An Inside Look at the Money Experience Leadership Forum

Feb 9, 2026 | 2 min read

Blog

Blog

March 15, 2018|0 min read

Copied

When Moorad Choudhry, author of The Principles of Banking, was asked what’s the biggest challenge facing banks right now, he said that it’s “to stay engaged with the customer.”

Choudhry says that most practitioners, if asked that question, would say the biggest challenge is “capital” or “liquidity” because of the amplified regulations that followed the 2008 crash.

However, Choudhry says that because every financial institution has to meet certain regulatory standards these things are “necessary, but not sufficient.” In other words, banks aren’t going to win business simply by meeting capital requirements; they’re going to win business by engaging their customers.

That’s what will make the difference.

Choudhry adds, “banking is going to remain very competitive for the foreseeable future,” and so the risk of losing wallet share right now is real.

KPMG echoes this sentiment in their report, “Banking Outlook: An Industry at a Pivot Point.” They show how recent changes in return on equity and net interest margins mean that banks are truly at a pivot point.

As a result KPMG says, “In our view, few mandates are more important to the banking industry right now than a relentless attention to connecting with customers as a means of building new revenue streams.”

The bottom line is that banks must provide customers with what they want.

All of this opens the question: What do bank customers want?

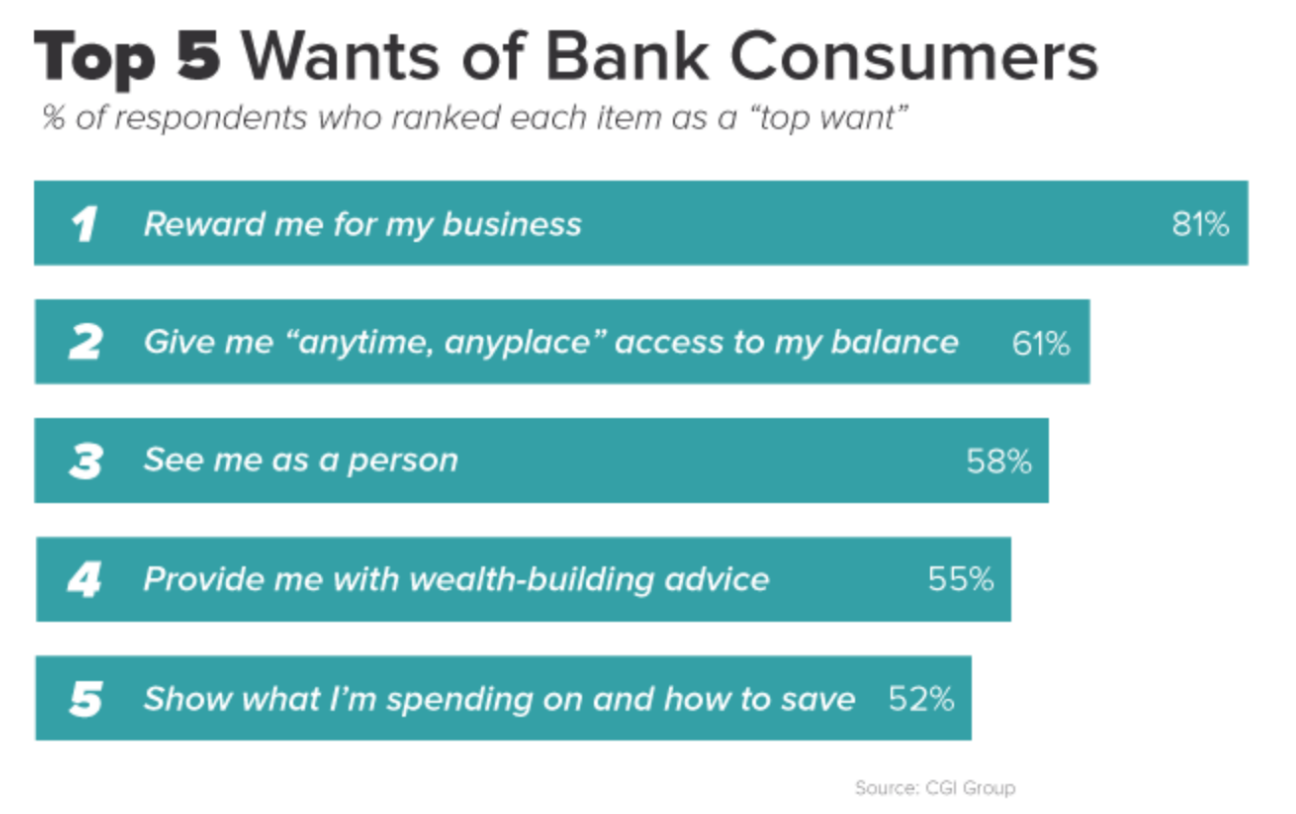

CGI answered this question in their report, “Understanding Financial Consumers in the Digital Era,” wherein they surveyed 1,244 consumers about banking. The report found that five items stood out above the rest:

Let’s briefly unpack each of these points.

This point is somewhat vague, but we can assume that people were thinking about rewards programs. Credit card points, discounts for local venues, and free money for opening an account all fit under this category.

Users want convenience, and nothing is more convenient than an app that can fit in your pocket.

Again, this is somewhat vague, but it’s almost certain that people were thinking of a personalized, consistent banking experience. Indeed, according to the report, “the majority of financial consumers want omni-channel services, regardless of age or income.” Users want banks to remember their preferences.

This shows that there is real potential for bankers to leverage their banking knowledge for the benefit of their users.

Users know that banks have access to their financial data, and they want banks to leverage that data to provide advice on how they can succeed in their financial life.

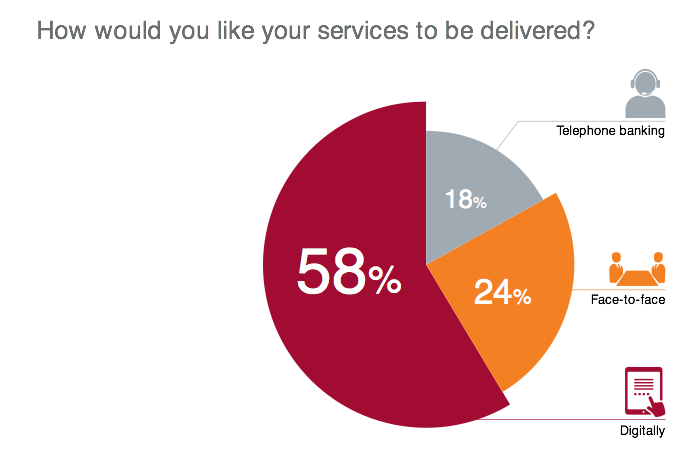

In addition to discovering these five points, the report from CGI also talks about how users want these services to be delivered. It is no surprise that digital channels overwhelmingly dominate. Here’s a chart from the report:

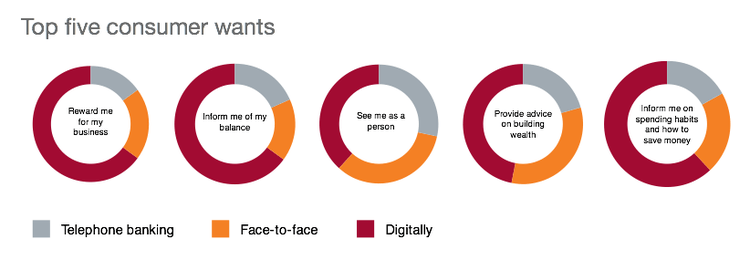

And here’s the breakdown for each of the five points:

You can see that users consistently want a digital experience that takes into account each of these five points. By providing a digital experience that legitimately stands above the competition, financial institutions can be assured that they’re engaging users in the digital age.

How does a financial institution provide an experience that stands above the competition?

To do this, financial institutions must be introspective and earnest in their self analysis. They should consider the following questions:

If financial institutions can say yes to all of these questions, they should know they’re effectively engaging their customers in the digital age. If financial institutions can’t answer yes, they should worry about being left behind as the competition continues to heat up.

Like Moohrad Choudhry says, engaging with the customer is the biggest challenge facing banks right now, and those that do it well will win market share over the next five years.

"Banks must begin to act less traditionally and follow the path forged by other customer-centric organizations that allow themselves to be shaped by customer demand, using more mobile, more two-way, more “right-now” experiences to give customers what they want when they want it."

Feb 9, 2026 | 2 min read

Jan 15, 2026 | 4 min read

Jan 9, 2026 | 3 min read