that digital executives will have to employ in order to better win, serve and retain customers.

While banks are not about to be swallowed by the competition, Wannemacher noted that the threats are real. 'I could stand in front of hundreds of bank executives and say you're all Blackberry and you don't know it yet. I could tell them the sky is falling and you've already lost this battle,' said Wannemacher. 'Our research shows this is not the case. The customer relationship model is different, the customer lifecycle is different. But that doesn't mean that banks are safe.' Wannemacher observes that banks as entities will not cease to exist in the near term but the role bank brands play is under threat and the payments market is exposing cracks in the foundation. 'If I stood outside a Starbucks and asked how you paid for that mocha frappuccino, they're likely to say their mobile phone or Starbucks app,' said Wannemacher, alluding to the coffee giant's nearly nine million mobile payments a week, representing 20 percent of in-store transactions. 'That is one example of the threat of disintermediation and commoditization that we're talking about.'

Banks will need to reinvent themselves and the gap will dramatically widen between those institutions embracing digital transformation and those that do not. In posing the question of what it means to be a bank in the 21st century and what purpose digital will serve, Forrester determined that financial institutions will have to enable well-being, even moreso than storing or moving money. 'How do digital strategists at banks achieve this? We've been writing about digital money management, what people for a decade called PFM. This is the next generation of that which is embedded within, deeply integrated within everyday banking activities,' said Wannemacher.

Digital money management will play a central role in enabling financial well-being and Wannemacher outlines four steps financial institutions must follow. The first is telling users what they have, providing a financial snapshot with a real-time view of their finances and net worth. The next steps include answering 'How am I doing?' and 'What should I do?' — supplying executable advice applications to users. The fourth and toughest step is enabling action on the part of the user to improve their financial position. Forrester notes that 'success will depend on the degree to which banking executives and teams weave digital money management into customers' task flows and everyday experiences.'

Forrester notes that mobile is acting as a catalyst for a broader shift in consumer expectations. The mobile mind shift — or expectation that a customer can get what they want in their immediate context and moment of need — requires organizations to design mobile engagements, engineer platforms, processes and people for mobile and analyze results to drive continuous improvement. Wannemacher emphasizes that organizations cannot think too much about the front end UI at the expense of the experience as a whole.

One good example of capitalizing on a mobile moment is Discover's Freeze It tool. In the past the disappearance of a card would lead a customer to call customer service and report it as missing or stolen, resulting in a lengthy wait for a new card to arrive by mail. This customer experience could prove especially frustrating if the missing card reappeared shortly thereafter but was unavailable for use due to its cancellation. Thanks to Discover's innovation a customer can now freeze a missing card — making it unavailable for purchases —and unfreeze it if it is rediscovered.

While the mobile age has been unleashed, Forrester envisions a future in which cross channel interactions will increase in both number and impact. An increasing number of customers are beginning an application process in one channel before completing it in another. A Forrester survey of 13,096 US adults who applied for a financial product in the past year revealed that 58 percent engaged in cross-channel shopping, the act of researching a financial product via one touchpoint (e.g. branch, website, phone, mobile app) and applying for it in another.

While many of Forrester's predictions are oriented toward technological change, the biggest drivers of the shared finances phenomenon are demographic in nature. Complex lives — produced by divorce and blended families, care for elderly parents and dependent children who are staying at home longer — have also made financial management a more intricate matter, with more parties involved. The reality of shared finances, defined as any situation in which a person acts as an observer, partner in or proxy for another person's finances, will require banks to improve the way they enable account access. The financial industry already trails other industries that allow family members to collaborate around shared goals; for example, JetBlue allows family members to pool their flight points. 'Expectations will be rising. These expectations will be driven by experiences customers have in other industries,' said Wannemacher.

Forrester predicts that digital teams will focus more on personalization, which to date has been painfully lacking. 'Chase knows it's my birthday but the honest answer is you should know when it's my birthday. You have all of my money!' said Wannemacher. 'The context, everything they know about the customer at the point of engagement, will enable (FIs) to personalize those digital experiences.' Wannemacher offered USAA, Discover, and mBank as examples of institutions that have 'embraced the idea of testing and learning, experimenting. USAA carries out a lot of pilots, learns from those through careful rigorous measurement of what works and what doesn't.' USAA's Savings Coach App was featured as an example of savvy personalization, as it highlights past spending behaviors and offers specific recommendations to users.

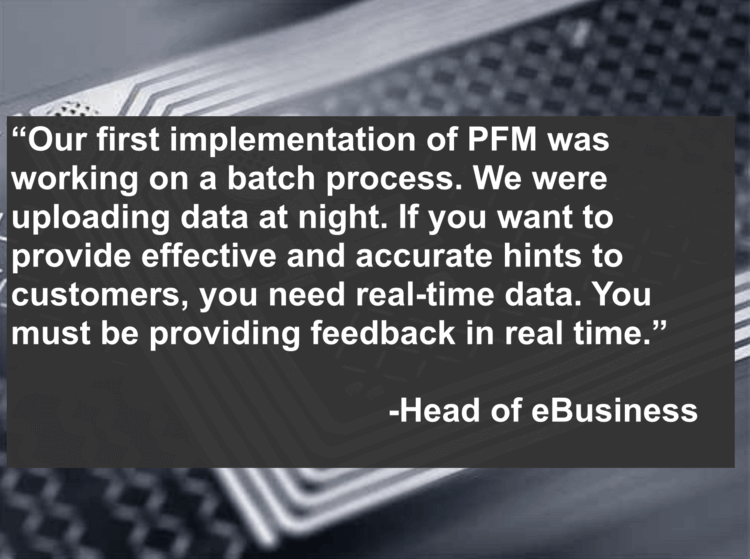

Forrester predicts that the transition from batch to real-time will have major implications for financial institutions. It could bring particular value to the aggregation underpinning digital money management:

45 percent of those surveyed by Forrester expect real-time, ubiquitous, secure payments within the next five years. Forrester foresees that APIs will become more prominent as banking incumbents seek to tap fintech innovation. 'The use of APIs will swell within the banking industry,' predicted Wannemacher. 'Banks have been behind in their use of APIs. We believe that will change over the next three years and will enable integration with partners.'

Feb 13, 2026 | 2 min read

Jan 27, 2026 | 3 min read

Dec 17, 2025 | 3 min read