Winston Churchill is credited with having famously stated, “Never let a good crisis go to waste.” After a year of profound challenges on many fronts, there very much remains a crisis, causing especially deep financial turmoil for millions of unemployed Americans as a result Covid-19.

Many are undoubtedly feeling financial uncertainty, stress and fear. This crisis represents a singular opportunity for banks to earn and establish deep foundations of trust with customers navigating the murky waters of their financial stress. These efforts will garner a loyalty and connection that will bear incredible fruit in the future, as those customers come out of their own individual crises. Banks should earn this deep trust by making their customers’ financial strength an urgent, key focus in 2021.

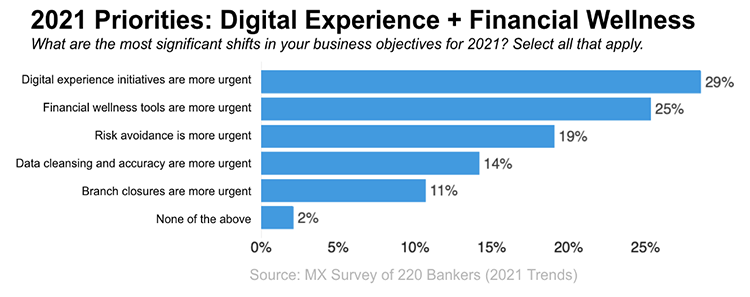

Many financial institutions are tuned into this urgency, according to our ongoing original research into financial services. Our recent survey of 220 bankers at institutions spanning the financial industry showed that two of the most significant shifts in business objectives for 2021 are toward recognizing the urgency of digital experience and financial wellness tools.

These two initiatives go hand in hand, especially following a year of branch closures. People are increasingly looking for ways to get financial guidance directly on their phones. We’ve found that 84% of consumers use their mobile banking app at least weekly and 26% use it daily. By contrast, 83% of consumers say they go into a branch once a month or less — and a third say that they plan to visit bank branches less frequently than they did before the pandemic once it is over.

Put simply, your customers need and expect real-time financial guidance on their devices. Here are three ways to offer that:

1. Show People Where They Are Today

First, people need to know where they are currently — financially speaking. Offering a money experience that provides users with a 360-degree view of their accounts in one place is like seeing the words “You Are Here” on a map. That alone can provide tremendous relief, especially if an individual sees that they are not too far from help.

The same is true for finances. People need clarity about their broad financial picture. They need to be able to quickly see how they’ve been doing, with transactions that are cleansed, categorized, and augmented — and then visualized simply. The days of manually documenting every single check from a checkbook are long gone; very few people have the time or patience to do that kind of work. To be competitive, people need you to do the work for them. It’s not about money management. It’s about a money experience.

2. Help Them Look Ahead

Second, people need to know where to go next. This experience should be a GPS for finances, detailing what true financial strength looks like and laying out general principles to get to that destination. This means that people should be able to quickly see their savings goals, receive recommendations on what route to take and quickly choose or simply confirm automatic funneling of money toward those specific goals, without having to pause their busy life.

3. Get Personal

Third, the money experience should also guide and protect users by offering personalized advice and warnings moment to moment — leading user toward what they need to do. This requires a foundational corpus of clean, enriched data coupled with powerful algorithms behind the scenes to even have a shot at offering an elegant, personalized experience. It is exactly the kind of money experience that will establish trust and build loyalty, especially from customers in dire need of it. This will also become more and more critical as customers desire going into a branch less and less.

Creating a money experience that follows these principles will help create a world where individuals are empowered to be financially strong, where fewer and fewer face personal financial crises.

For me, this mission is personal. I’ve taken an entrepreneurial approach to my career, bounding between exhilarating highs and anxiety-inducing lows. I’ve experienced four separate times where my income dropped to zero, and felt the overwhelming weight of trying to navigate my finances as a young husband and father. I empathize with anyone who feels that stress. Similarly, I can also empathize with the deep trust and lifetime loyalty that can be established when someone helped navigate out of those tough situations. This understanding motivates me to help banks and fintech companies offer a money experience that empowers true financial strength in 2021.

News

News