Setting the Standard for Financial Health Starts with Data Access

June 16, 2025 | 2 min read

Blog

Blog

Feb 28, 2018|0 min read

Copied

When it comes to leveraging consumer data to optimize the user experience, Amazon is king. Amazon’s recommendation engine has been honed to perfection over the last decade, but recommendations are just the beginning. Amazon uses its troves of data to optimize operations across the organization from procurement to fulfillment, but where data has really made an impact has been its use to shape the development of products such as Amazon Prime, Prime Services (i.e. Music & Video), Alexa, and Echo (to name a few).

All of this data-based decision-making is working amazingly well. Amazon now controls nearly 50% of the e-commerce market in the United States, and is bigger than several of the next largest major retailers combined. Amazon has taken the retail world by storm, dominating the market and threatening longtime incumbents with extinction.

Source: http://www.visualcapitalist.com/extraordinary-size-amazon-one-chart/

Many of Amazon’s most successful uses of data can be applied in principle to the challenge of guiding consumer financial health. We can use financial data to enhance the customer experience, test repeatedly to discover what is most effective, and help our account holders get the information and services they really need, faster, and without the mental clutter. Banks have a tremendous amount of financial data at their fingertips, with the potential to empower account holders to become more financially savvy and resilient, increase loyalty, and drive deeper relationships (and wallet share) over time.

Consumers expect that you have their financial data, and that you’ll use it to provide them with real benefit. According to the 2017 Global Distribution & Marketing Consumer Study by Accenture, 67% of US consumers would share more data with financial institutions in return for personalized product and services.

The Accenture report classifies banking consumers into three categories: “Nomads,” who are digitally active, eager for innovation, and expect personalized advice; “Hunters,” who are on the look for the best price, are comfortable in the digital landscape, but still value in-person interaction; and “Quality Seekers,” who value providers who put their interests first, provide responsive service, and ensure that their data is safe. Within those buckets, 78% of Nomads are happy to share their personal data with their financial institution, but 66% demand faster, easier services in return. Of the Hunters, 76% say lower prices are important in return for sharing data, and 53% of Quality Seekers say that confidence that their personal data will be kept secure is what will make them stay. Clearly, the modern consumer is data-aware and willing to share, provided that you keep their data safe and provide them with some value in return.

One of the best ways to benefit your account holders with their data is by helping them to understand their own financial data. The 2017 Consumer Financial Literacy Survey by the NFCC reported that almost half (43%) of U.S. adults would grade themselves a C or lower on their knowledge of personal finance, and 80% agree that they could benefit from advice and answers to everyday financial questions from a professional. As financial institutions, with troves of financial data on your users, you have the ability to truly help your account holders better understand and manage their finances.

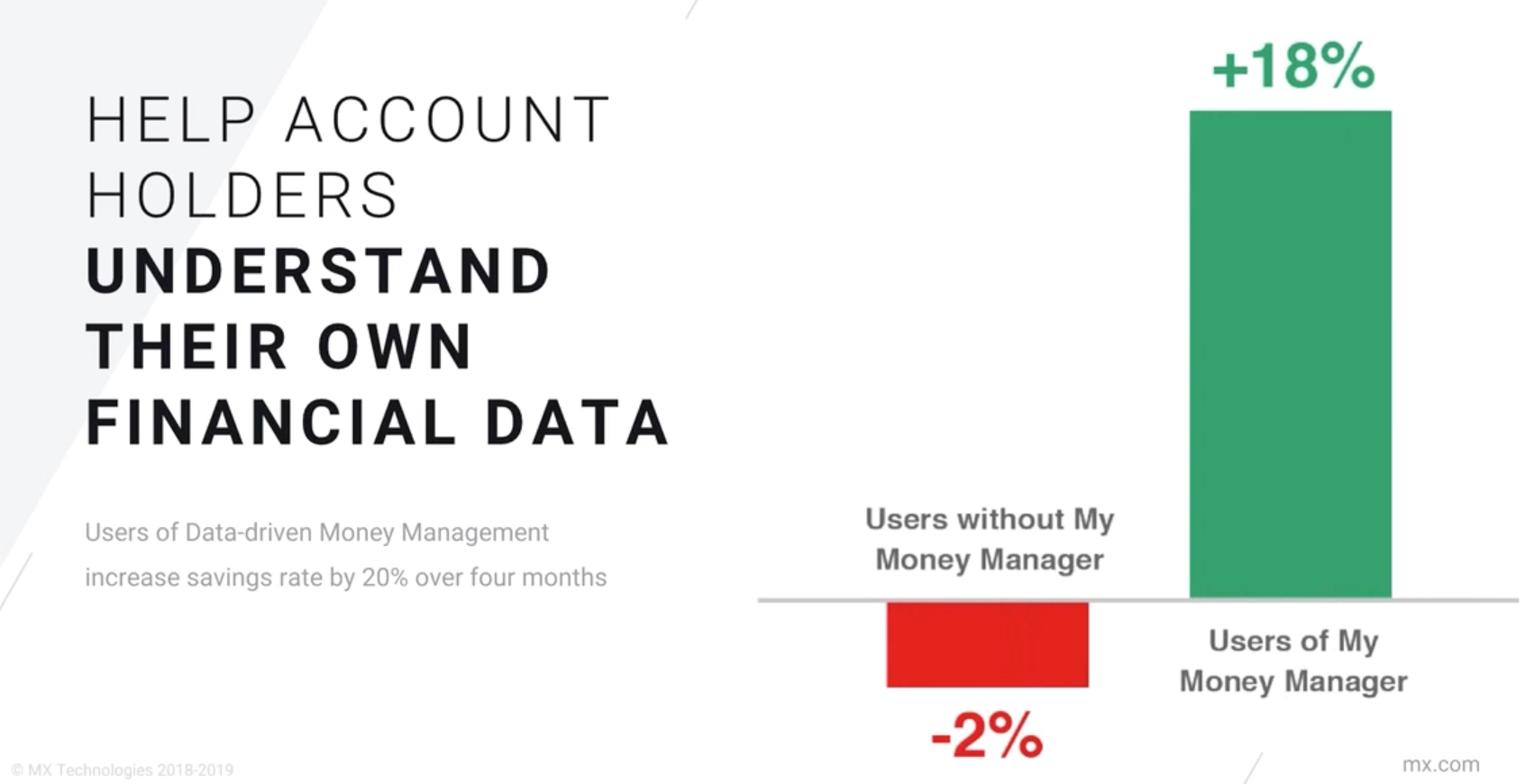

Based on the Accenture study, 59% of Nomads want tools to help them manage a budget, with real-time adjustments based on spending. At MX, we deliver a personal financial management solution that provides consumers with the data they need to understand their money and make informed financial decisions, resulting in greater financial health. One of our clients, found that their account holders who used the digital money management tools increased their savings rate by 18 percent over the four-month study period, compared with a decrease of 2 percent among non-users — a difference of 20 percent. That increase in savings rate makes a big impact on balances over time.

Another MX client, Mercantile Bank, is leveraging the MX data APIs to connect consumer financial data with chatbots through fintech startup AbeAI, allowing them to meet their customers wherever they are. Of the Nomads, as defined by Accenture, 45% are interested in new communication methods, which Mercantile Bank and AbeAI are on track to satisfy with chatbots optimized for Amazon Alexa, Google Home, Facebook Messenger, and more. Now consumers can stay on track of their balances and budgets through whatever channel they engage with most easily. Everything is built on a solid foundation of data to fully leverage artificial intelligence.

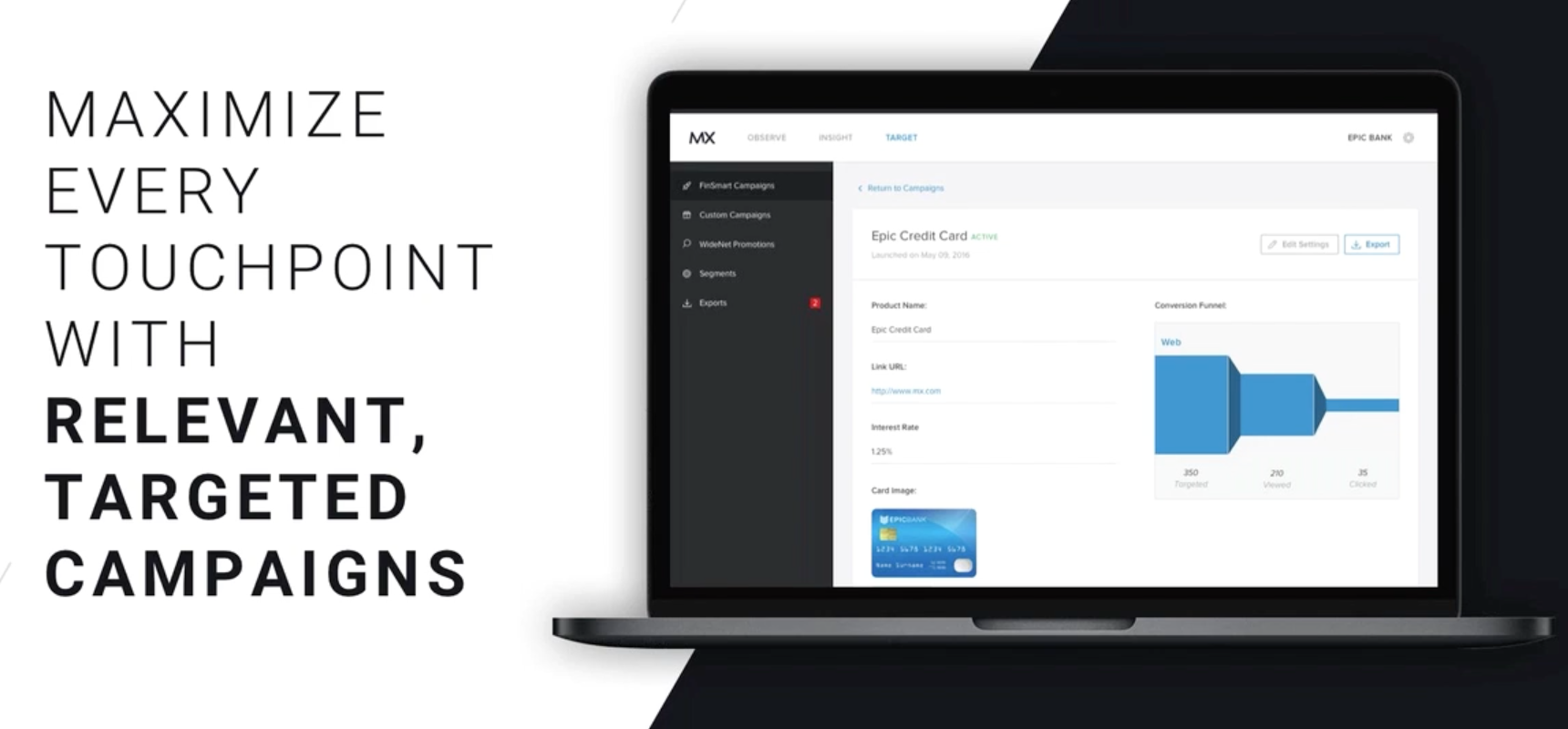

On more path to deliver value back to your account holders using their own financial data is by making the most of every touchpoint with relevant, targeted marketing campaigns. If you can provide affordable, relevant financial products and services to the right consumers at the right time, then you can satisfy a legitimate financial need while growing wallet share. Of the Accenture study’s Hunter group, 38% would like their bank to help them make major purchase decisions by sending relevant information in real time, and 42% of Quality Seekers want banks to send them information about services exactly as their need arises. Consumers don’t mind being marketed to, they expect it, but they want their financial institutions to be intelligent about it.

The “big data” drum has been beating for the last two decades, and by now most organizations know that they should be using their data to optimize business. Yet many organizations still struggle to solidify a comprehensive data strategy that enables them to make the most of the data goldmine in front of them. How well-prepared is your organization to put its data to use?

Ask yourself these questions for a quick data readiness assessment:

If you answered “no” or “I don’t know” to any of those questions, chances are that your organization is still working on how to maximize the value of the data, and should be considering a partner that has the expertise to consult you in how to shape your data strategy.

Once you have real clarity around your data, a powerful way to leverage it is to provide curated guidance and messaging to your end users. Using the marketing tools at your disposal, you can customize your communication with end users, nudge them towards healthy financial decisions, offer up services that meet their immediate needs, and stitch together valuable information and insights into the notification you send to them.

MX is able to assist on this front with Target, a marketing tool which allows financial institutions to digest their users’ financial data to identify the best opportunities, target the right audience, and run tests to discover the most effective message. One client, Evansville Teachers FCU, used the data gathered from money management to re-run a credit card campaign with Target, and it brought in six times more balance transfers and three times more new credit cards than the previous campaign — all because they were able to create hyper-personalized offers that got real results.

Another client used money management data to target account holders with balances on high-interest credit cards with an offer to switch. This offer saw a 6% click-through rate and an average balance transfer of $3,000, saving account holders an average of 12% in interest rate and $433 per year in interest expense. Major savings, major conversion — a major win-win. This is how consumers expect you to use their data!

Today’s consumer is looking for a financial partner — an institution to not only hold their money and lend them money, but to help them be effective with their money. Market yourself as such (and back it up with action!) to win new users. Be transparent with how you use consumers’ data for their benefit. For example, “We saved new credit card holders an average of 12% on their interest rate, and $433 in interest expense!” Then add the call to action of, “Take advantage of our great rates today!” or “Connect your outside accounts and we’ll help you find the best ways to save!” Better yet, run both messages with different segments of customers to find out which is more effective at spurring action.

You can also create shareable content from the data that drives your message. Imagine a social campaign that reads, “39% of account holders roll over more than $2,500 in credit card debt each month at 18% APR or more. Is this you? Take advantage of a personal loan to consolidate high interest debt. Our low promo rate gives you time to get caught up!” You can use your consumers’ data to better understand their real needs, develop products and services that address real issues, and communicate the right message, leading to higher click-through and conversion rates.

MX works with a lot of excellent, innovative partners — financial institutions, fintechs, and nonprofits — to execute on our mission. First, we help our partners enable their account holders to aggregate all their financial data into one view. Then, we enhance that raw data to deliver accuracy and reliability so consumers can truly understand where they sit financially. Next, we present it in ways that are clear and actionable, so financial institutions can guide their end users to make the right financial decisions. We believe that together, with complete and clean data put to good use, we can build a world where finances are as they should be. As consumer choice increases and switching costs drop, guiding account holders to develop their financial strength is going to prove to be the best way to maximize the ROI of data.

At MX, we believe in the power of data to drive better decision-making. With consumer-facing money management solutions and behind-the-scenes analytics and marketing tools, we’ve seen the impact that clean data can have on consumer financial health. Keep consumer advocacy at the heart of your data strategy, and you’ll be sure to win the loyalty — and wallet share — of your account holders.

For more on this topic, watch this webinar I did with John Schulte, CIO at Mercantile Bank in Michigan, wherein John elaborates on why solutions such as MX paired with Abe.ai are so critical to his institution's success.

Data Webinar, Part 2 — Using Data to Empower True Financial Strength from MX on Vimeo.

June 16, 2025 | 2 min read

April 8, 2025 | 4 min read

April 2, 2025 | 2 min read