News

News

Tearsheet: Financial data as the currency of the modern economy

- User financial data has been harnessed for decades to help sell people more stuff.

- But the trends portend a future where data becomes currency, according to MX's Jane Barratt.

By Zoe Murphy, December 4, 2019

In our economy, value has shifted away from physical assets to digital. And underlying all of digital is consumer data. That was the message Jane Barratt, MX’s chief advocacy officer had for participants in Tearsheet’s first Embedded Conference held last month.

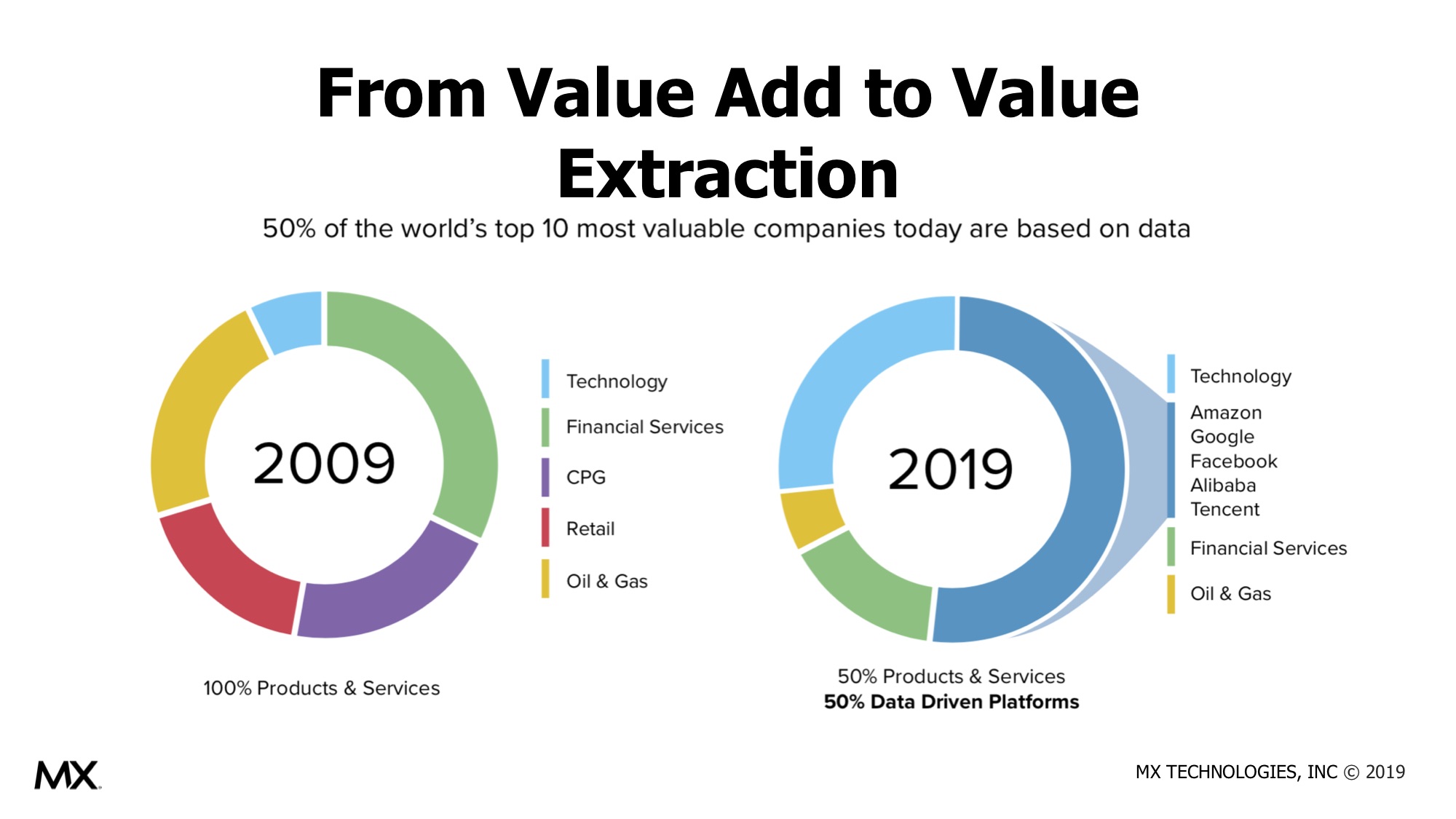

In fact, if you look at the composition of the world’s top ten most valuable companies, you’ll find an interesting thing has transpired over the past decade. Ten years ago, 100 percent of the top companies in the world created products and services in industries like consumer goods, retail, and oil and gas. Now, 50 percent of today’s largest firms are data-driven platforms. Amazon, Google, Facebook, Alibaba and Tencent — all arguably extract hundreds of billions of dollars of market cap value from data.

The financial data that comes out of the exhaust pipes of financial services, though, is pretty opaque, said Barratt. “Bank statements are still full of mismatched categories and alphanumeric strings that aren’t designed to help customers make financial decisions,” she said.

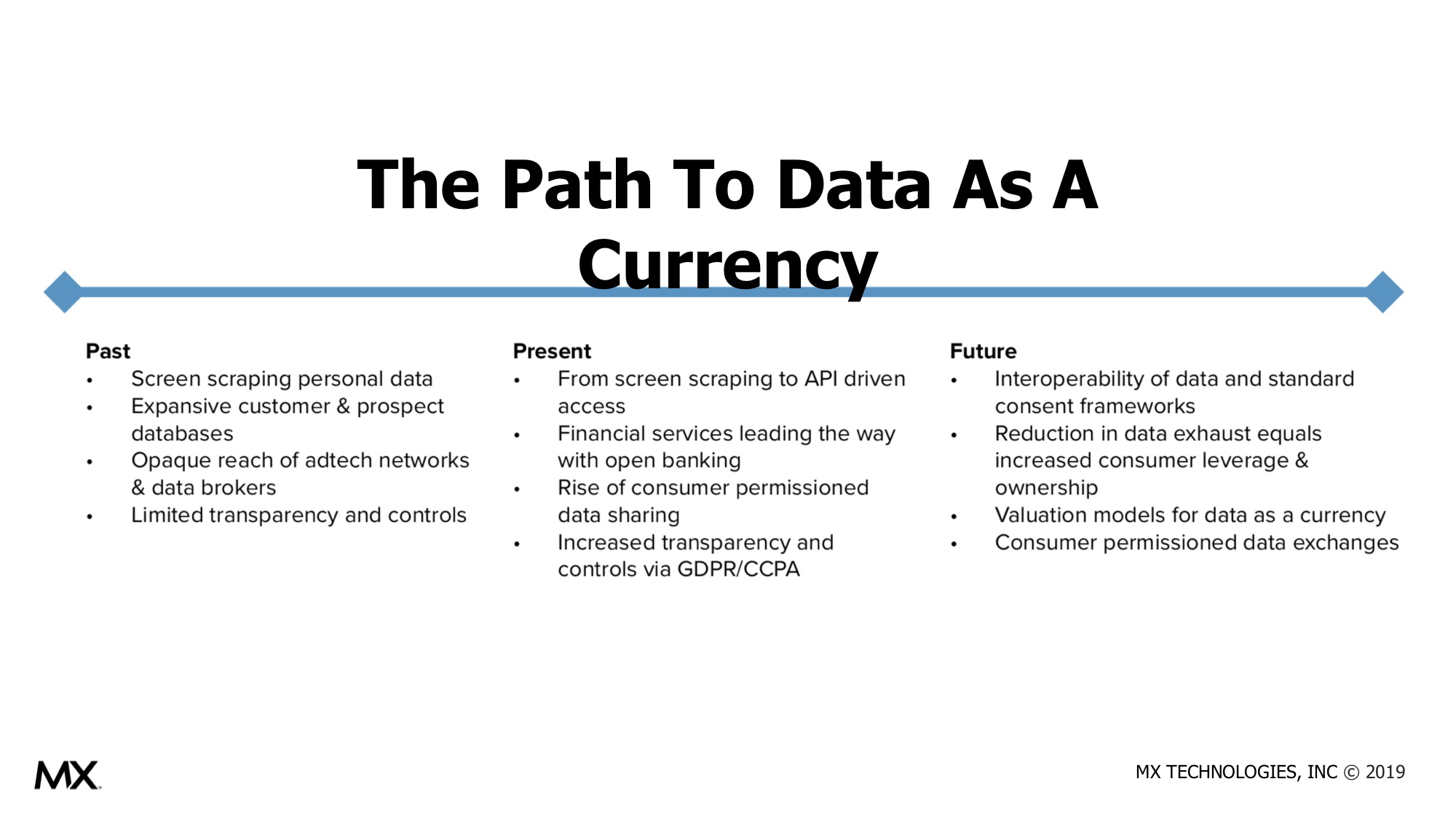

Getting to the point where data really acts as currency requires technological and structural changes. It’s been hard historically to access and share consumer data. The industry relied on user credentials to screen scrape consumer financial data. Other parties made money off of consumer financial data while consumers really had no idea who was using it or how valuable it was to them. There’s a long way to go.

“We’ve moved from an insecure marketplace with a lot of middlemen making money to permissioned data sharing where people are going to get a lot more used to granting access to their data,” Barratt said.

It may take 10 to 15 years to get to the point where data is used as currency, but Barratt thinks it will be worth it. She gave a few different scenarios where, in the future, consumers will be able to better control and monetize the value of their personal financial data.

Instead of a lender shopping a consumer’s mortgage around, an individual could be able to do that. In return for access to anonymized financial records, a person could exchange their info for tools, guidance and offers to reduce her costs of borrowing.

Or, imagine if a family shared 12 months of its shopping history across various credit and debit cards and stores in exchange for discounts or benefits from a local grocery chain.

“Could you imagine going to LinkedIn and looking at your profile to see that you’re worth $5,000 to the social network?” she said.

The financial services ecosystem is evolving to meet the needs of consumer data protection and sharing as more and more of it becomes interconnected. But to move data from being a crude resource to becoming a personal asset and form of currency, fiduciaries and custodians of such data need to emerge and play a strong role. New ways of valuing and exchanging data will help users understand and manage their information. Ultimately, the financial ecosystem needs to come together to advocate for better outcomes for consumers.

“Data is in such a unidirectional flow right now, it’s such a transformative way of thinking about turning it around to benefit the individual,” Barratt said.