The past two years of the COVID-19 pandemic have had a profound and lasting impact on everyone’s lives. New habits like curbside grocery pick-up, home delivery of everything from paper towels to dinner, and managing our finances at our fingertips are here to stay. Online and mobile banking has risen among all consumers, with the average person using at least 5 different financial apps in their lives.

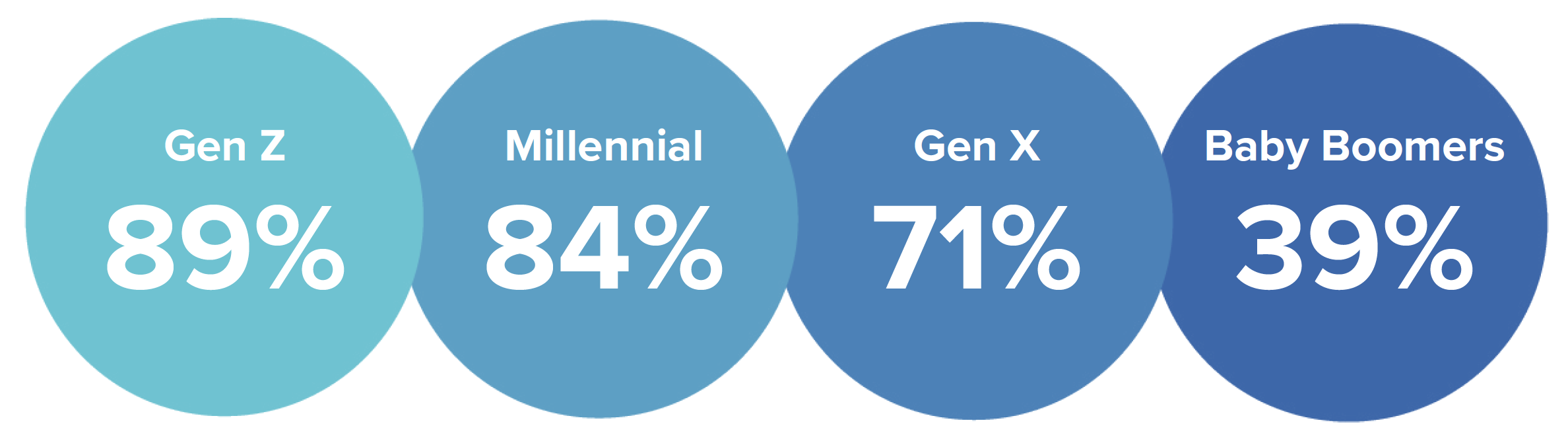

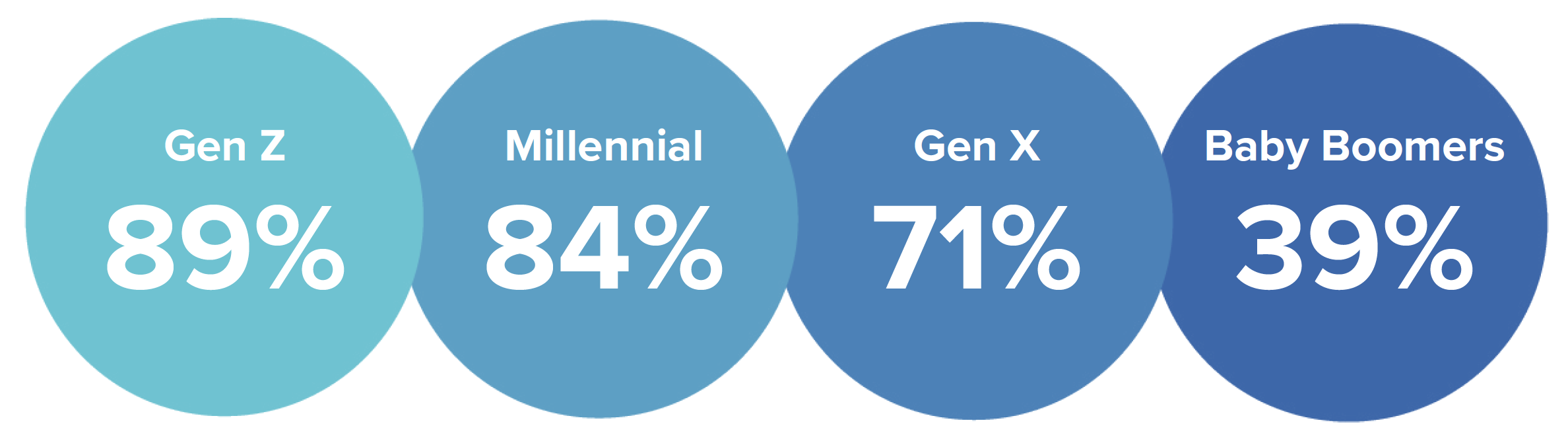

New research from MX shows that online and mobile methods are by far the most used methods for viewing and managing financial accounts. Eighty percent of consumers surveyed use an online account to view or manage their financial accounts. For mobile, 68% of all consumers view or manage their accounts with a mobile app and mobile usage is higher among younger generations:

Percent of Consumers who View or Manage Financial Accounts via Mobile App

And, 72% of all respondents say they prefer to manage all their finances online or through a mobile app. Among different age groups, Millennials most prefer online and mobile at 85%, followed by Gen Z at 79%.

So what does this mean for financial institutions and fintech providers? This new report highlights key research findings that show a preference and demand for digital services, the desire for personalized, proactive support in managing finances, and a growing opportunity to connect all financial accounts into one view.

The Rise of Cryptocurrency Accounts and Buy Now, Pay Later Services

When asked what type of financial products they currently use, 22% of respondents say they have a cryptocurrency account. Among younger generations, this number is even higher — 30% of Millennials, 25% of Gen Z, and 31% of Gen X respondents, compared to only 5% of Baby Boomers. In addition, twice as many men as women said they have a cryptocurrency account.

Buy Now, Pay Later services — those which allow you to gradually pay for a product/service over time — are also on the rise. Thirty-four percent of respondents have used a Buy Now, Pay Later service on a purchase, and 45% of Gen Z have said they have used one of these services.

The Preference and Demand for Digital

Not only do consumers prefer online and mobile to manage their finances, they are also more frequently checking their finances. In the same way that the average consumer checks their social accounts once or many times a day, this behavior has now spread to their financial lives.

In fact, 56% of consumers check their financial accounts at least once a day, while 18% check multiple times per day. Gen Z respondents check their accounts even more often, with 67% checking at least once a day compared to just 45% of Baby Boomers.

There is also a growing attachment among consumers and their favorite financial apps. When asked what they would do if their preferred bank or credit union did not support connecting to their favorite fintech apps, 72% said they would seek out a different bank or credit union that could connect. This was even higher for Millennials and Gen X respondents at 75%.

And, when issues occur, they are becoming more comfortable with reaching out to the financial app provider. Historically, financial institutions have frequently dealt with call center questions around connecting to financial apps. Today, our findings show that 62% would contact the digital service provider instead of their bank or credit union if an issue occurred. And, 1 in 4 consumers say they have experienced technical issues when connecting external financial accounts to their financial apps or online financial accounts.

If your preferred bank or credit union did not support connecting to the fintech apps you use regularly, what would you be more likely to do?

As consumers grow their digital habits and comfort levels, financial institutions and fintechs have an opportunity to expand into new solutions and services to help consumers become financially strong.

Personalized, Proactive Financial Support

Our survey found a significant interest — and expectation — for a more personalized and proactive role from their financial services providers and apps. Seventy percent of consumers expect their financial services providers to give them personalized notifications and insights. At the same time, 63% want their financial services providers to proactively help them better manage their finances. Every generation of respondents was united in these desires and expectations.

It is not enough to just provide basic financial functions like balances and statements. Enter Open Finance. Open Finance enables everyone to access and act on financial data to build personalized experiences and make smarter decisions. It means that companies, financial and otherwise, can build and offer consumers and businesses digital products that help them understand and manage their financial lives better.

Rising Opportunity for Consolidated Financial Pictures

With multiple financial accounts and financial data across traditional and non-traditional financial services providers, consumers lack a clear view of their full financial picture. The survey data shows a clear opportunity to better educate and support consumers with a consolidated view of their finances to drive better financial outcomes.

The reality is most consumers are not yet taking advantage of the value a single view of finances can deliver. Fifty percent of respondents say they have not used digital tools to bring different financial accounts into one view, such as a mobile app or online account. When asked why they don’t bring all of their accounts into one view (i.e., account aggregation), the opportunity becomes clear. Consumers either don’t yet see the value or don’t know how to create that single picture.

Twenty-eight percent say they don’t know how to connect their accounts in one place and 27% say they don't care about seeing all their accounts in one place — presenting an opportunity for financial institutions and fintechs to educate consumers on the value of having a consolidated view of their finances.

Other top responses for why they haven’t connected accounts point to the financial services provider not offering this option (7%) or concerns about sharing financial information (10%) or username and password with a third party (11%).

Have you used any digital tools to bring your different financial accounts into one view?

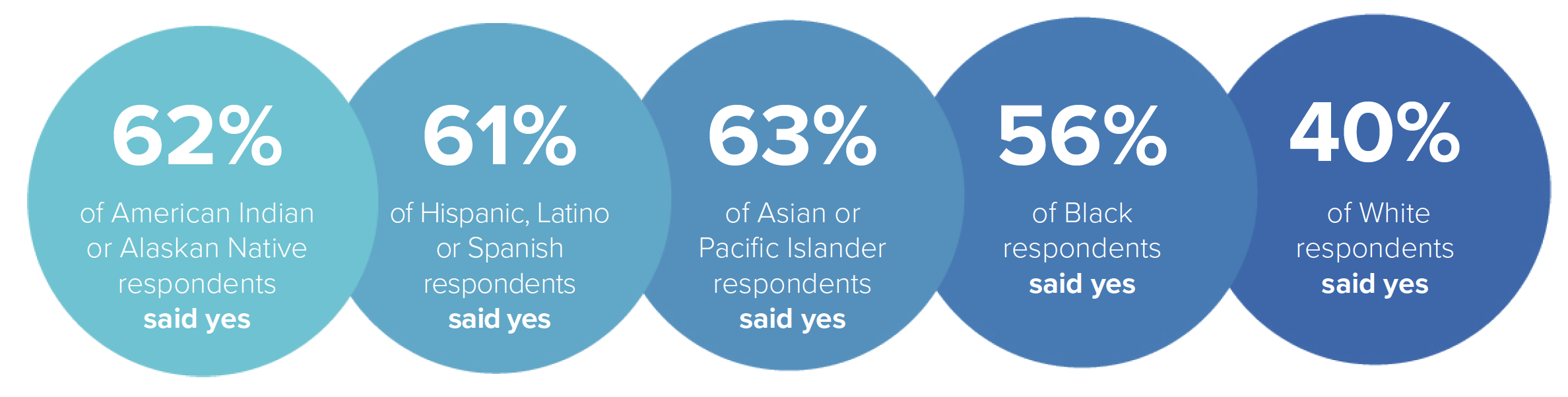

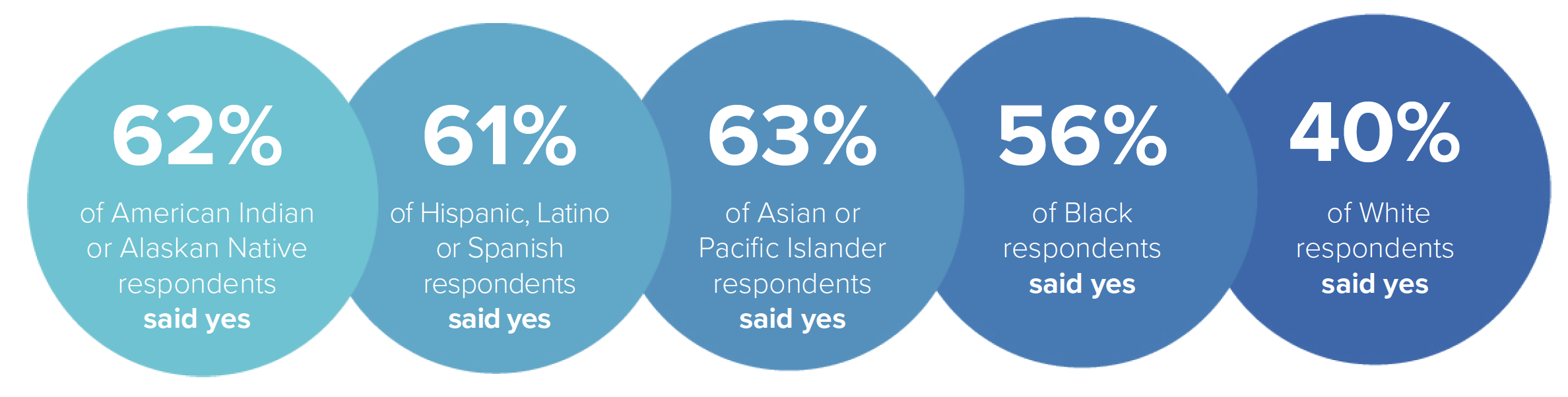

That said, 44% of respondents have connected different accounts into one view. Among Gen Z and Millennials, this number is even higher at 60% and 59% respectively. Minority groups are also more likely to have brought their accounts together into one view:

While those who have connected accounts is still less than half, more than half agree that being able to see all accounts in one place is important. Financial institutions and fintechs have a tremendous opportunity to pave the road to Open Finance by enabling seamless connectivity and data sharing between financial accounts.

Survey Methodology

This survey of 1,002 American adults was conducted by MX from March 15 to March 21 using the online survey platform platform. Results included responses across each generation with 29% respondents identifying as Baby Boomers, 27% as Gen X, 28% as Millennials, and 16% as Gen Z. The respondents were evenly split between male and female (50% each).

Consumer Research on Digital and Mobile Banking

Consumer Research on Digital and Mobile Banking