Ready to Get Started?

Learn more about how MX can improve your customer’s journey, uncover growth opportunities, and help you innovate faster.

MX provides lenders with accurate, real-time insights and additional sources of information on borrowers’ financial behavior that go beyond the traditional credit score, helping them create more competitive and relevant offers while minimizing risk and increasing loan completion. Give borrowers an easy, faster, and more seamless loan application process.

Better assess a consumer’s financial situation and ability to pay off loans or lines of credit with alternative sources of data, such as cash flow

Unlock new insights with enhanced data to help deliver differentiated products, programs, and personalized solutions across the loan lifecycle

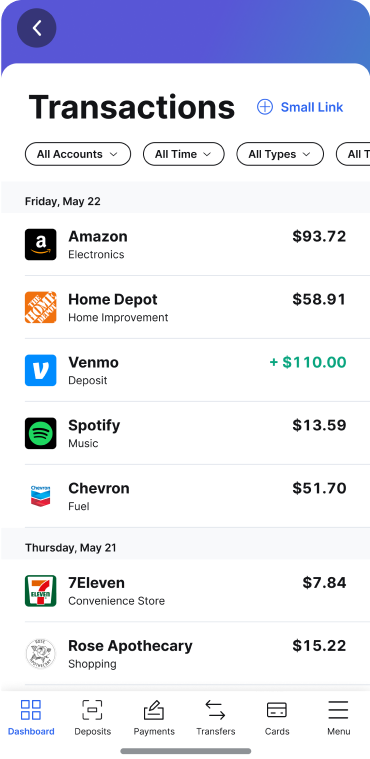

Speed up the loan process and take manual work and errors out of it by enabling consumers to easily grant permission to financial data and connect accounts for loan data and asset verification

Help borrowers easily connect their financial accounts and set up payments, reducing friction in the funding and repayment process — all while decreasing risk and reducing NSF fees

Help mitigate risk and reduce fraud with instant verification of account owner identities, bank accounts, and other financial accounts in less than 5 seconds

Ready to Get Started?

MX offers a comprehensive suite of data enhancement services to deliver enhanced, verified financial data to improve money experiences, drive new growth opportunities, enhance decision making, and make better use of time and resources.

MX provides fast, reliable verification technologies to help organizations better manage risk, protect against cyberattacks, and maintain compliance. MX reduces your reliance on manual verification processes with instant account verifications (IAV) and account owner identification.

MX’s account aggregation solutions enable consumers to easily connect and view all of their financial accounts in one place — and give financial providers full visibility into consumer financial data to better meet their needs.

Learn more about how MX can improve your customer’s journey, uncover growth opportunities, and help you innovate faster.