News

News

MX Announces New Addition to Data-driven Money Management Tool Available to Millions of Users

New Feature to Core MX Product Announced at American Banker's Digital Banking 2016

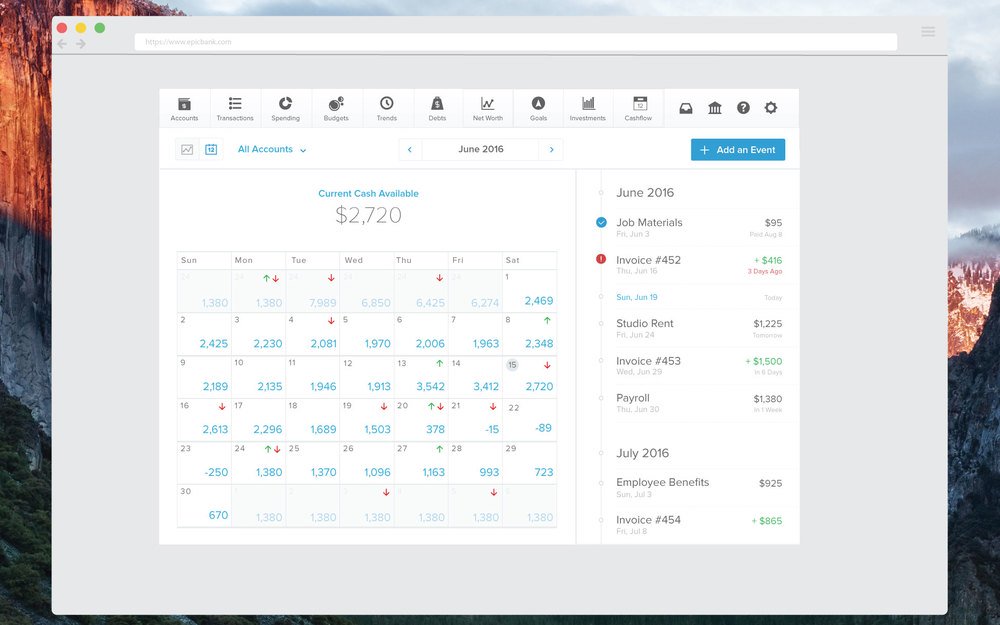

SILICON SLOPES, Utah, June 21, 2016 — MX, the fintech company for financial institutions who want to become true advocates for their account holders, today announced a new feature, Cash Flow, designed to help consumers increase their financial strength by giving them crucial visibility to better manage their financial lives.

'Cash Flow is a transformative step in the direction of predictive analytics, providing individuals the ability to not only track data but also take action on their own financial data,' said Ryan Caldwell, Founder & CEO of MX. 'At MX, we continue to build and promote solutions that enable financial institutions to build a culture of consumer advocacy and drive increased financial health for millions of individuals and families.'

With Cash Flow, individuals will have the ability to:

- Quickly and easily capture recurring events (Paychecks, Utility Bills, Rent/Mortgage payments, etc)

- Effortlessly match transactions from their accounts to recurring events to accurately predict account behavior

- Award-winning interface offering the choice to view your account activity as a line graph or a calendar view

- Enabling you to view your financial trajectory on a monthly or yearly basis

- The ability to view your financial trajectory for one, or all of your accounts

Cash Flow uses account transactions to identify recurring deposits and payments and show historical and future trends in a clear, simplified view. Customers can also clearly see the impact of additional recurring payments and take action by planning for future expenses.

MX’s focus on enabling customer advocacy for financial institutions, this new product addition is an add-on feature for the company's already robust MoneyDesktop platform which includes: account aggregation, full transaction history, spending trends, budgeting, debt management, etc.

Cash Flow by MX

Cash Flow by MXAbout MX

MX enables banks and credit unions to achieve record breaking growth by winning their competitor’s most profitable account holders. As one of the fastest-growing fintech providers, MX drives customer-centric banking relationships by gathering and providing data upon which online and mobile banking partners and financial institutions can create and deliver next generation banking applications and solutions.

Founded in 2010, MX delivers data aggregation, data cleansing, auto-categorization, classification, money management, custom API, data analytics, marketing, UI and more. In addition, MX offers an extensive array of client services, ranging from training to custom marketing services. MX currently partners with more than 650 financial institutions and more than 35 digital, online and mobile banking providers — designating MX as a proven powerhouse in the fintech space. Learn more at MX.com.

Media Contact:

Alyssa Call, press@mx.com

Tags: